Atlanta Real Estate Investors Alliance Blog

How to Make a Website For Fun or Profit – Part 3

Posted on November 26, 2013 byHello – Nice To See You Again! Here’s what you’ve learned in the first 2 parts of this article:

- How important it is to have a website, if you’re in business in the 21st Century.

- There are so many things you can do with it, like get more business, educate your consumers, entertain an audience, inspire your community, link it to Facebook, etc… and that’s just scratching the surface.

- We also discussed HOW and WHERE to actually get a website up & running quickly – all for either FREE, OR almost free (inexpensive).

- We identified the first few steps you need to take on the road to having a nicely-performing, lead-generating website for your business.

Ok, with the quick review out of the way, I have a question for you: Have You Done Your Homework? If you recall, I’d given you two choices: 1. The free route (to learn how to get started), or 2. The paid route, if you’re running a business or want a ‘legit’ site.

If you’ve wisely chosen the legit/paid route, you should have picked a domain name and bought it by now! Remember? You should also have gotten your Hosting Account set up.

You… did that, right? Read More→

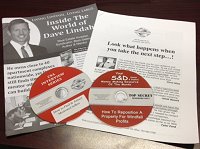

December 2nd Atlanta REIA Meeting with David Lindahl on Huge Monthly Cash Flows with Apartments

Posted on November 25, 2013 bywith Special Guest, David Lindahl

Guests Can RSVP Online Now for $15 or Pay $20 at the Door.

On December 2nd at the Atlanta REIA Main Meeting, David Lindahl will teach you how to create a $10,300 per month positive cash flow and become a multi-millionaire in five years or less by investing in single family houses and then transitioning into apartment buildings!

On December 2nd at the Atlanta REIA Main Meeting, David Lindahl will teach you how to create a $10,300 per month positive cash flow and become a multi-millionaire in five years or less by investing in single family houses and then transitioning into apartment buildings!

With more than 18 years of experience in Real Estate Investing, David Lindahl has rehabbed over 820 houses, and currently controls over 7,400 apartment units. Starting out as a struggling landscaper with no experience in construction, Dave would rehab single-family houses to “flip” for chunks of money, so he could buy apartment buildings. Within the first 14 months, Dave’s apartment buildings created a positive cash flow of more than $10,300 a month for him and his family and within three and one half years Dave became a multi-millionaire.

Dave then learned about the four phases of the Real Estate Market Cycle, what strategies to use in each cycle for maximum profit and the fact that at any given time there are 10 – 20 markets around the United States that are “Emerging.” Dave learned how to find these markets, and he created a system to buy in these markets and became much wealthier, much faster! He has done and does all of this without dealing with a single tenant! Now he is ready to tell you how you can do it too!

Today, Dave has earned millions of dollars renovating houses for resale. And, he controls over 7,400 apartment units with a monthly cash flow equaling what most people make in a year!

Join Dave at Atlanta REIA where he will teach you:

- How to Recognize Market Cycles and Use Them to Become Wealthy Fast!

- How To Find Good Quality Management Companies to Manage Your Tenants so You Don’t Have to!

- The 5 Steps To Creating Wealth Through Real Estate Investing

- How to Find Motivated Sellers of Apartment Buildings and Get Them to Call You!

- How to Analyze an Apartment Building in 3 minutes or Less to Determine if It’s a Deal!

- The 6 Value Plays that You Should Look for in Every Deal—Finding Just One Can Make You a Fortune!

- How to Explode Your Wealth Using 1031 Tax Free Exchanges!

- Why There is Far Less Risk Owning Apartment Houses!

- How to Refinance and Get Chunks of Cash—Tax Free!

- Many Other Money Making Systems and Strategies that Dave has Successfully Developed!

- And much, much more including answers to your questions…

Come join Dave and the rest of us at the Atlanta REIA Meeting on Monday, December 2nd at 5PM at the Crown Plaza Ravinia Hotel in Atlanta located at 4355 Ashford Dunwoody Road in Atlanta, GA and learn how to invest in apartment buildings. Dave has several bonuses for the 1st 100 members and guests who attend (one per couple please)!

