Atlanta Real Estate Investors Alliance Blog

What Is The Best Way to Buy Investment Real Estate?

Posted on January 9, 2017 byOver the past few days I’ve been thinking about the different ways real estate investors can achieve their goals and dreams in the fastest way possible. I get asked this question frequently by students who are just getting started in the real estate investing business. As I thought about the different strategies of how real estate goals can be achieved, I came up with the three most common ways most investors use today.

First of all wholesaling is what I hear about the most. The problem as I see it with wholesaling is two-fold. First, wholesaling real estate is to me just like having a job. Once you get a property bought and either “pre-habbed” or if you assign your purchase agreement you are creating the Hamster On the Wheel way of doing business. You buy the property, you fix the property then you sell the property. At that time hopefully you get a check. You use some of the money you get to pay for your living expenses and if there is any money left you might use the excess to pay for a portion of the next deal you do. Read More→

Have We Reached the Top of the Market?

Posted on January 9, 2017 byOn the Front Page of The Wall Street Journal on Wednesday Nov. 30, it stated “Home Prices Hit record levels”. If you read this article, you will think it is over, the window of the “massive profits in real estate” opportunity has slammed shut. If you did not buy any property since the great recession, you have missed the boat. In your old age when you go into the smelly retirement home, that your Social Security or what’s left of it will pay, you will remember this lost opportunity of buying real estate in the 2012-2016. Yes, it is true the national average states that prices have recovered. If you sat on the fence, you have missed that once in a lifetime opportunity. You decided that the market wasn’t right and you would wait. Those who waited have lost the greatest opportunity in this decade or life time to hit it big and coast into retirement. You might as well go to your “JOB= Just over broke” opportunity and sell your health, back, brain and soul to the company. Don’t invest in any more real estate courses… Save your money, you will need it for your retirement. Read More→

Self-Directed IRAs and Real Estate Notes

Posted on January 9, 2017 byExpected returns are hard to come by. Stocks are at elevated P/Es on a historical basis, and yields are near all time lows. With economic growth sluggish, at 2-3 percent per year, any major gains will have to come from multiple expansion – and who can count on that? Earnings multiples can fall as easily as rise. This is what caused many of us to gravitate to self-directed IRA strategies in the first place!

Bonds aren’t much better, in the publicly traded market. There’s some downside protection, in theory.

Fortunately, electing to use self-directed IRA strategies allows you to transcend the limited publicly-traded stock and bond world, and explore hidden opportunities that are invisible to most investors – but which still offer reasonable yields – at acceptable risk levels, or at least with some security.

One such opportunity for self-directed IRA investors: Discounted Owner-Financed Real Estate Notes.

Here’s how it works: Read More→

Knowing the After Repaired Value on Your Flip House

Posted on January 9, 2017 byAs an Investor, having a Realtor to work with is important in your business if you are buying or selling houses on the Multiple Listing Services. Many new Investors rely on their Realtor to send them “good deals” to buy, hold, fix and/or flip. However, a Realtor does not know what good deal means to an Investor. A good deal for us could be the cash flow that you receive on a rental property or it could be the profit that you would receive from reselling the home. As Investors, you are taught a MAO “Maximum Allowable Offer” Formula in which you use to make offers on homes for buying, fixing and reselling. The formula varies based on your own situation. The average formula used for Investors who have to get hard money to purchase the home would be: ARV (After repaired Value) x 65% – Repairs = MAO. Let me give you an example: $100,000 (ARV) x 65% = $65,000 – $10,000 Repairs = $55,000 Maximum Allowable Offer. This formula would then leave you with $35,000 for holding costs, cost of money, closing costs of purchase and resale, and then profit. Your MAO formula would be different if you are purchasing the home as a Landlord and/or you have your own money to fund the deal. You may be willing to pay between 70-75% of the After Repaired Value for the home – Repairs = Your MAO. Read More→

Paying Bills in QuickBooks Online

Posted on January 9, 2017 byIn a previous column, we talked about setting up bills in QuickBooks Online. Now it’s time to pay them.

We recently laid out the benefits of using QuickBooks Online for bill entry and payment. It’s faster than manual methods. It leaves an electronic record of your accounts payable. And it helps ensure that bills are paid accurately and on time.

