Atlanta Real Estate Investors Alliance Blog

Structuring Your Business for Success!

Posted on January 1, 2013 byOne of the first things to consider when you are starting your real estate business is how you are going structure your business or businesses. I probably would say in most cases the word businesses! Over the years of dealing with my business, working with clients and the people whom I do business with, I have learned a great deal regarding the ways of structuring entities for success. I have seen the affect of poor planning which include increased risk, personal liability, and a servicing and filing nightmare at great cost. The one thing I would like to make clear is that this is business advice and not legal or tax advice. When you start your business you should consult with a CPA, attorney and others investors or business owners that operate the type of business you are setting up. A good mentor can be worth their weight in gold as you start real estate business and structure it for success.

The five basic entities for business are: Sole Proprietorship, General Partnership, Limited Partnership, Corporation and Limited Liability Company. Choosing the entity usually depends on issues and concerns with people, place and things. Read More→

Different Things You Can Use to Buy Real Estate Other Than Cash

Posted on January 1, 2013 byThis month I want to give you an example of different ways any investor can use notes to buy houses instead of using CASH. Once upon a time I knew an investor who was trying to structure a deal with a seller who wanted the money from the sale of his property to buy a motor-home so he and his wife could travel the country. The investor asked the seller if he was able to find a motor-home of the sellers liking, would the seller use the book value of the motor-home in exchange for the down payment on the property the investor was trying to buy from the seller. This was regardless of what the investor had to pay for the motor home he would be trading to the seller for his property. The seller told the investor exactly what he wanted a motor-home to have, that he would accept. Once the investor knew what the sellers wanted, he then immediately set out to find a motor-home he could use as catalyst to complete the transaction to buy the sellers house. Read More→

Real Estate Has a Sense of Humor

Posted on January 1, 2013 by With over 30 years of Atlanta real Estate under my belt, one begins to think you’ve heard or seen it all. Not true! As an analytical person that usually utilizes this column to the explain Atlanta market statistics, I decided the end of the year needed a little levity. Those of you that know me, would state that I have a healthy sense of humor anyway. Therefore, this column is devoted to the more humorous true stories I have experienced in real estate.

With over 30 years of Atlanta real Estate under my belt, one begins to think you’ve heard or seen it all. Not true! As an analytical person that usually utilizes this column to the explain Atlanta market statistics, I decided the end of the year needed a little levity. Those of you that know me, would state that I have a healthy sense of humor anyway. Therefore, this column is devoted to the more humorous true stories I have experienced in real estate.

Auctions and Land:

- In 1983, I went to Mendenhall Auction School in North Carolina, exactly 20 years after my Dad had graduated from the same auction school. He fronted the money for the school and the expenses for me to attend, on the condition, that we deduct it from future auction commissions. Well, in the eighties, auction and real estate were mostly male occupations. Therefore, 90% of a class of 100 was men. The first day of school, the schoolmaster, Mr. Mendenhall, announced that, “We have a very special student here. She is the second generation to attend auction school, and, her father is the President of the National Auctioneers Association.” With that, everyone wanted to meet me, and, a group invited me to play poker with them. Well, I inherited my math and card playing abilities from Dad, and, I am sure this group had no idea who they were tangling with. The following Monday after my graduation from school, I was in my Dad’s office, when I started counting of hundreds of dollars to him. “Here’s the tuition money. Here’s the expense money. And, I am keeping the rest”, I exclaimed. “Where did you get all that money, girl?” my father questioned. “I won it playing poker with the rednecks that wanted to learn to sell cows and tobacco,” I proudly said. With that, he slammed his fist on his desk and stated, “Way to go, Girl!” Read More→

Note Buyers

Posted on January 1, 2013 byBy now everyone has heard that banks have ceased foreclosures for the holidays. This has made finding inventory much more difficult for a few investors that depend on just those foreclosures as leads. In the last few years I have began working with non-performing note buyers or NPN buyers. These buyers buy notes from the same banks that you are expecting foreclosures from. What do many note buyers have in common? They were once real estate investors that now prefer to buy and sale the notes in order to avoid house renovations, tenants, etc. They are also looking to liquidate those properties so they can purchase another bundle of notes.