Come join Dave and the rest of us at the Atlanta REIA Meeting on Monday, December 2nd at 5PM at the Crown Plaza Ravinia Hotel in Atlanta located at 4355 Ashford Dunwoody Road in Atlanta, GA and learn how to invest in apartment buildings. Dave has several bonuses for the 1st 100 members and guests who attend (one per couple please)!

WIN A CRUISE or Other Door Prizes: All participants who attend the Atlanta REIA Meeting will have a chance to win a *Complimentary 2 Day Cruise to the Bahamas with Caribbean Cruise Line! The 2 day Cruise does not include port fees, transportation and taxes. *We will also be giving away other door prizes such as Gift Cards and more! *You must be present at the meeting to win.

WIN A CRUISE or Other Door Prizes: All participants who attend the Atlanta REIA Meeting will have a chance to win a *Complimentary 2 Day Cruise to the Bahamas with Caribbean Cruise Line! The 2 day Cruise does not include port fees, transportation and taxes. *We will also be giving away other door prizes such as Gift Cards and more! *You must be present at the meeting to win.

With Bill Nemeth & Merry Brodie

At the Meeting-Before-the-Meeting

Bill Nemeth and Merry Brodie will be our special Guest at the Active Investor Group Meeting on Monday, December 2nd at 3:00 PM at Total Wine & More located at 124 Perimeter Center W (see map). Bill Nemeth and Merry Brodie are both Enrolled Agents and the founding partners and owners of Tax Audit Guardian, an Atlanta-based group of professionals who specialize in assisting troubled tax clients in representation, audit and tax court matters. They recently sold their 7 Jackson Hewitt Tax Service franchises (24 locations). Additionally, Brodie works with small businesses as owner of Brodie Accounting Services and Nemeth is active in education and membership activities of the Georgia Association of Enrolled Agents.

Bill Nemeth and Merry Brodie will be our special Guest at the Active Investor Group Meeting on Monday, December 2nd at 3:00 PM at Total Wine & More located at 124 Perimeter Center W (see map). Bill Nemeth and Merry Brodie are both Enrolled Agents and the founding partners and owners of Tax Audit Guardian, an Atlanta-based group of professionals who specialize in assisting troubled tax clients in representation, audit and tax court matters. They recently sold their 7 Jackson Hewitt Tax Service franchises (24 locations). Additionally, Brodie works with small businesses as owner of Brodie Accounting Services and Nemeth is active in education and membership activities of the Georgia Association of Enrolled Agents.

After the conclusion of the Main Meeting, we will be reconvening at the Tilted Kilt Perimeter located at 1155-B Mount Vernon Highway in Atlanta for the “Meeting-After-The-Meeting”. The Tilted Kilt will be offering half price appetizers as well as food and drink specials for our members and guests. Come eat, drink, network and have fun with us as hang out late into the night! Thanks Tilted Kilt Perimeter!

After the conclusion of the Main Meeting, we will be reconvening at the Tilted Kilt Perimeter located at 1155-B Mount Vernon Highway in Atlanta for the “Meeting-After-The-Meeting”. The Tilted Kilt will be offering half price appetizers as well as food and drink specials for our members and guests. Come eat, drink, network and have fun with us as hang out late into the night! Thanks Tilted Kilt Perimeter!

*Please Note: Meeting agenda is subject to change.

Each and every month, for the duration of our meeting, we have a Vendor Trade Show in which you can come out and meet many of our participating business members who help sponsor our meeting. Vendors can Reserve a Table Here. Thanks again sponsors!

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

FirstCall Claims – Our public adjusters are experts in preparing, documenting, and negotiating claims. With more than 20 years of experience and millions of dollars for our clients, FirstCall has a solid record of improving settlement outcomes. Read More>>

FirstCall Claims – Our public adjusters are experts in preparing, documenting, and negotiating claims. With more than 20 years of experience and millions of dollars for our clients, FirstCall has a solid record of improving settlement outcomes. Read More>>

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More>>

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More>>

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele.

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele.

Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Pete’s Friendly Home Inspections, LLC. – Pete’s provides home inspections, radon monitoring, gas/water/septic tests, checks pools/sprinklers and any other type of inspection needed to get you that next home! Read More>>

Pete’s Friendly Home Inspections, LLC. – Pete’s provides home inspections, radon monitoring, gas/water/septic tests, checks pools/sprinklers and any other type of inspection needed to get you that next home! Read More>>

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

Read More>>

Atlanta Private Lending – Atlanta’s premier private real estate lending company. We provide private, hard money loans to professional real estate investors for renovation and investment purposes. Read More>>

Atlanta Private Lending – Atlanta’s premier private real estate lending company. We provide private, hard money loans to professional real estate investors for renovation and investment purposes. Read More>>

Craftbuilt, Inc. – We are a Metro Atlanta design-build construction firm specializing in whole-structure renovations, restorations, and new construction. No matter what the situation, we are up to the challenge! Read More>>

Craftbuilt, Inc. – We are a Metro Atlanta design-build construction firm specializing in whole-structure renovations, restorations, and new construction. No matter what the situation, we are up to the challenge! Read More>>

Goldmine Properties, Inc. – As Atlanta’s first full service real estate wholesaler, we offer wholesale property at 65% loan to value, with financing available. Purchase price and repairs are 65% of certified after repaired appraisal. Read More>>

Goldmine Properties, Inc. – As Atlanta’s first full service real estate wholesaler, we offer wholesale property at 65% loan to value, with financing available. Purchase price and repairs are 65% of certified after repaired appraisal. Read More>>

House4CashBuyers.com – Underwater? Behind on Payments? Repairs Needed? No matter what the issue is we can help! We can buy your house as-is for cash. We can also pay most of the closing costs, and we typically close fast!

House4CashBuyers.com – Underwater? Behind on Payments? Repairs Needed? No matter what the issue is we can help! We can buy your house as-is for cash. We can also pay most of the closing costs, and we typically close fast!

CRS Data – We offer comps from the MLS & FSBO’s, custom searches, property tax records, interactive maps, sales & mortgage info, real estate valuations, mailing lists & more. Read More>>

CRS Data – We offer comps from the MLS & FSBO’s, custom searches, property tax records, interactive maps, sales & mortgage info, real estate valuations, mailing lists & more. Read More>>

Atlanta Carpet Services, Inc. – Providing carpet, wood, vinyl, and tile, ACS is dedicated to every aspect of your floor covering needs from initial consultation to the sale and follow-up services. Read More>>

Atlanta Carpet Services, Inc. – Providing carpet, wood, vinyl, and tile, ACS is dedicated to every aspect of your floor covering needs from initial consultation to the sale and follow-up services. Read More>>

Fuller Center for Housing of Greater Atlanta – A faith-driven, Christ-centered, non-profit organization dedicated to providing adequate shelter for people in need in the Greater Atlanta area. Read More>>

Fuller Center for Housing of Greater Atlanta – A faith-driven, Christ-centered, non-profit organization dedicated to providing adequate shelter for people in need in the Greater Atlanta area. Read More>>

- Bowen’s Specialized Services

- Platinum Key Management, Inc (Rock Shukoor)

7 Ways To Find 7 Great Deals in 7 Days at Atlanta REIA West on November 25, 2013

Posted on November 22, 2013 bywith Special Guest, Rock Shukoor on…

7 Ways To Find 7 Great Deals in 7 Days

Join us at the Atlanta REIA West Meeting on Monday, November 25th at 6:30PM at the Cherokee Cattle Company where our special guest will be Rock Shukoor who who will showcase his Guerilla Marketing skills and show you how to find at least one deal a day. Yes, I said one deals a day. In fact, Rock wants to show you “7 Ways To Find 7 Great Deals in 7 Days”!

Join us at the Atlanta REIA West Meeting on Monday, November 25th at 6:30PM at the Cherokee Cattle Company where our special guest will be Rock Shukoor who who will showcase his Guerilla Marketing skills and show you how to find at least one deal a day. Yes, I said one deals a day. In fact, Rock wants to show you “7 Ways To Find 7 Great Deals in 7 Days”!

Rock will share everything you need to know on how to find deals quickly without using any money. This is guerrilla marketing at its best and at lightning fast speed. If you have a phone, have access to a computer and the desire to make changes in your life, you are in business! Rock will explain the whole process: the small but vital details, where to find deals, how to find the sellers and how to how to stay focused to find one deal a day (cha-ching!).

