Archive for Articles

It’s DeJa Vu All Over Again and It’s Time to Make a Change

Posted on January 30, 2015 byHere we are already in the second month of what I believe is going to be a bumper year for real estate investors. For real estate investors who decide that they need to change the way they are trying to buy houses, many have little success without available affordable financing.

Did you see the movie Groundhog Day? In the movie events kept repeating themselves over and over. Today I am seeing this very same thing happening to real estate investors. Many investors today are still trying to do exactly what they did in the past and it still isn’t working for them. Most of these investors are getting what most of the other investors who lack the ability to borrow money are getting which isn’t very much. Many of these beginning investors are struggling to make little money, most are just going through the motions of what they were taught by some guru.

I just spent 5 days teaching with Robyn Thompson at her Junkers to Millions boot camp and I was amazed to hear her students who are totally unaware of any method of buying houses other than getting institutional financing to buy houses. I discussed this with most of her audience during my time at the boot camp and found that over 75% of those attending were unable to get any type of institutional financing for one reason or another. Does this sound familiar for you too? Read More→

Don’t Leave Thousands on the Table at Closing

Posted on January 30, 2015 byOne of the things that never ceases to amaze me in the real estate business is how many investors leave hundreds or thousands of dollars on the table at closing due to errors in the closing documents. This is an area where many investors need to be educated. Many times investors get excited about the bottom line and forget to check the figures on the documents.

It is a mistake to assume that the HUD or closing statement is correct or that the closing documents are correct. The person preparing the closing statement can make mistakes. In addition, the person preparing the closing statement and documents is using figures that they have acquired from other people who could also make mistakes, such as the insurance company, the Realtors, the lender, home inspection service, or the surveyor.

You need to take the time to read all the documents carefully before closing on any deal. I have personally seen errors on the HUD at almost every closing I have ever been part of. Many investors only look at the bottom line and think “yes that’s enough money” but they fail to look at the whole closing statement, and in doing so possibly leave thousands at the table. I just had a closing take place recently where there was a mistake of a thousand dollars on the HUD. They put one of the buyer’s expenses on my side of the closing statement. I don’t know about you, but I think a thousand dollars is a lot of money to leave behind when you are entitled to it. Read More→

Wells Fargo Paper Pushers are a PAIN!

Posted on January 30, 2015 byIn the past several months, Wells Fargo has taken on a new policy wherein they want a copy of all lien releases for any outstanding liens on the property PRIOR to submitting the file to the negotiator for review. They are now pulling their own title work and reviewing it to make sure that all liens are being reported to them. This may cause a huge battle because often the Second Lender will not approve the lien release until they have the written approval from the First.

I have always said that Wells Fargo is one of the strictest Banks that requires a crazy amount of paperwork for them to move forward. We recently had a file wherein the second mortgage, even though they had a second mortgage on the property, took the Sellers to court on the Note and received a Final Judgment against them. The seller was even garnished. However, in Florida, if you are head of household, you can stop the garnishments if you do not agree with the garnishment, so that ended. We have been fighting with a Negotiator that cannot put the second mortgage payoff and the Final Judgment Payoff together as one.

The Bank Negotiator keeps asking for another payoff from Citi Financial which is both the second mortgage and the Final Judgment Plaintiff. She just can’t get it thru her head! We have gone over her head multiple times to a supervisor and she refuses to submit our file. I requested a copy of her title work so we could see what she is seeing, but she just keeps sending us the recorded page number of the Judgment. We have contacted Citi Financial and they said yes this payoff includes the mortgage and the Final Judgment. We have asked Citi Financial to state that in their letter but they complain that this is a standard letter and it will not be tailored to the request of the First Mortgage Company. Read More→

Real Estate IRAs – The Most Common Questions Answered

Posted on January 30, 2015 byIn this business, in client meetings, telephone consultations and seminars, we find ourselves answering the same common questions about real estate IRAs over and over again. So we thought we’d compile them here, in one convenient list.

1. Is it legal to hold real estate in an IRA?

Absolutely. The U.S. tax code gives taxpayers broad latitude to hold just about anything they want within an IRA. The only restrictions as far as the types of allowable investments are as follows:

- You can’t own life insurance in an IRA.

- You can’t own gems or jewelry.

