Atlanta Real Estate Investors Alliance Blog

Onsite Renovation Group Meets on August 15th in Lawrenceville

Posted on August 15, 2017 byHands-On Learning “Onsite” at Real Renovation Projects

Tuesday, Aug 15th at NOON

312 Kings Hill Ct, Lawrenceville, GA

Please join us on Tuesday, Aug 15th at NOON for the Atlanta REIA Onsite Renovation Group (ORG), hosted by Don DeRosa and Dustin Griffin, to learn all about finding, funding, fixing, and flipping houses for big profits. This month’s meeting will be held at a property being renovated by Chrissy Griffin and Maggie Groholski located at 312 Kings Hill Ct, Lawrenceville, GA.

This was a run down, vacant house full of junk. Cleanout, demolition and renovations have begun, so come out and see what the house looks like now and how Chrissy and Maggie are going to transform it into a charming modern home.

The Atlanta REIA Onsite Renovation Group (ORG) is an educational and networking group that focuses on the acquisition, renovation and retail resale (fix and flip) of single family residential homes. The purpose of the group is to allow both new and experienced rehabbers and investors to meet, network and share knowledge and experience with “hands on” access to real property.

The Onsite Renovation Group meets on the 3rd Tuesday each month at NOON at an active renovation site, build site or rental property which will vary from month to month. As always, there is no charge for Atlanta REIA members to attend. Guests & Non-Members can RSVP Online for Only $15 or pay $20 at the door.

The Onsite Renovation Group meets on the 3rd Tuesday each month at NOON at an active renovation site, build site or rental property which will vary from month to month. As always, there is no charge for Atlanta REIA members to attend. Guests & Non-Members can RSVP Online for Only $15 or pay $20 at the door.

Atlanta REIA Members Please RSVP on Meetup.com

with Scott Maurer of Advanta IRA

Aug 15th, 6:00PM, The Loft At Due South

302 Clover Reach, Peachtree City, GA 30290

NEW LOCATION!

EPIC is proud to present Scott Maurer of Advanta IRA, who will be showing you what you can do within your self-directed IRA.

EPIC is proud to present Scott Maurer of Advanta IRA, who will be showing you what you can do within your self-directed IRA.

If You Want To Know More About…

- Why Invest in Real Estate in an IRA

- Private Lending with SDIRA’s

- Checkbook Control with Your IRA

- Different ways to structure your purchase in the IRA

- How you can use other people’s IRA’s to fund your deals

then RSVP NOW! on Meetup then join us this Tuesday, Aug 15th at 6:00PM (3rd Tuesday) at the The Loft At Due South located at 302 Clover Reach, Peachtree City, GA. This is our newest location for our meetings, The Loft at Due South. Come enjoy the Southern Cuisine of this restaurant. There is no charge for Atlanta REIA Members and currently no charge for not-yet members as well.

Come Out on Tuesday, Aug 15th and every 3rd Tuesday of Each Month. You are sure to meet some great individuals and make lasting connections that will help propel your business in the right direction. We look forward to seeing you there!

Meeting Agenda*

- 6:00PM: Networking, Haves and Wants & Introductions

- 7:00PM: Information, Upcoming Events & Market Update (Chris & Donna)

- 7:20PM: Main Presentation with Scott Maurer

- 8:30PM: Closing Comments & Last Minute Networking

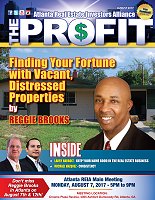

The Profit Newsletter August 2017 Edition

Posted on August 7, 2017 by The August 2017 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 54 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The August 2017 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 54 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer.

Be sure to Subscribe to The Profit by Email or Subscribe to The Profit by Text so you don’t miss a single issue.

Finding Your Fortune with Vacant, Distressed Properties

Posted on August 7, 2017 by When I began my career as a real estate investor in 1985, I stumbled across a tremendous opportunity that most people still don’t know about to this day. Yet it has given my family and me a lifestyle we never dared dream we’d have.