- Where to find deals

- How to sell them in a flash

- What market to choose

- Where to get your list from

- What kind of properties to focus on

- Where to get the money from for these deals

- How to stay focused on one deal per day

- And much, much more…

Rock even has some special FREE Bonuses for all those who attend!

When: Monday, November 25, 6:30-9:00 pm

Late Night Networking: From 9:00 to 10:00PM

Where: Cherokee Cattle Company, 2710 Canton Rd, Marietta, GA

More Info: Call 678-895-1460

There will be door prizes, fun, great networking! As always, the meeting is free for Atlanta REIA Members and just $5 (CASH ONLY at the door) for non-members. EVERYONE can bring a guest for free this month, so pair on up and ride on in Monday for a great night out. Don’t miss this very special Guest Speaker! See you there!

Buying Houses Subject-To, With Wrap Around Mortgages, Owner Financing & More at Atlanta REIA North

Posted on November 19, 2013 byBuying Houses Subject-To, With Wrap Around Mortgages, Owner Financing & More!

Learn how a local investor is finding hot deals in this hot sellers’ market. Learn how he is able to purchase them using no banks, none of his own money, and no credit. He will even tell you how one seller even paid him to purchase the property. Join guest speaker, Gordon Catts at the Atlanta REIA North Group on Wednesday, November 20th at 6:30 PM where he will discusses this important and exciting real world topic. Find out how Gordon is making deals happen and how you can too!

Learn how a local investor is finding hot deals in this hot sellers’ market. Learn how he is able to purchase them using no banks, none of his own money, and no credit. He will even tell you how one seller even paid him to purchase the property. Join guest speaker, Gordon Catts at the Atlanta REIA North Group on Wednesday, November 20th at 6:30 PM where he will discusses this important and exciting real world topic. Find out how Gordon is making deals happen and how you can too!

Atlanta REIA North is a of the Atlanta Real Estate Investors Alliance that meets on the 3rd Wednesday of each month at from 6:30 PM to 8:30 PM at 1960 Skylar Hill Dr, Suite D, Buford, Georgia in North Gwinnett County just a few miles from the Mall of Georgia. There is no charge to attend this meeting for Atlanta REIA members and the cost is $5.00 at the door for non-members.

After the conclusion of the Atlanta REIA North Meeting (after 9:30 PM), we will be reconvening at the Mall of Georgia located at 3250 Woodward Crossing Blvd in Buford, GA for the “Meeting after the Meeting”. We may arrive late if the Atlanta REIA Meeting runs late. So please come eat, drink, network and have fun with us as hang out late into the night!

After the conclusion of the Atlanta REIA North Meeting (after 9:30 PM), we will be reconvening at the Mall of Georgia located at 3250 Woodward Crossing Blvd in Buford, GA for the “Meeting after the Meeting”. We may arrive late if the Atlanta REIA Meeting runs late. So please come eat, drink, network and have fun with us as hang out late into the night!

What’s Happening at Atlanta REIA for the Week of November 18, 2013

Posted on November 18, 2013 byNov 18th at 6:30 PM @ Hudson Grille Sandy Springs

Fortune With Tax Sales!

With Special Guest, Tom DiAgostino

Atlanta REIA Members Can RSVP at No Charge

Guests Can RSVP for $15 Online or Pay $20 at the Door.

Atlanta REIA and the Beginning Investors Group are excited to announce that Tom DiAgostino will be our special guest trainer this month at BIG on Monday, November 18th at 6:30 PM at the Hudson Grill located at 6317 Roswell Rd NE in Sandy Springs, GA. Tom will be teaching us “How to Create a Cash Flow Fortune with Tax Sales”, a real estate niche that most investors know nothing about. Join us at the meeting and you will learn…

Atlanta REIA and the Beginning Investors Group are excited to announce that Tom DiAgostino will be our special guest trainer this month at BIG on Monday, November 18th at 6:30 PM at the Hudson Grill located at 6317 Roswell Rd NE in Sandy Springs, GA. Tom will be teaching us “How to Create a Cash Flow Fortune with Tax Sales”, a real estate niche that most investors know nothing about. Join us at the meeting and you will learn…

- Why this is the easiest way to buy properties so cheap it feels like stealing

- Why auctions are not the answer, and the secret to making maximum interest

- How to make easy 18-36% returns without owning real estate, but enjoying its security

- Where to tap into the most motivated sellers on the planet with the LEAST Competition

- Why there is so much meat on the bone, it’s hard NOT to make insane profits

- How to do it all tax free within your IRA

- How we make our staff available to do it for you if you wish

After Tom’s presentation, we will be having Late Nite Networking where you can have a drink, network and socialize with Tom DiAgnostino and other new and experienced investors as well. This is a great way to build your network and have fun doing it!