- Any precious metals you own in an IRA have to meet certain standards for purity and consistency. See our exclusive Guide to Gold and Precious Metals IRAs for more information on this topic.

- You cannot own alcoholic beverages within an IRA.

Are You Ready For Your Taxes To Be Prepared?

Posted on January 30, 2015 byApril 15th — tax day — will be here before you know it. Actually, most businesses need to file by March 15th and there are a number of special things small-business owners need to be aware of when preparing their taxes this year. Let’s take a look at four areas that may affect your business’ 2014 tax return.

The Affordable Health Care Act

Most people know that businesses with more than 50 employees will be heavily impacted by the Affordable Health Care Act. But what about companies with only a few employees? It turns out that if small companies want to provide health insurance for their employees, they may be eligible for increased tax credits this year. Check it out with your CPA.

Section 179 Tax Deduction

The Section 179 Tax Deduction allows business owners to write off equipment in the same year they bought it. But the $500,000 limit of 2013 was reduced to just $25,000 for tax year 2014. However, Congress passed the Tax Extenders Bill in mid-December, restoring the $500,000 expense limit. President Obama is expected to sign it into law, but has not done so yet (see “Tax Incentives Extended,” below). Read More→

New Year… New Plan?

Posted on January 30, 2015 byThe great thing about being in real estate is that it always changes, keeps you interested and forces you to adapt to the ever changing market. At the same time, these exact things are what keeps many people from becoming real estate investors. Each year you should look back at the previous year’s performance and take note of what made you the most profit. Once the most profitable part of your business is identified, it is time to figure out if the market is going to permit that part of the business to perform the same for one more year.

Last year, 2014, was an amazing year for anyone in real estate. Agents, wholesaler, investors, bird dogs, etc. were all making a killing. Agents listed a home and it was immediately in “highest and best.” Wholesalers were selling properties as high as 90% LTV. Investors were able to sell any renovation project they listed even if the workmanship was not the best. Our workmanship surpassed most competitors and caused our homes to sell in single digit days on market. I refused to get involved in all the hype and stuck to my criteria. In the end, there were many very successful investors. My partners and I bought, fixed, and sold more properties this year than previous years. In 2015 we will continue to buy, fix and sell. Not because it worked in 2014 but because in December 2014 our housing inventory reached a record low 2.5 month supply. As long as our market housing inventory stays low, buying, fixing and selling should be a revenue stream in your real estate business. According to the National Association of Realtors, “the national inventory of single-family homes is 5.1 months of supply.” This inventory level still justifies flipping homes in most markets. Once the market you are in reaches a constant 6 month supply or higher you may want to start looking into holding/renting in the near future. Read More→

Is A Modification Offer An Enforceable Contract? Appellate Court Says Yes!

Posted on January 30, 2015 byAlmost every real estate investor who buys short sales or pre-foreclosures has heard this story a hundred times. A homeowner requests a loan modification from the bank, the bank grants a “temporary” modification, payments were made and accepted, then bank changes its mind and forecloses on the homeowner for not making the full, original mortgage payment. It has been happening every day since the economic crisis began, leading millions of homeowners into foreclosure. This was business as usual for years, until a recent appellate court ruling that modification offers are in fact enforceable contracts that must be honored by the banks.

In this case, Wells Fargo offered a temporary modification to a homeowner. The offer was accepted, and the trial payments were all made and accepted. Wells Fargo then disavowed the modification settlement under the claim that it lacked consideration. Wells Fargo then went ahead with the foreclosure. The trial court ruled that Wells Fargo was correct by saying that there was no consideration. The appellate court reversed that ruling, declaring that there was more than enough consideration. This ruling has led to hundreds of cases in which trial and appellate courts have enforced the modification agreements ignored by banks. Read More→

We Can Raise The Rents!

Posted on January 30, 2015 byRents are on the rise in most markets today. This is a great way to increase overall revenue and value of our deals. In this article I want to discuss the reality of raising rents and increasing values of our multifamily properties.

As I stated rents are naturally on the rise but raising rents is not always as easy as it may seem. “The rents are below market” seems to be the mantra of realtors today. I can’t remember the last time I looked at a property that the agent didn’t tell me that I could raise the rents and make a lot more cash flow. I agree in a lot of cases the rents could have been raised but rarely can it be done for free.