When note buyers acquire in bulk they end up with plenty of properties at pennies on the dollar. For example, they might purchase a $100,000 note from a bank for $40,000. They know that the current property owner of the property is not making payments. Because they now carry the mortgage/note they can now foreclose on the property and take procession of the property. Again, these note buyers usually do not want to bother with holding or repairing these properties. At this stage is where you, the real estate investor, would like to step in and relieve this note buyer of this burden. Of course, you will not be purchasing this deal at $40,000 but maybe for $45,000-$50,000 if the property needed $20,000-$25,000 in repairs. Given that the property is still worth $100K this purchase would be at 70% LTV including repairs. This would be a deal any serious investor would consider. Read More→

Pre-Screening Sellers For Your Real Estate Investing Business – Part 1

Posted on January 1, 2013 byI strongly believe that pre-screening sellers is one of the most important tasks you will undertake in your real estate investing business. The more quickly you learn to pre-screen prospects, the more money you will make in your Real Estate Investing business. This article is focused on teaching you how to tell a good deal from a time waster in 30 seconds or less.

If you don’t learn to pre-screen prospects quickly and efficiently, you will get burned out of the real estate investing business by working with sellers who won’t sell you their house, no matter what you say. Your job as a real estate investor is to very quickly determine the difference between a prospect and a “suspect”, meaning someone who needs to sell versus someone who just wants to sell their property.

People who just want to sell will either reject you immediately (don’t take this to heart, it just helps you move on quicker) or they will jerk your chain with a bunch of excuses as to why they won’t sell to you. Don’t waste your time with these folks!!

I know from first hand experience that motivated sellers will make themselves known to you quickly and they are a whole lot more fun to work with. Their attitude is more like “Please take my house off my hands…..now!” They are usually pretty easy to identify once you ask the right questions. Read More→

Atlanta REIA Meeting & New Year’s Party on January 7th, 2013

Posted on January 1, 2013 by& Annual New Year’s Party

with Ron LeGrand on

“Quick Turning Real Estate for Fast Cash”

at the Crowne Plaza Ravinia on January 7th

Atlanta REIA Members Can Attend at No Charge.

Guests Can RSVP Online Now for $15 or Pay $20 at the Door.

Atlanta REIA is very excited to announce that real estate investing legend and millionaire maker, Ron LeGrand, will be speaking at our Atlanta REIA Main Meeting on January 7th at the Crowne Plaza Ravinia in Atlanta which starts at 5:30 PM. Ron has created more millionaire real estate investors than anyone else on the planet and you can be one of them!

Atlanta REIA is very excited to announce that real estate investing legend and millionaire maker, Ron LeGrand, will be speaking at our Atlanta REIA Main Meeting on January 7th at the Crowne Plaza Ravinia in Atlanta which starts at 5:30 PM. Ron has created more millionaire real estate investors than anyone else on the planet and you can be one of them!

America is on sale right now and if you’re not making obscene amounts of money in real estate right now, you’re missing the best opportunity of your lifetime to get rich. Come spend the evening with Ron where he will teach you can make 2013 your most profitable year ever! You will learn about…

- Making Big Money With No Money Or Credit – Ron will show you where the big money is in real estate and how you can get it with NO money, credit or risk on your part.

- Making Huge Profits On Over Leveraged Houses – Ron will show you how to control houses without ownership and make a minimum of $5,000 per house 3 to 4 times a month.

- Getting Rich In Your IRA Tax Free – Ron will teach you how to use real estate to grow your IRA to a MILLION DOLLARS in less than five years without you ever personally contributing another dime.

- Where To Find The Best Deals Even With Hot Competition – Ron will show you the best tool he’s ever used to absolutely ensure you never struggle to find deals and it only costs pennies to implement.

- Where To Get The Money To Buy Bank-Owned Deals– Since banks require cash to purchase their properties, Ron will show you where to get the cash to buy bank-owned homes that won’t come from other banks or require credit or qualification.

- Purchasing a Beautiful New Home for Your Family – Ron will show you how you can purchase a new home for your family in the next 45 days and never fill out an application, apply for a loan, or put up a down payment.