Atlanta REIA Members RSVP Here at NO CHARGE. Non-Members RSVP Here for $15 per person or pay $20 at the door. Seating is extremely limited at the Hudson Grill and this is sure to be a popular educational topic, so RSVP Now and be sure to bring your ticket receipt to the meeting to get a seat. Networking and ordering food begins at 6:30PM. Presentations begin at 7:00PM. Late Nite Networking begins at 9:00PM until Late.

This week, on Tuesday, November 19th at Noon, the Onsite Renovation Group meets at 3152 Dodson Dr, East Point GA 30344. Nestled in a veritable pine forest, this is a moderate-level renovation that includes some reframing, a whole lotta wiring and plumbing, and one very steep driveway. You may want to park next- door in Sykes park.

This week, on Tuesday, November 19th at Noon, the Onsite Renovation Group meets at 3152 Dodson Dr, East Point GA 30344. Nestled in a veritable pine forest, this is a moderate-level renovation that includes some reframing, a whole lotta wiring and plumbing, and one very steep driveway. You may want to park next- door in Sykes park.

The Onsite Renovation Group, led by Aaron McGinnis of Craftbuilt Properties, is an new educational and networking group that focuses on the acquisition, renovation and retail resale (fix and flip) of single family residential homes inside the I-285 perimeter and the in-town neighborhoods. The purpose of this group is to allow both new and experienced rehabbers and investors to meet, network and share knowledge and experience with “hands on” access to real property. The Onsite Renovation Group meets on the 3rd Tuesday of each month at NOON at an active renovation site, build site or rental property which will vary from month to month. There is currently no charge to attend these meeting.

The Onsite Renovation Group, led by Aaron McGinnis of Craftbuilt Properties, is an new educational and networking group that focuses on the acquisition, renovation and retail resale (fix and flip) of single family residential homes inside the I-285 perimeter and the in-town neighborhoods. The purpose of this group is to allow both new and experienced rehabbers and investors to meet, network and share knowledge and experience with “hands on” access to real property. The Onsite Renovation Group meets on the 3rd Tuesday of each month at NOON at an active renovation site, build site or rental property which will vary from month to month. There is currently no charge to attend these meeting.

Buying Houses Subject-To, With Wrap Around Mortgages, Owner Financing & More!

Learn how a local investor is finding hot deals in this hot sellers’ market. Learn how he is able to purchase them using no banks, none of his own money, and no credit. He will even tell you how one seller even paid him to purchase the property. Join guest speaker, Gordon Catts at the Atlanta REIA North Group on Wednesday, November 20th at 6:30 PM where he will discusses this important and exciting real world topic. Find out how Gordon is making deals happen and how you can too!

Learn how a local investor is finding hot deals in this hot sellers’ market. Learn how he is able to purchase them using no banks, none of his own money, and no credit. He will even tell you how one seller even paid him to purchase the property. Join guest speaker, Gordon Catts at the Atlanta REIA North Group on Wednesday, November 20th at 6:30 PM where he will discusses this important and exciting real world topic. Find out how Gordon is making deals happen and how you can too!

Atlanta REIA North is a of the Atlanta Real Estate Investors Alliance that meets on the 3rd Wednesday of each month at from 6:30 PM to 8:30 PM at 1960 Skylar Hill Dr, Suite D, Buford, Georgia in North Gwinnett County just a few miles from the Mall of Georgia. There is no charge to attend this meeting for Atlanta REIA members and the cost is $5.00 at the door for non-members.

