Atlanta Real Estate Investors Alliance Blog

Property Protégé Group Preview Event on February 1, 2017

Posted on January 31, 2017 byPreview Event on Wed, Feb 1st at 7PM

1960 Skylar Hill Dr, Ste D, Buford, GA

Real Estate Investors, are you getting the results you desire in your investing business? Do you want to become a better, more profitable investor? Are you having trouble getting off the ground or getting to the next level? Having trouble finding deals or getting deals closed? Would you like some coaching and ongoing training without paying an arm and a leg? Would you like to see better results in the next few months?

If you answered YES to any of these questions, the Property Protégé Group (PPG) was created just for you! PPG is an annual group coaching program that meets on the 1st and 3rd Wednesday of each month at 7PM. The first part of the meeting is educational and the second part is where we evaluate your deals and decide if they are a deal or no deal.

Join Don DeRosa on Wed, Feb 1st at 7PM at 1960 Skylar Hill Dr, Suite D in Buford, GA to find out more about PPG and see if it’s what your investment business might be missing. At this PPG Preview Meeting, Don will give you an overview of the PPG Program and what he will be covering in upcoming months such as:

- How to locate properties and motivated sellers

- How to pre-screen sellers and properties

- How to analyze deals

- How to determine repair costs

- How to determine property value before and after repair

- How to construct multiple offers

- How to present and negotiate your offers

- How to put properties under contract and complete the paperwork

- Where to find the money to fund your deals

- How to find buyers and sell houses fast

- Wholesaling – What It Is and How It Works

- Buying & selling pretty houses with creative terms

- Finding Deals With The Most Profit Potential

- How to avoid pitfalls and minimize risk

- How to find leads on your mobile device

- How to automate and systematize your business using mobile technology

- And much more!

If you would like to take your investing business to the next level this year, don’t miss this Property Protégé Group Preview Event!

Atlanta REIA Members & Guests, Please RSVP on Meetup.com

Learn to Wholesale Like a Pro on February 6, 2017

Posted on January 30, 2017 by& Vendor Trade Show

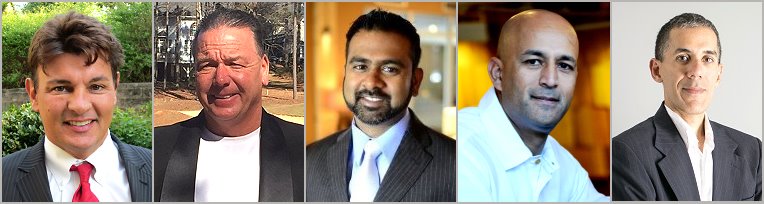

with 5 of Atlanta’s Top Wholesalers

Atlanta REIA Members Can Attend at No Charge. This month,

Guests Can RSVP Online Now for $20 or Pay $25 at the Door.

It’s a proven fact that real estate has created more millionaires than any other investment in history, so what’s stopping you from being the next real estate multi-millionaire? Perhaps it’s not knowing how or where to get started. Maybe you don’t know how to find good deals, how to analyze them or how to fund them? The good news is… there has never been a better time to start building income through wholesaling houses and getting started is easy!

Wholesaling is a simple, fun and highly profitable way to get started investing in real estate without a lot of training, experience, cash or cred. You can quickly learn to wholesale houses in any real estate market and can often complete many of these deals, from start to finish in a few days or weeks. This means you can often get paid thousands of dollars in 30 Days or less!

If you want dramatically increase your income in 2017, don’t miss the Atlanta REIA Main Meeting on Monday, February 6th at 5PM at the Crowne Plaza Ravinia located at 4355 Ashford Dunwoody Rd, Atlanta, GA where we are doing an Expert Panel this month on “Wholesaling Houses for Fast Cash” with 5 of Atlanta’s Top Wholesalers.