As we discussed, QuickBooks Online employs a two-step process for bill payment. Once you’ve completed the first (setup), the hard part is done, and you can move on to fulfilling your financial obligations. Let’s take a look.

Warning: Because you may be “handling” a lot of your bills twice in QuickBooks Online, this system can take some getting used to. We’ll be happy to walk you through the process until you’re comfortable. Read More→

Hi Alexa: A Comprehensive Review of Amazon Echo

Posted on January 9, 2017 by“I live a highly scheduled life. There’s absolutely no time wasted. I’m very focused. And I have a great assistant.” ~ Madonna

Amazon Echo has been a game changer at my house. I find it a great selling point for new homes I’m working on as well. I use “Alexa” to turn on my lights, my television, set the thermostat and basically anything that’s connected to the system. It’s been really helpful around the holidays too, baking with the family has been a breeze while “Alexa” sets up the timer and converts measurements for us.

I’ve talked about other systems, like the Ring for the doorbell answering service, but Amazon comes to a new level with Echo. Technology won’t solve all our problems but it does make things a bit easier. While baking holiday cookies with the kids, I do have a bit of trouble in the kitchen. It’s just that Echo made small tasks easier like setting the timer and changing the measurements from weight to cups. Small hiccups were easier to get through when the tech was literally a voice command away. Read More→

Know Your Guru

Posted on January 9, 2017 byWith the internet, fake news and social media anyone can create a persona and/or a story and have people believing it is true. With a great marketing plan, a website, paid likes, paid followers, a cheap book on Amazon written through research as a top seller and some know how you can be the next real estate guru. And who knows, maybe you end up knowing more IN THEORY than actual successful investors but it would only be in theory. Therefore, you should be cautious of who you are giving your money to and more importantly who you are learning from. Here are a few questions you should ask along with a few acceptable answers.

The number one thing to do is find referrals. I do not mean the testimonials on their website, unless you personally know of that person in your market area, but someone in your local REIA that has used that person and has hopefully had success. Ask them if the guru and/or their program provided what it advertised. However, also keep in mind that you have to ask detailed questions to find out if that person actually implemented the program. For this reason, you want to find as many referrals/users as possible. Eventually you will begin to notice a consistency that the program was not as advertised, good but lacked content, ok for a beginner, not worth buying, terrible or maybe so bad they will give you the content. Read More→

Learn How to Fund Your Rehab Deals at Atlanta REIA on January 9, 2017

Posted on December 29, 2016 by& Vendor Trade Show

Jan 9th @ Crowne Plaza Ravinia Dunwoody

Your Rehab Deals

with a Panel of Lending Experts

Will You Use Your Money, Hard Money, Soft Money, Private Money or a Bank Loan?

Atlanta REIA Members Can Attend at No Charge. This month,

Guests Can RSVP Online Now for $20 or Pay $25 at the Door.

Have you ever wanted to buy, sell or hold investment properties buy didn’t know where to get the money to fund your deals? Maybe you want to find, fix and flip properties needing major repairs… Or maybe you don’t want to flip houses, but want to buy and hold them long term as rentals. Regardless of your investment strategy, you need to raise money to fund your deals. If you don’t have cash and/or credit, what are your options?

If you want to learn how to get your deals funded in 2017, don’t miss the Atlanta REIA Main Meeting on Monday, January 9th at 5PM at the Crowne Plaza Ravinia located at 4355 Ashford Dunwoody Rd, Atlanta, GA where a panel of real estate funding experts will talk to you about how to use bank loans, hard money, soft money and private money to fund your deals.

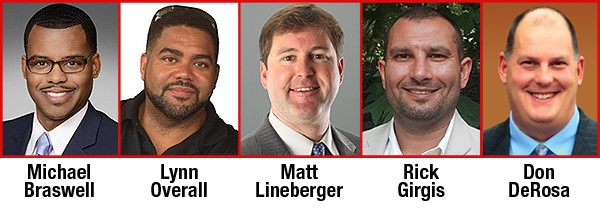

The Panel will consist of Michael Braswell from Visio Lending, Lynn Overall from Secured Investment Lending, Matt Lineberger from Lima One Capital, Rick Girgis from Equitable Consulting and Don DeRosa, a Private Lender & Private Money Borrower. These gentlemen will teach you everything you need to know about funding and answer all your questions during the meeting. The panel will discuss…

- Lending Requirements

- Down Payment Needed

- Points & Interest Rates

- Lending Terms

- Refinancing

- Credit Score

- Collateral

- Answers to your questions and more!