After the conclusion of the Atlanta REIA North Meeting (after 9:30 PM), we will be reconvening at the Mall of Georgia located at 3250 Woodward Crossing Blvd in Buford, GA for the “Meeting after the Meeting”. We may arrive late if the Atlanta REIA Meeting runs late. So please come eat, drink, network and have fun with us as hang out late into the night!

After the conclusion of the Atlanta REIA North Meeting (after 9:30 PM), we will be reconvening at the Mall of Georgia located at 3250 Woodward Crossing Blvd in Buford, GA for the “Meeting after the Meeting”. We may arrive late if the Atlanta REIA Meeting runs late. So please come eat, drink, network and have fun with us as hang out late into the night!

Hosted by Joe Thompson

Haves and Wants is a weekly investor’s networking, brainstorming and deal making jam session hosted by Joe Thompson and held every Thursday at 5 Seasons Brewing at the Prado from 1:30 PM till approximately 3:00 PM. This group has been meeting for over 6 years and is all about networking, sharing information, doing deals and making money right now. Be sure to bring lots of your business cards and flyers and be prepared to promote your business and/or your haves, wants and deals with our group. If you are a real estate player or want to be, this is one meeting you don’t want to miss!

Haves and Wants is a weekly investor’s networking, brainstorming and deal making jam session hosted by Joe Thompson and held every Thursday at 5 Seasons Brewing at the Prado from 1:30 PM till approximately 3:00 PM. This group has been meeting for over 6 years and is all about networking, sharing information, doing deals and making money right now. Be sure to bring lots of your business cards and flyers and be prepared to promote your business and/or your haves, wants and deals with our group. If you are a real estate player or want to be, this is one meeting you don’t want to miss!

5 Seasons Brewing is located at 5600 Roswell Rd (map) inside the Perimeter at the “Prado” in Sandy Springs. The all natural, organic food at the 5 Seasons is excellent and the hand-crafted beer is even better! Come out and eat, drink, network and share your deals with us! There is no charge to attend this meeting for Atlanta REIA Members or guests. Please come early and stay late. We would love to have you!

5 Seasons Brewing is located at 5600 Roswell Rd (map) inside the Perimeter at the “Prado” in Sandy Springs. The all natural, organic food at the 5 Seasons is excellent and the hand-crafted beer is even better! Come out and eat, drink, network and share your deals with us! There is no charge to attend this meeting for Atlanta REIA Members or guests. Please come early and stay late. We would love to have you!

How to Buy Houses Fast with as

Little as $275 Using Tax Sales

A Full Day Workshop with Tom DiAgostino

On November 23rd from 9AM – 4PM

1960 Skylar Hill Dr, Suite D, Buford, GA

Elite Tax Sale Training: How to Create Generational Wealth with Tax Liens & Deeds & get Out of the Rat Race Forever!

- How to CONSISTENTLY buy properties at 10-30% of Repaired Value so you make more money EACH Deal

- Where to get great liens at the maximum rate allowed by the state and double your money in half the time

- How to get Valuable properties for FREE with simple mail done for you

- How to use your IRA to keep 100% of the profits, compounding your wealth building

- What kind of diligence is necessary for the property and for title work to avoid mistakes

- Strategies for wholesaling, retailing, rehabbing, and landlording for maximum profit

- How to get the same savings on material as Tom’s 20yr relationships – for more money in your pocket!

Tom says… I’ve been around the block for 21 years and done it all. This is not the flavor of the week. This training will change your financial life, and your generations to come. Stop trying to ride the next wave, only to find you’re on the back end, left at sea. We’re not just trainers, we’re your investment partners. Trust us and come spend Saturday, November 23rd, 2013 with us, where I’ll explain why this is the best deal source on the planet for every type of investor & show you how to do it.

Tom says… I’ve been around the block for 21 years and done it all. This is not the flavor of the week. This training will change your financial life, and your generations to come. Stop trying to ride the next wave, only to find you’re on the back end, left at sea. We’re not just trainers, we’re your investment partners. Trust us and come spend Saturday, November 23rd, 2013 with us, where I’ll explain why this is the best deal source on the planet for every type of investor & show you how to do it.