The Panel will consist of Mike “The Godfather of Wholesaling” Cherwenka of Goldmine Properties, Jack Kudron of Georgia Home Deals, Manesh Hardeo of Networth Realty of Atlanta, Rock “The Investor” Shukoor of Cash Now Deals and Frank Iglesias of Working with Houses. These gentlemen will teach you everything you need to know about wholesaling like a pro and answer all your questions during the meeting. The panel will discuss…

- What is Wholesaling and how does it work?

- How to find deals with best profit potential

- How to determine value of properties

- How to determine cost of repairs

- How to negotiate the deal

- How to offer all cash even if you have no cash

- How to complete the paperwork

- How to find a buyer

- How to close quickly and get paid

- Wholesaling pros and cons

- Answers to your questions and more!

Come join us to learn how to Wholesale Houses for Fast Cash at the Atlanta REIA main meeting on Monday, February 6th at 5PM at the Crowne Plaza Ravinia located at 4355 Ashford Dunwoody Rd, Atlanta, GA.

As always, Atlanta REIA Members can attend the event at no charge and Non-Members can Register Online for $20 or pay $25.00 at the door. Be sure to bring your business cards and flyers and join us for an evening of real estate deals, vendors, networking, education and fun! See you there!

If you have Wholesale Deals, bring your flyers…

There will be plenty of buyers at the meeting!

Atlanta REIA Members Please RSVP on Meetup.com

*Please Note: Meeting agenda is subject to change.

WIN A 4 NIGHT STAY IN CANCUN: All participants who attend the Atlanta REIA Meeting will entered into a drawing for a chance to win a *Complimentary 5 Day, 4 Night Stay in Cancun! *You must be present at the meeting to win. Giveaway does not include dining, transportation, transfers, taxes, upgrades, etc.

WIN A 4 NIGHT STAY IN CANCUN: All participants who attend the Atlanta REIA Meeting will entered into a drawing for a chance to win a *Complimentary 5 Day, 4 Night Stay in Cancun! *You must be present at the meeting to win. Giveaway does not include dining, transportation, transfers, taxes, upgrades, etc.

with Don DeRosa

Atlanta REIA Members Please RSVP on Meetup.com

Real Estate Investors, are you getting the results you desire in your investing business? Do you want to become a better, more profitable investor? Are you having trouble getting off the ground or getting to the next level? Having trouble finding deals or getting deals closed? Would you like some coaching and ongoing training without paying an arm and a leg? Would you like to see better results in the next few months?

Real Estate Investors, are you getting the results you desire in your investing business? Do you want to become a better, more profitable investor? Are you having trouble getting off the ground or getting to the next level? Having trouble finding deals or getting deals closed? Would you like some coaching and ongoing training without paying an arm and a leg? Would you like to see better results in the next few months?

If you answered YES to any of these questions, the Property Protégé Group (PPG) was created just for you! PPG is an annual group coaching program that meets on the 1st and 3rd Wednesday of each month at 7PM. The first part of the meeting is educational and the second part is where we evaluate your deals and decide if they are a deal or no deal.

Join Don DeRosa at the High Tech Home Buying Creative Deal Structuring Subgroup on Monday, February 6th from 5PM to 6PM at the Atlanta REIA Main Meeting at the Doubletree to find out more about PPG and see if it’s what your investment business might be missing. At this PPG Preview Meeting, Don will give you an overview of the PPG Program and what he will be covering in upcoming months such as:

- How to locate properties and motivated sellers

- How to pre-screen sellers and properties

- How to analyze deals

- How to determine repair costs

- How to determine property value before and after repair

- How to construct multiple offers

- How to present and negotiate your offers

- How to put properties under contract and complete the paperwork

- Where to find the money to fund your deals

- How to find buyers and sell houses fast

- Wholesaling and how it works

- Buying & selling pretty houses with creative terms

- Finding deals with the most profit potential

- How to avoid pitfalls and minimize risk

- How to find leads on your mobile device

- How to automate and systematize your business using mobile technology

- And much more!