Come join us to learn how to get your deals funded at the Atlanta REIA main meeting on Monday, January 9th at 5PM at the Crowne Plaza Ravinia located at 4355 Ashford Dunwoody Rd, Atlanta, GA.

As always, Atlanta REIA Members can attend the event at no charge and Non-Members can Register Online for $20 or pay $25.00 at the door. Be sure to bring your business cards and flyers and join us for an evening of real estate deals, vendors, networking, education and fun! See you there!

Atlanta REIA Members Please RSVP on Meetup.com

*Please Note: Meeting agenda is subject to change.

WIN A 4 NIGHT STAY IN CANCUN: All participants who attend the Atlanta REIA Meeting will entered into a drawing for a chance to win a *Complimentary 5 Day, 4 Night Stay in Cancun! *You must be present at the meeting to win. Giveaway does not include dining, transportation, transfers, taxes, upgrades, etc.

WIN A 4 NIGHT STAY IN CANCUN: All participants who attend the Atlanta REIA Meeting will entered into a drawing for a chance to win a *Complimentary 5 Day, 4 Night Stay in Cancun! *You must be present at the meeting to win. Giveaway does not include dining, transportation, transfers, taxes, upgrades, etc.

with Don DeRosa

Atlanta REIA Members Please RSVP on Meetup.com

Are you spending money on marketing and not getting any deals? Are you able to take any lead and make a deal out of it? Do you know how to make multiple offers that actually get accepted? Are you using technology to your advantage? If the answer is “NO” to these questions then you MUST attend this subgroup meeting.

Are you spending money on marketing and not getting any deals? Are you able to take any lead and make a deal out of it? Do you know how to make multiple offers that actually get accepted? Are you using technology to your advantage? If the answer is “NO” to these questions then you MUST attend this subgroup meeting.

Would you like to learn how to structure deals so you can buy houses with little or none of your own cash and none of your own credit? 15 hours a week… That’s all you need! Imagine… taking any seller lead and being able to create a winning deal out of it… Making thousands of dollars where you thought there were none. No more wasted marketing dollars. No more wasted phone calls. No more wasted time.

Join Don DeRosa at the High Tech Home Buying Creative Deal Structuring Subgroup on Monday, January 9th from 5PM to 6PM at the Atlanta REIA Main Meeting at the Doubletree where he will be teaching about a wide variety of topics each month. Don will teach you about the state-of-the-art tools and techniques you’ll use to evaluate deals and figure out how to make them work – so you can work less and spend more time where you want, when you want and with whom you want.

Some topics Don will be teaching about include:

- Using Apps on your iPad or other mobile device to evaluate deals on the go

- Creative Techniques such as Wrap Around Mortgages, Sandwich Lease Options, Subject-To, Seller Financing, and more

- How to be a transaction engineer.

- How to be a problem solver.

- And so much more…

Bring your deals and Don will walk through them step-by-step and he’ll show you how to easily evaluate the lead, determine your exit strategy, structure the deal, negotiate with the seller, and get the paperwork done in a snap.

Its an amazing time to be a real estate investor. Don’t look back 5 years from now and wish you had acted. Learn how to buy right… Learn to Make More and Work Less, Right Now!

At 5:00 PM in the Main Lobby, we have a Vendor Trade Show that lasts throughout the meeting where you can come out and meet many of our participating Business Members and Vendor Guests who help sponsor our meeting. See a full list of our vendors and sponsors below as they are added.

At 5:00 PM in the Main Lobby, we have a Vendor Trade Show that lasts throughout the meeting where you can come out and meet many of our participating Business Members and Vendor Guests who help sponsor our meeting. See a full list of our vendors and sponsors below as they are added.

Vendor tables are limited, so any vendors wanting to reserve a table for the meeting can RSVP for a Vendor Table here. Vendor tables are reserved and setup on a first-come, first-serve basis.

Starting at 6:15 PM, Dustin Griffin kicks off the Atlanta REIA Main Meeting with updates and announcements. Dustin covers what’s happening at Atlanta REIA in the upcoming weeks and months such as upcoming workshops, webcasts, special events, members benefits and much more! Be sure to be in the main meeting room at 6:15 PM for your chance to be one of the first to receive a printed copy of The Profit Newsletter while supplies last.