Tax Sales Workshop with Tom DiAgostino on November 23, 2013

Posted on November 5, 2013 byAtlanta REIA Presents:

How to Buy Houses Fast with as

Little as $275 Using Tax Sales

A Full Day Workshop with Tom DiAgostino

On November 23rd from 9AM – 4PM

1960 Skylar Hill Dr, Suite D, Buford, GA

Sold Out. Sold Out. Sold Out.

Elite Tax Sale Training: How to Create Generational Wealth with Tax Liens and Deeds and get Out of the Rat Race Forever

Elite Tax Sale Training: How to Create Generational Wealth with Tax Liens and Deeds and get Out of the Rat Race Forever

- How to CONSISTENTLY buy properties at 10-30% of Repaired Value so you make more money EACH Deal

- Where to get great liens at the maximum rate allowed by the state and double your money in half the time

- How to get Valuable properties for FREE with simple mail done for you

- How to use your IRA to keep 100% of the profits, compounding your wealth building

- What kind of diligence is necessary for the property and for title work to avoid mistakes

- Strategies for wholesaling, retailing, rehabbing, and landlording for maximum profit

- How to get the same savings on material as Tom’s 20yr relationships – for more money in your pocket!

Tom says… I’ve been around the block for 21 years and done it all. This is not the flavor of the week. This training will change your financial life, and your generations to come. Stop trying to ride the next wave, only to find you’re on the back end, left at sea. We’re not just trainers, we’re your investment partners. Trust us and come spend Saturday, November 23rd, 2013 with us, where I’ll explain why this is the best deal source on the planet for every type of investor & show you how to do it.

Learn How to Create a Cash Flow Fortune with Tax Sales at the Beginning Investors Group on November 18, 2013

Posted on November 1, 2013 byNov 18th at 6:30 PM @ Hudson Grille Sandy Springs

Fortune With Tax Sales!

With Special Guest, Tom DiAgostino

Atlanta REIA Members Can RSVP at No Charge

Guests Can RSVP for $15 Online or Pay $20 at the Door.

Atlanta REIA and the Beginning Investors Group are excited to announce that Tom DiAgostino will be our special guest trainer this month at BIG on Monday, November 18th at 6:30 PM at the Hudson Grill located at 6317 Roswell Rd NE in Sandy Springs, GA. Tom will be teaching us “How to Create a Cash Flow Fortune with Tax Sales”, a real estate niche that most investors know nothing about. Join us at the meeting and you will learn…

Atlanta REIA and the Beginning Investors Group are excited to announce that Tom DiAgostino will be our special guest trainer this month at BIG on Monday, November 18th at 6:30 PM at the Hudson Grill located at 6317 Roswell Rd NE in Sandy Springs, GA. Tom will be teaching us “How to Create a Cash Flow Fortune with Tax Sales”, a real estate niche that most investors know nothing about. Join us at the meeting and you will learn…

- Why this is the easiest way to buy properties so cheap it feels like stealing

- Why auctions are not the answer, and the secret to making maximum interest

- How to make easy 18-36% returns without owning real estate, but enjoying its security

- Where to tap into the most motivated sellers on the planet with the LEAST Competition

- Why there is so much meat on the bone, it’s hard NOT to make insane profits

- How to do it all tax free within your IRA

- How we make our staff available to do it for you if you wish

Tom says… “Regardless of your experience or location, you can earn unthinkable interest, or find unbelievable deals to wholesale, flip, or partner on. Even Homer Simpson can do what I am going to teach you. I mean deals at 10-30% of repaired value.”

“I’ve been around the block for 21 years and done it all. This is not the flavor of the week. This training will change your financial life, and your generations to come. Stop trying to ride the next wave, only to find you’re on the back end, left at sea. We’re not just trainers, we’re your investment partners. Come join us and spend 90 min on November 18th at the Beginning Investors Group where I’ll explain why this is the best deal source on the planet for every type of investor.”

After Tom’s presentation, we will be having Late Nite Networking where you can have a drink, network and socialize with Tom DiAgnostino and other new and experienced investors as well. This is a great way to build your network and have fun doing it!