When I began my career as a real estate investor in 1985, I stumbled across a tremendous opportunity that most people still don’t know about to this day. Yet it has given my family and me a lifestyle we never dared dream we’d have.

I’m talking about investing in vacant, distressed, abandoned properties – a highly lucrative, yet little-known, segment of the market.

Vacant/Abandoned properties are just that – vacant. No one lives or works there anymore. Weeds may be collecting and taxes may be accruing, but in many cases the owner has already divorced himself emotionally from the property. And that means you could get an excellent under-market deal.

Where do you find these properties? Just look around. You probably pass right by them on a daily basis – and you could be passing up hundreds of thousands of dollars in profits! These properties have been vacant/abandoned for any number of reasons. Perhaps because of a divorce, an illness, a death in the family, or a job relocation.

A case in point… Read More→

Using The Right Mailing Lists To Locate Motivated Sellers – Part 2

Posted on August 7, 2017 bySo what other lists can we use to locate highly motivated sellers? One of my favorite lists is people who are behind on taxes. You can get this list by getting a list of tax certificates available for sale in your county. In most counties this list comes out right before the tax certificate sale takes place. You would then mail them a neutral type of letter saying you are interested in buying properties in their neighborhood or subdivision.

When mailing these letters initially, I suggest that you do not refer to the seller’s specific problem. All you will accomplish is to alienate them so that they will not want to work with you. I personally do a mailing every year to folks whose tax bills have not been paid and I have purchased many properties this way. A lot of these folks are people who have a problem they need to solve, they just don’t know how until they are contacted by you. A lot of these people have inherited properties they neither want nor need and appreciate your offer to purchase it, especially if they have just received another big tax bill to pay. This is an extremely good lead source for really great deals. Read More→

Three Misconceptions About Building Wealth Through a Real Estate IRA

Posted on August 7, 2017 byBuilding wealth is a bit like dieting, in that everyone has different advice for you. “Cut up the credit cards,” personal finance gurus say, “and don’t buy that morning latte every morning.” Others say that stocks are the one true—and only—way to achieve prosperity. But is there any truth to these ideas, or is an option like a Real Estate IRA just as valid as any other path to wealth?

To figure it out, we’ll have to cut straight through the clutter. Let’s debunk three misconceptions about retirement investment in real estate right off the bat.

Misconception #1: The Real Estate IRA is Unpredictable

True: real estate is an investment that comes with risk. But if you know of any investments that don’t involve risk, please, tell the world—because we’d like to hear it. Read More→

How To Do More With Less

Posted on August 7, 2017 byIf you’ve been reading my articles then you know that I like to write about philosophy and self-help topics more than the topic of investing and there is a reason for this. Even though I love to talk deals, in my experience I have found no matter what you are investing in, the act of investing is just another piece of the puzzle in the grand scheme.

We spend our days investing in lots of things. Many times, we spend so much time focusing on what we should be doing, how we should be acting and who we should be associating with that we get wrapped up in almost a mindless pattern fixated on material acquisitions.

Again, I go back to the idea that there is no sanctuary that you will arrive at. You won’t wake up and just be a different person that has a bunch of money and lives all the desires that you want. Even if you became a millionaire overnight in stocks, you still had to work for that change. Read More→

Keep Your Name Good in the Real Estate Business

Posted on August 7, 2017 byMake Sure You Always Keep ALL Avenues of Communications Open If You Want to Keep Your Name Good In the Real Estate Business.

What an interesting thing to say. Making sure you always stay in communication with everyone you have any type of financial obligations with. This is a subject that has caused much unneeded anxiety and stress that is totally not necessary if both people involved in every financial situation continually have open communications regardless of the status of the transaction they are involved in.

Over the years having been both a private Lender and a Landlord it has been my experience when life and unforeseen situations arise and the tenant or the borrower find themselves with a shortage of money to pay the obligations they originally agreed to pay, communications often stop. Somehow the tenant or borrower finds the money to pay for personal items such as their cell phone bill, their cable television bill, their car payment and eating out periodically or going out on the town. Read More→

Mayor Kasim Reed Blowing Smoke

Posted on August 7, 2017 byMayor Kasim Reed is a short-sighted politician. Thank goodness for term limits.