At approximately 6:30 PM, Joe Thompson will be hosting the Haves & Wants Speed Marketing Session which gives our members the opportunity to quickly market deals they HAVE and to find deals they WANT. We also give our business members the opportunity to get up and say a few words about their businesses. Members who want to participate in the Haves & Wants Marketing Session must bring your flyers and get to the meeting early to get on Joe’s list of participants.

At approximately 6:30 PM, Joe Thompson will be hosting the Haves & Wants Speed Marketing Session which gives our members the opportunity to quickly market deals they HAVE and to find deals they WANT. We also give our business members the opportunity to get up and say a few words about their businesses. Members who want to participate in the Haves & Wants Marketing Session must bring your flyers and get to the meeting early to get on Joe’s list of participants.

Taco Mac Perimeter

After the conclusion of the Atlanta REIA Main Meeting, we will be reconvening at 9:30 PM at Taco Mac Perimeter located at the Perimeter Place, 1211 Ashford Crossing, Atlanta, GA for the Late Nite Networking and the “Meeting-After-The-Meeting”! There is no charge for Atlanta REIA Members or guests to attend Late Nite Networking, so bring a friend and head on down to Late Nite Networking and have a cold brew with us! Just be sure you order food and beverages from the restaurant and please tip their wait staff generously. When you get there, be sure to look for Joe Thompson who will be leading our Late Nite Networking.

After the conclusion of the Atlanta REIA Main Meeting, we will be reconvening at 9:30 PM at Taco Mac Perimeter located at the Perimeter Place, 1211 Ashford Crossing, Atlanta, GA for the Late Nite Networking and the “Meeting-After-The-Meeting”! There is no charge for Atlanta REIA Members or guests to attend Late Nite Networking, so bring a friend and head on down to Late Nite Networking and have a cold brew with us! Just be sure you order food and beverages from the restaurant and please tip their wait staff generously. When you get there, be sure to look for Joe Thompson who will be leading our Late Nite Networking.

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

Read More>>

Secured Investment Lending – A licensed direct mortgage lender specializing in non-traditional hard money loans for non-owner occupied buy/fix sell properties or rental properties throughout the GA and FL. Read More>>

Secured Investment Lending – A licensed direct mortgage lender specializing in non-traditional hard money loans for non-owner occupied buy/fix sell properties or rental properties throughout the GA and FL. Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Visio Lending – Simply put, we thrive on real estate. Dedicated to serving the landlord investor space, we crafted our loan products with three words in mind: fast, simple and dependable. Our suite of 30-year fully amortizing loans starts as low as 5.99%. Read More>>

Visio Lending – Simply put, we thrive on real estate. Dedicated to serving the landlord investor space, we crafted our loan products with three words in mind: fast, simple and dependable. Our suite of 30-year fully amortizing loans starts as low as 5.99%. Read More>>

Equitable Consulting – Investors, wether you have a short term or long term plan, “fix & flip” or “buy & hold”, individual units or entire portfolios, Equitable Consulting is your resource at every step. Read More >>

Equitable Consulting – Investors, wether you have a short term or long term plan, “fix & flip” or “buy & hold”, individual units or entire portfolios, Equitable Consulting is your resource at every step. Read More >>

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More>>

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More>>

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more! Read More>>

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more! Read More>>

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele. Read More>>

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele. Read More>>

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

Auction.com – The nation’s leading online real estate marketplace, having sold over $34 billion in real estate assets. Auction.com’s mission is to provide the most trusted online real estate marketplace, making transactions easier and more transparent. Read More>>

Auction.com – The nation’s leading online real estate marketplace, having sold over $34 billion in real estate assets. Auction.com’s mission is to provide the most trusted online real estate marketplace, making transactions easier and more transparent. Read More>>

Angel Oak Prime Bridge – A direct hard money lender headquartered in Atlanta. We provide renovation/construction loans for investors and builders to purchase and renovate residential properties. Read More>>

Angel Oak Prime Bridge – A direct hard money lender headquartered in Atlanta. We provide renovation/construction loans for investors and builders to purchase and renovate residential properties. Read More>>

CRS Data – We offer comps from the MLS & FSBO’s, custom searches, property tax records, interactive maps, sales & mortgage info, real estate valuations, mailing lists & more. Read More>>

CRS Data – We offer comps from the MLS & FSBO’s, custom searches, property tax records, interactive maps, sales & mortgage info, real estate valuations, mailing lists & more. Read More>>

Legal Shield

Coldwell Banker Residential Brokerage

Lluminare Windows & Doors

Atlanta REIA BIG Christmas Party on December 19, 2016

Posted on December 12, 2016 byBIG Christmas Party!