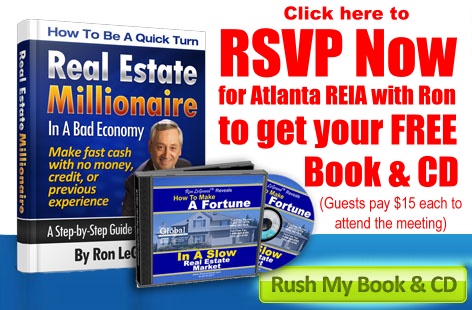

RSVP for the Meeting to Get Your Gift from Ron!

ATTENTION Members & Guests: If you RSVP to attend the meeting right now, Ron has a special gift for you… his book on “How To Be A Quick Turn Real Estate Millionnaire In A Bad Economy” so you can make fast cash with no money, credit or previous experience. He is also throwing in his new audio CD called “How To Make A Fortune In Foreclosures In A Slow Real Estate Market.” This book and CD will reveal how you can make a boatload of cold hard cash in today’s troubled Real Estate market.

PLEASE NOTE: If you are NOT an Atlanta REIA Member, there is a $15 charge to attend the meeting on January 7th. If you wait to pay at the door, the fee will be $20 and you will not get Ron’s downloadable book and CD, so RSVP Now, get the gifts & save!

with Bob Massey

On January 7th at 3 PM, Bob Massey will be having his quarterly meeting at Total Wine & More located at 124 Perimeter Center W (see map). Bob will be giving a presentation you don’t want to miss! He is going to be going over the details of a $875,000 short sale he just closed that most investors would have abandoned months ago. Instead of giving up, he modified his strategies and ended up making more than if everything had gone according to the original plan! He is also going to be discussing mortgage fraud, securitization issues, and foreclosures. The banks have been defrauding homeowners for years, and we now have a way to use that to fight back against the banks and do some pretty incredible deals while helping underwater homeowners across the country.

On January 7th at 3 PM, Bob Massey will be having his quarterly meeting at Total Wine & More located at 124 Perimeter Center W (see map). Bob will be giving a presentation you don’t want to miss! He is going to be going over the details of a $875,000 short sale he just closed that most investors would have abandoned months ago. Instead of giving up, he modified his strategies and ended up making more than if everything had gone according to the original plan! He is also going to be discussing mortgage fraud, securitization issues, and foreclosures. The banks have been defrauding homeowners for years, and we now have a way to use that to fight back against the banks and do some pretty incredible deals while helping underwater homeowners across the country.

After the conclusion of the Main Meeting, we will be reconvening at the Tilted Kilt Perimeter located at 1155-B Mount Vernon Highway in Atlanta for our annual New Year’s Party. There will be FREE Food, networking and lots of fun! Come eat, drink, network, have fun and celebrate the New Year with us late into the night!

After the conclusion of the Main Meeting, we will be reconvening at the Tilted Kilt Perimeter located at 1155-B Mount Vernon Highway in Atlanta for our annual New Year’s Party. There will be FREE Food, networking and lots of fun! Come eat, drink, network, have fun and celebrate the New Year with us late into the night!

*Please Note: Meeting agenda is subject to change.

Each and every month, for the duration of our meeting, we have a Vendor Trade Show in which you can come out and meet many of our participating business members who help sponsor our meeting. Thanks again sponsors!

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

Angel Oak Funding – A direct hard money lender headquartered in Atlanta. We provide renovation/construction loans for investors and or builders to purchase and renovate residential properties. Read More>>

Angel Oak Funding – A direct hard money lender headquartered in Atlanta. We provide renovation/construction loans for investors and or builders to purchase and renovate residential properties. Read More>>

Pete’s Friendly Home Inspections, LLC. – Pete’s provides home inspections, radon monitoring, gas/water/septic tests, checks pools/sprinklers and any other type of inspection needed to get you that next home! Read More>>

Pete’s Friendly Home Inspections, LLC. – Pete’s provides home inspections, radon monitoring, gas/water/septic tests, checks pools/sprinklers and any other type of inspection needed to get you that next home! Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

Read More>>

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele.

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele.