Atlanta REIA Members RSVP Here at NO CHARGE. Non-Members RSVP Here for $15 per person or pay $20 at the door. Seating is extremely limited at the Hudson Grill and this is sure to be a popular educational topic, so RSVP Now and be sure to bring your ticket receipt to the meeting to get a seat. Networking and ordering food begins at 6:30PM. Presentations begin at 7:00PM. Late Nite Networking begins at 9:00PM until Late. Read More→

The Profit Newsletter November 2013 Edition

Posted on October 31, 2013 by The November 2013 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on November 4th. You can download The Profit Newsletter as a High Quality PDF or Low Res PDF for slower devices. The Profit is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

The November 2013 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on November 4th. You can download The Profit Newsletter as a High Quality PDF or Low Res PDF for slower devices. The Profit is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

Abandoned Properties – One Of The Best Kept Money-Making Secrets

Posted on October 30, 2013 by When I began my career as a real estate investor in 1985, I stumbled across a little known area of real estate that had the potential to make us a ton of money. This was an area of the market that went unnoticed by most people. This was the area of abandoned properties.

When I began my career as a real estate investor in 1985, I stumbled across a little known area of real estate that had the potential to make us a ton of money. This was an area of the market that went unnoticed by most people. This was the area of abandoned properties.

How To Profit From Abandoned Properties

You might pass these properties on a daily basis, but just never paid much attention to them. You could be passing up hundreds of thousands of dollars in profits! These are properties that the owner has walked away from for whatever reason. It could be a divorce situation, an illness, a death in the family, a job relocation, or any number of other reasons. Do we care why? Absolutely not! Don’t waste your energy trying to figure out why sellers do what sellers do. Read More→

Five Marketing Musts

Posted on October 30, 2013 byWhen it comes to 800 Pound Guerilla Marketing, I have learned that the number of motivated buyer and seller leads I am able to generate only seem to be limited by the time, effort and creativity I put into the marketing process, rather than how much money I spend.

When I put in the time, effort and creativity needed to successfully market my real estate investing business, the leads come pouring in on a steady and predictable basis. When I slack up, the leads often start to dry up rather quickly.

Over the years, as I came to this realization, I created a few personal marketing rules or “marketing musts” to help keep me and my marketing efforts on track so I can consistently generate a steady stream of incoming buyer and seller leads.

I wanted to share these “Five Marketing Musts” with you in hopes they might positively influence your future marketing efforts and real estate investing success… Read More→

Building a Better Blog

Posted on October 30, 2013 by“I’m writing a book. I’ve got the page numbers done.” ~ Steven Wright

Last month, if you’ll remember, I talked about starting a blog. I began with a reality check, which I’ll repeat here: Blogging can be a great marketing tool, but it takes a lot of work to keep one up. And don’t expect riches!

I gave you four other tips as well: make sure you have something to say, know your goals, identify your audience, and read other blogs. Those tips are just as important when you sit down to write individual posts, too.

Remember my second cousin Flora, the cat lady? I told you about her last month. She has a blog called “Cats.” I’m afraid it’s not very good. The background is hot pink, the text is yellow, and there’s a hamster dancing around in the corner. As soon as you enter the site, you hear the song for the Chicken Dance. I’m pretty sure she has posted every single picture she’s ever taken of her 34 cats, including the pictures that are blurry and underexposed. Plus, she adds lots of kitty pictures off the web. Oh, and a recipe for Flora’s Skinny Butterscotch Potatoes. And that was just yesterday.

Thank goodness she only posts about three times a year! Read More→

The Right Title Company

Posted on October 30, 2013 byWhen discussing investment real estate everyone focuses on finding deals, locating financing, remodeling, selling, etc. Few people speak about the importance of a title company. Not only do you need a title company that closes real estate transactions but that closes investment real estate transactions. Most people believe that any title company will close any transaction but that is not true. Title companies will usually only close transactions that they are comfortable insuring. They are also able to only close transactions that their underwriters will approve.

Opening escrow at the wrong title company can cost you a deal. When interviewing a title company you want to know if they close investment real estate transactions. Also, make sure they will close an assignment contract, double assignment contract, a double close, a wrap, a subject –to, etc. Surprisingly, title companies that do not deal with real estate investment type transactions may not be aware of what some of these are or how to close them. All the transactions mentioned here are fairly similar with settle differences that can allow one title company to close and another title company to not close. Of course, you have to do your part and make sure the contracts are in order. Read More→