Mon, December 19th at Hudson Grille Sandy Springs

*Food & Non-Alcoholic Beverages Included!

Atlanta REIA wants to wish you and yours a very Merry Christmas and Happy Holidays!

Atlanta REIA wants to wish you and yours a very Merry Christmas and Happy Holidays!

On Monday, December 19th at 6:30PM, we’re having our annual Atlanta REIA BIG Meeting & Christmas Party at the Hudson Grille located at 6317 Roswell Rd NE in Sandy Springs, GA.

Atlanta REIA Gold Members can attend for $15, Silver Members for $20 and Guests for $40. RSVP Now & Save Your Seats!

*PLEASE NOTE: Food and non-alcoholic Beverages will be provided for those who register and show up on time. Attendees can also order off the Hudson Grille menu and/or purchase adult beverages at the cash bar at their own expense if they wish.

Christmas Party Sponsors

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more! Read More>>

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more! Read More>>

Solutions Realty Network – Providing expert property management and investment services since 2003. You invest and we take care of the rest! We’re the solution to all your real estate needs. Read More>>

Solutions Realty Network – Providing expert property management and investment services since 2003. You invest and we take care of the rest! We’re the solution to all your real estate needs. Read More>>

Visio Lending – Simply put, we thrive on real estate. Dedicated to serving the landlord investor space, we crafted our loan products with three words in mind: fast, simple and dependable. Our suite of 30-year fully amortizing loans starts as low as 5.99%. Read More>>

Visio Lending – Simply put, we thrive on real estate. Dedicated to serving the landlord investor space, we crafted our loan products with three words in mind: fast, simple and dependable. Our suite of 30-year fully amortizing loans starts as low as 5.99%. Read More>>

Christmas Party Sponsors Wanted

As always, we are looking for Atlanta REIA Business Members and other businesses who are non-members to sponsor our Annual Christmas Party. To sign up for sponsorship, please visit SponsorChristmas.AtlantaREIA.com. Thanks in advance for signing up to sponsor the party! And remember to bring some door prizes and giveaways. Merry Christmas!

Haves & Wants Meets on December 15, 2016

Posted on December 12, 2016 byThurs, December 15th at 1:30PM

5 Seasons Brewing, 5600 Roswell Rd, Sandy Springs

Hosted by Joe Thompson

Haves and Wants is a weekly investor networking and deal making lunch meeting hosted by Joe Thompson and held every Thursday at 5 Seasons Brewing at the Prado from 1:30 PM till approximately 3:00 PM. This group has been meeting for over 6 years and is all about networking, sharing information, doing deals and making money right now. Be sure to bring lots of your business cards and flyers and be prepared to promote your business and/or your haves, wants and deals with our group. If you are a real estate player or want to be, this is one weekly meeting you don’t want to miss!

Haves and Wants is a weekly investor networking and deal making lunch meeting hosted by Joe Thompson and held every Thursday at 5 Seasons Brewing at the Prado from 1:30 PM till approximately 3:00 PM. This group has been meeting for over 6 years and is all about networking, sharing information, doing deals and making money right now. Be sure to bring lots of your business cards and flyers and be prepared to promote your business and/or your haves, wants and deals with our group. If you are a real estate player or want to be, this is one weekly meeting you don’t want to miss!

5 Seasons Brewing is located at 5600 Roswell Rd (map) inside the Perimeter at the “Prado” in Sandy Springs. The all natural, organic food at the 5 Seasons is excellent and the hand-crafted beer is even better! Come out and eat, drink, network and share your deals with us! There is no charge to attend this meeting for Atlanta REIA Members or guests. Please come early and stay late. We would love to have you!