Read More>>

Atlanta Private Lending – Atlanta’s premier private real estate lending company. We provide private, hard money loans to professional real estate investors for renovation and investment purposes. Read More>>

Atlanta Private Lending – Atlanta’s premier private real estate lending company. We provide private, hard money loans to professional real estate investors for renovation and investment purposes. Read More>>

Solutions Realty Network – Providing expert property management and investment services since 2003. You invest and we take care of the rest! We’re the solution to all your real estate needs. Read More>>

Solutions Realty Network – Providing expert property management and investment services since 2003. You invest and we take care of the rest! We’re the solution to all your real estate needs. Read More>>

Craftbuilt, Inc. – We are a Metro Atlanta design-build construction firm specializing in whole-structure renovations, restorations, and new construction. No matter what the situation, we are up to the challenge! Read More→

Craftbuilt, Inc. – We are a Metro Atlanta design-build construction firm specializing in whole-structure renovations, restorations, and new construction. No matter what the situation, we are up to the challenge! Read More→

Goldmine Properties, Inc. – As Atlanta’s first full service real estate wholesaler, we offer wholesale property at 65% loan to value, with financing available. Purchase price and repairs are 65% of certified after repaired appraisal. Read More>>

Goldmine Properties, Inc. – As Atlanta’s first full service real estate wholesaler, we offer wholesale property at 65% loan to value, with financing available. Purchase price and repairs are 65% of certified after repaired appraisal. Read More>>

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more!

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more!

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More→

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More→

Commercial Realty Experts – Our Team utilizes the latest information technologies, market research, and business strategies to move real estate quickly, or satisfy your particular buying needs. Read More>>

Commercial Realty Experts – Our Team utilizes the latest information technologies, market research, and business strategies to move real estate quickly, or satisfy your particular buying needs. Read More>>

D S Murphy & Associates, Inc. – Residential and commercial real estate appraisal services specializing in pre-listing, tax appeal, renovation and new construction consultation. Read More>>

D S Murphy & Associates, Inc. – Residential and commercial real estate appraisal services specializing in pre-listing, tax appeal, renovation and new construction consultation. Read More>>

Atlanta Carpet Services, Inc. – Providing carpet, wood, vinyl, and tile, ACS is dedicated to every aspect of your floor covering needs from initial consultation to the sale and follow-up services. Read More>>

Atlanta Carpet Services, Inc. – Providing carpet, wood, vinyl, and tile, ACS is dedicated to every aspect of your floor covering needs from initial consultation to the sale and follow-up services. Read More>>

Fuller Center for Housing of Greater Atlanta – A faith-driven, Christ-centered, non-profit organization dedicated to providing adequate shelter for people in need in the Greater Atlanta area. Read More>>

Fuller Center for Housing of Greater Atlanta – A faith-driven, Christ-centered, non-profit organization dedicated to providing adequate shelter for people in need in the Greater Atlanta area. Read More>>

Happy Homeowners Club, LLC (Rock Shukoor)

Platinum Real Estate (Luther Ragsdale)

WGC Commercial Lending

ATL RE GROUP, LLC

AtlantaHomesYall.com

Alexandra Spollen

The Best Deals To Do in Real Estate in 2013 & Beyond! – Part 1

Posted on January 1, 2013 byAs I write this, it’s coming up on the end of 2012. The real estate market is still crazy, and there are a lot of questions in people’s heads as to what the market is going to do. What else is new?

Ever since I first got in to real estate investing, back in 1996 (wow!), the market has ALWAYS been changing. So that’s NO excuse not to get involved & do some deals. The KEY is to just recognize WHAT the best strategies are to use at the moment, then learn all you can about them, and – most important of all – ACT on what you learn!

Winners with tiger blood running through their veins will tell you that CHANGE (and chaos!) just creates more opportunity, and the real estate market right now is certainly no exception. It used to be that the hot things in real estate were: Wholesaling, Short Sales, Rehabbing, and of course, the related “Get the Deed” system, where you take over existing houses ‘Subject To’ the existing mortgage. Read More→

New Habits for a New Year

Posted on January 1, 2013 byTime and health are two precious assets that we don’t recognize and appreciate until they have been depleted.” ~ Denis Waitley

Wow. What a year! The turkey leftovers are gone. There are just a few pine needles left in the carpet. And your Aunt Miriam, thank goodness, has gone home to Indiana and has taken the fruitcake with her. Now it’s time to reflect.