On average rents can be raised by 1-3% per year without any upgrades needing to be done. This is what we call the “annoyance raise”. When analyzing a deal and considering a rent raise as a “value add” component we need to look at several factors and ask one very important question, “why are the rents currently low?”. In most cases I don’t find that the current owner hates money and just won’t raise the rents because they just love the tenants so much. Your agent may want you to believe that something like this may be the case and you can just magically raise rents but it usually doesn’t work that way. Read More→

Why Asking Price Is In The Comparable Sales

Posted on January 30, 2015 byAsk any Realtor how he or she prices houses, and you will hear a version of the following statement: “Well, I look at the comparable sales and then I …”

The same answer would include potential buyers, lenders, brokers and even appraisers. The data within REIAComps has consistently shown investors how to determine both solid acquisition value and after repair value for residential real estate.

Now, in the defense of Realtors, using comparable sales (“comps”) to price listings is what they were taught. Find the (3)“closest”comparable sales, make some adjustments for the differing features and use this analysis to arrive at an asking price for the home.

Truly, Appraisers typically use the same technique, as do most county assessor offices. Free broker and agent lead generation web sites like Trulia and Zillow apply similar inputs to their valuation algorithms. The comparable sales method has been in use for the measure of my career, and I am approaching 20 years in the valuation business.

A comp flatly, is a closed sale sharing as much similarity as possible with the home being valued. A good comp will be a recent sale of a similar type of property from within (or nearby) the subject property’s neighborhood. In theory, the more similar the comparable sale, the more power it has. The base logic behind using comps to price goes something like this —if House A sold for $X, House B sold for $Y and House C sold for $Z, then your house should sell for some adjusted average of the three. The catch is, the comps used are the most appropriate ones available.

But, we have to ask, is this really accurate? Read More→

The Ice Man Is Coming and He Will Freeze Your Pipes

Posted on January 8, 2015 by Atlanta Houses are not designed to handle sustained temperatures in low single digits. With low temperatures and higher winds the wind chill over the next several days will be brutal.

Atlanta Houses are not designed to handle sustained temperatures in low single digits. With low temperatures and higher winds the wind chill over the next several days will be brutal.

If you have vacant houses you might consider antifreeze in the traps, drain water lines where you can and drip faucets.

Even occupied homes with the heat on are not immune to frozen pipes.

Years ago after a severe cold spell I had a bucket full of short lengths of split copper pipes. We had cut them out of my houses when we repaired the “frozen pipes”. The problem is not when they freeze, it’s when they thaw.

Today I will be purchasing twenty five dollar portable electric space heaters and ceramic tiles to set them on. I will be making sure that cabinet doors in kitchens and baths are open. I will tape notes on the cabinets reminding folks not to close them. The note will be taped on such that in order to close the door the note will have to be moved. I will make sure that laundry rooms have adequate heat and that doors are open. I will use space heaters where necessary.

Anywhere that plumbing is in an outside wall I will be sure to drip the faucets.

Remember to be very careful with space heaters you do not want a fire. I will place space heaters on the ceramic tiles I purchase. I do not want to place a heater on carpet, vinyl or wood.

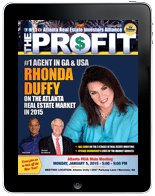

The Profit Newsletter January 2015 Edition

Posted on January 2, 2015 by The January 2015 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on January 5th. The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Be sure to Subscribe to The Profit Here so you don’t miss a single issue.

The January 2015 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on January 5th. The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Be sure to Subscribe to The Profit Here so you don’t miss a single issue.

“Impossible” is a Human Invention

Posted on January 1, 2015 byRobert Schuller came up with a great quote in 1973: What would you attempt to do if you knew you could not fail?

As 2015 begins, after finding yourself a quiet place to write down your goals, place Mr. Schuller’s quote in front of you. Next, with each goal you put to paper ask yourself: If failure is impossible, is this still a worthy goal for me to pursue?

At the beginning of each January, many of us make goals – they’re called New Year’s resolutions. This flood of goal setting is evident by the huge increase in the number of folks in the gym, and also by the number of people reading self-help books.

Sadly, by February, we’re back to seeing just the regulars working out – with the exception of two or three new people who’ve gutted out the pain and continue coming to the gym. As for the self-help books, most lay half read on shelves gathering dust…never to be opened again. Read More→