5 Seasons Brewing is located at 5600 Roswell Rd (map) inside the Perimeter at the “Prado” in Sandy Springs. The all natural, organic food at the 5 Seasons is excellent and the hand-crafted beer is even better! Come out and eat, drink, network and share your deals with us! There is no charge to attend this meeting for Atlanta REIA Members or guests. Please come early and stay late. We would love to have you!

Atlanta REIA Members & Guests, Please RSVP on Meetup.com

Atlanta Intown Investors Meets at Madre & Mason on December 15, 2016

Posted on December 12, 2016 byThis Group is All About Doing Deals!

Dec 15th, 6PM at Madre & Mason

Bring Your Deals, Biz Cards & Flyers

Atlanta REIA Members & Non-Members Welcome!

The Atlanta Intown Investors Club is an Atlanta REIA Subgroup led by Maggie Groholski that meets on Thursday, December 15th at 6PM at the Madre & Mason (This Month Only) located at 560 Dutch Valley Rd NE, Atlanta, GA. Our mission and focus is to provide an open forum for real estate investors and industry professionals to network and have direct access to hot real estate deals. The format for this meeting is totally member-centric. It’s content and value is derived from our members and guests actively participating and networking with each other during the meeting.

The Atlanta Intown Investors Club is an Atlanta REIA Subgroup led by Maggie Groholski that meets on Thursday, December 15th at 6PM at the Madre & Mason (This Month Only) located at 560 Dutch Valley Rd NE, Atlanta, GA. Our mission and focus is to provide an open forum for real estate investors and industry professionals to network and have direct access to hot real estate deals. The format for this meeting is totally member-centric. It’s content and value is derived from our members and guests actively participating and networking with each other during the meeting.

This meeting is all about transacting and doing deals. You will have the opportunity to pitch your properties, products, and services; voice your real estate haves and wants; and participate in open discussions of real estate questions and concerns. We will not be pitching products from the front of the room. We will strive to remain a forum for investors to do deals and learn and seek advice from your peers and trusted industry professionals. The more you attend and participate, the more deals you’ll do and, the smarter we all become.

This meeting is all about transacting and doing deals. You will have the opportunity to pitch your properties, products, and services; voice your real estate haves and wants; and participate in open discussions of real estate questions and concerns. We will not be pitching products from the front of the room. We will strive to remain a forum for investors to do deals and learn and seek advice from your peers and trusted industry professionals. The more you attend and participate, the more deals you’ll do and, the smarter we all become.

Atlanta REIA Members & Guests, Please RSVP on Meetup.com

Onsite Renovation Group Meets on December 20, 2016

Posted on December 12, 2016 byHands-On Learning “Onsite” at Real Renovation Projects

Tuesday, December 20th at NOON

MEETING ADDRESS HAS CHANGED TO:

901 Bouldercrest Dr SE, Atlanta, GA

Please join us on Tuesday, December 20th at NOON for the Atlanta REIA Onsite Renovation Group (ORG) to learn all about finding, funding, fixing, and flipping houses for big profits.

Please join us on Tuesday, December 20th at NOON for the Atlanta REIA Onsite Renovation Group (ORG) to learn all about finding, funding, fixing, and flipping houses for big profits.

This month’s meeting will be held at one of Frank Iglesias’s renovation projects located at 901 Bouldercrest Dr SE, Atlanta, GA. Come join us onsite and learn how Frank will turn this old run down house into a profitable deal!

The Atlanta REIA Onsite Renovation Group (ORG) is an educational and networking group that focuses on the acquisition, renovation and retail resale (fix and flip) of single family residential homes. The purpose of the group is to allow both new and experienced rehabbers and investors to meet, network and share knowledge and experience with “hands on” access to real property.

The Atlanta REIA Onsite Renovation Group (ORG) is an educational and networking group that focuses on the acquisition, renovation and retail resale (fix and flip) of single family residential homes. The purpose of the group is to allow both new and experienced rehabbers and investors to meet, network and share knowledge and experience with “hands on” access to real property.

The Onsite Renovation Group meets on the 3rd Tuesday each month at NOON at an active renovation site, build site or rental property which will vary from month to month. As always, there is no charge for Atlanta REIA members to attend. Guests & Non-Members can RSVP Online for Only $15 or pay $20 at the door.

Atlanta REIA Members, Please RSVP on Meetup.com