I don’t know about you, but I reached many of my goals in 2012, and that feels great! Still, I know 2013 will bring plenty more challenges and opportunities. It would be boring, wouldn’t it, if we were completely finished with everything by the end of the year. I mean, what would we do then?

So we carry our unfinished business into the following year. That’s what New Year’s resolutions are for, right? “For every single day of 2013. I’m going to eat just 700 calories and jog six miles!”

For many of us, new year’s resolutions are made to be broken. In fact, for some of us, the best way to make sure something doesn’t get done is to make a new year’s resolution to do it. It’s the kiss of death!

Thankfully, though, we live in the digital age where help is as close as your iPad. So this month, I’ve got two apps to recommend. Read More→

Proving Lender Negligence and Fraud Part 1: The Paper Trail

Posted on January 1, 2013 byThere are two approaches you can take to determine whether or not there has been negligence or fraud in the loan process. Both paths can be equally effective in uncovering lender misconduct and providing you with leverage for negotiations with the bank. One path follows the documentation from mortgage application through foreclosure documentation, and the other approach follows the money trail. This article will examine how the documentation can lead to a damaging case against a pretender lender. Our next article will cover the money trail method.

In order to prove that they have the right to foreclose on a property, it is becoming standard for lenders to be required to produce the original note on the property. The note is required before a court will allow a lender to sell a property. It must show that the lender is named with a recorded economic interest in the property. However, in many cases these original notes have been either lost in the securitization shuffle or purposefully destroyed as the note bounced around from entity to entity. The note could even have been Photoshopped or otherwise forged to make it appear that the entity trying to foreclose has the standing to do so. Fortunately, the lenders are being called on it by the courts. Read More→

Real Estate IRA Investing – The Purchase

A young couple found a home they wanted to purchase with their real estate IRA. The purchase price was $50,000. They borrowed $55,000 and had $800 worth of repairs. I know that $800 worth of repairs for a house purchased with 1,400 square feet, three bedrooms, and two baths through a short sale sounds absurd, but these are actual numbers from an actual deal.

Real Estate IRA Investing – The Repair Bill

I’ve personally never seen $800 worth of repairs in my entire life and I’ve been in this business for 40 years. I can’t even walk through the house for $800. I don’t know what it is but I’ve never done that, so that was phenomenal to me. The deal’s great but how did you get $800? They actually got a little cash back at closing since they borrowed $55,000 for a $50,000 purchase. Read More→

The Winners and The Losers

Posted on January 1, 2013 by“Such wicked people are detestable to the Lord, but he offers his friendship to the godly.” (Pr 3:32, NLT)

As a business person, have you ever considered that honesty produces a substantial financial gain? Or, that dishonesty inherently produces huge monetary losses? I realize that everyone might not agree with this conclusion.

However, the biblical evidence suggests there are many advantages to being honest and there are dire consequences to dishonest practices in business and in life. It is clear that ethics do have a profound impact on the bottom line. An even more basic thought, indicates that our business practices dictate our relationship with God! The Book of Proverbs contrasts the financial outcome of the honest versus the economic decay of the dishonest. Let’s examine some of these profound truths. Read More→

WARNING! Short Sale Lender Has Mandated Deed Restrictions On Deed For Closing!

Posted on January 1, 2013 byThe Short Sale lenders are getting crazier and crazier. That is why you need to stay current with the short sale changes. Approximately 3 years ago, Bank of America was the first short sale lender to start requesting that the new buyer of the property consent to not resell the property for less than 30 days. This statement was included in their short sale approval letter. This statement alone caused a lot of challenges to investors who were still looking to close back to back on transactions. A few short sale lenders thereafter, such as GMAC and Wells Fargo, started adding 60 to 90 day resale clauses on their Arm’s Length Affidavits, but not their short sale approval letters.

Recently, I was in the process of purchasing a property where I needed to get an extension on the short sale approval letter. The reason was that the Homeowner Association advised us that, pursuant to their by-laws, their 35% ownership of investment properties had been reached and only homeowner occupants can purchase the property. The servicer for the lender was Seterus. I received a brand new approval letter for the same exact buyer as before, but with a few different statements: Read More→