Mayor Kasim Reed says he is concerned about affordable housing. In a recent AJC article, Mayor Reed used terms like “predatory purchasing”. I believe this slanderous name calling only causes separation and stirs up animosity between the sellers and investor buyers. I am upset about this article where Mayor Reed said that investors are using predatory purchases to acquire houses and force the property values to go up, so there is no longer affordable housing in Atlanta.

If the city of Atlanta is going to point fingers they need to look at the predatory purchase of the surrounding land, which now houses the Falcons Stadium. My understanding is the city of Atlanta did threaten eminent domain in order to get that stadium in place. I did like the powers to be forcing that move though. Even if it will displace 30 properties of affordable housing. I think the Atlanta Mayor must have been referring to the investors that buy single family houses as predatory purchasers, not the commercial buyers. But that is another article. Read More→

How to Keep Your QuickBooks Data Safe

Posted on August 7, 2017 byYou work hard to make sure your QuickBooks data is accurate. Make sure it’s safe, too.

Your QuickBooks company file contains some of the most sensitive information on your computer. You may have customers’ credit card numbers and employees’ Social Security numbers. An intruder who captured all that data could create tremendous problems for you and a lot of other people.

That’s probably the worst-case scenario. But other situations could also spell disaster for your business, which involve losing your company data through fraud, hacking, or simple technical failures.

We can’t overstate the vital importance of protecting your QuickBooks company file, especially your customer and payroll information. Whether someone steals it or it’s inaccessible for another reason, it’s gone. Keeping your business going after such a loss would be very difficult – maybe even impossible.

Here’s what we suggest to prevent that. Read More→

How We Creatively Funded A Recent Deal

Posted on August 7, 2017 byHow do seasoned real estate investors creatively fund their deals without going to a bank? To show you one way, let’s look at a deal that Kim and I recently got funded using a private-money lender.

This deal began when Kim and I were high bidders at the December 3, 2013 property tax auction in Cartersville, Georgia. We bought the tax deed on 50 Akin Drive for $2,800. The purchase money came from our checking account and was used to pay up the property’s back taxes for tax years 2010, 2011, 2012 and 2013. By the way, despite what the TV infomercial claims about buying tax deeds, as the high bidders, we only owned the tax deed, not the property!

Over the next twelve months, either the property owners (who had abandoned the property) or their mortgage company had the right to buy back the property’s tax deed for our $2,800 purchase price, plus pay us a fee of 20% interest. Read More→

Land Trusts! What You Need to Know to Get Started

Posted on August 7, 2017 byLand Trusts are one of the most confusing and often misunderstood aspects of real estate investing.

In this article, we’re going to discuss a few basic, essential things you should know about Land Trusts if you’re buying & selling houses, are concerned with privacy, and/or want to enhance your estate planning.

I’m often asked about these wonderful ‘things’ called Land Trusts, and the techniques & benefits that are associated with them. As a land trust expert, it’s an AMAZING feeling to have the knowledge & confidence to be able to use them correctly. Would you like to have that awesome feeling? Great! Keep reading…

There are SO many benefits you get by taking title to property in a Land Trust. Let’s look at a few of the benefits associated with these entities and WHY it’s vitally important for you to be familiar with them, shall we? Read More→

Coming Back Home… to Wholesaling!

Posted on August 7, 2017 byYou have seen the infomercial… it goes like this…

- Start with wholesaling

- Make some money

- Start Rehabbing

- Make Bigger Checks

- Retire

There are a few variations on this theme, so allow me to share a different spin that I and a few colleagues of mine have explored. It looks more like this…

- Start with wholesaling

- Make some money

- Start Rehabbing

- Make Bigger Checks… sometimes but not always

- Quit working so hard and go back to doing some wholesaling.

So this is not exactly what we are doing since we are also doing new construction but remove the new builds from the equation and it is pretty close. So what’s the deal? Read More→