If you would like to take your investing business to the next level this year, don’t miss this Property Protégé Group Preview Event!

At 5:00 PM in the Main Lobby, we have a Vendor Trade Show that lasts throughout the meeting where you can come out and meet many of our participating Business Members and Vendor Guests who help sponsor our meeting. See a full list of our vendors and sponsors below as they are added.

At 5:00 PM in the Main Lobby, we have a Vendor Trade Show that lasts throughout the meeting where you can come out and meet many of our participating Business Members and Vendor Guests who help sponsor our meeting. See a full list of our vendors and sponsors below as they are added.

Vendor tables are limited, so any vendors wanting to reserve a table for the meeting can RSVP for a Vendor Table here. Vendor tables are reserved and setup on a first-come, first-serve basis.

Starting at 6:15 PM, Dustin Griffin kicks off the Atlanta REIA Main Meeting with updates and announcements. Dustin covers what’s happening at Atlanta REIA in the upcoming weeks and months such as upcoming workshops, webcasts, special events, members benefits and much more! Be sure to be in the main meeting room at 6:15 PM for your chance to be one of the first to receive a printed copy of The Profit Newsletter while supplies last.

At approximately 6:30 PM, Joe Thompson will be hosting the Haves & Wants Speed Marketing Session which gives our members the opportunity to quickly market deals they HAVE and to find deals they WANT. We also give our business members the opportunity to get up and say a few words about their businesses. Members who want to participate in the Haves & Wants Marketing Session must bring your flyers and get to the meeting early to get on Joe’s list of participants.

At approximately 6:30 PM, Joe Thompson will be hosting the Haves & Wants Speed Marketing Session which gives our members the opportunity to quickly market deals they HAVE and to find deals they WANT. We also give our business members the opportunity to get up and say a few words about their businesses. Members who want to participate in the Haves & Wants Marketing Session must bring your flyers and get to the meeting early to get on Joe’s list of participants.

Taco Mac Perimeter

After the conclusion of the Atlanta REIA Main Meeting, we will be reconvening at 9:30 PM at Taco Mac Perimeter located at the Perimeter Place, 1211 Ashford Crossing, Atlanta, GA for the Late Nite Networking and the “Meeting-After-The-Meeting”! There is no charge for Atlanta REIA Members or guests to attend Late Nite Networking, so bring a friend and head on down to Late Nite Networking and have a cold brew with us! Just be sure you order food and beverages from the restaurant and please tip their wait staff generously. When you get there, be sure to look for Joe Thompson who will be leading our Late Nite Networking.

After the conclusion of the Atlanta REIA Main Meeting, we will be reconvening at 9:30 PM at Taco Mac Perimeter located at the Perimeter Place, 1211 Ashford Crossing, Atlanta, GA for the Late Nite Networking and the “Meeting-After-The-Meeting”! There is no charge for Atlanta REIA Members or guests to attend Late Nite Networking, so bring a friend and head on down to Late Nite Networking and have a cold brew with us! Just be sure you order food and beverages from the restaurant and please tip their wait staff generously. When you get there, be sure to look for Joe Thompson who will be leading our Late Nite Networking.

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

Read More>>

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

Goldmine Properties, Inc. – As Atlanta’s first full service real estate wholesaler, we offer wholesale property at 65% loan to value, with financing available. Purchase price and repairs are 65% of certified after repaired appraisal. Read More>>

Goldmine Properties, Inc. – As Atlanta’s first full service real estate wholesaler, we offer wholesale property at 65% loan to value, with financing available. Purchase price and repairs are 65% of certified after repaired appraisal. Read More>>

Working With Houses, LLC – Atlanta’s Real Estate Solutions Company helping homeowners along with improving communities everywhere we work. We buy and sell houses anywhere in Atlanta and its surrounding areas. Read More>>

Working With Houses, LLC – Atlanta’s Real Estate Solutions Company helping homeowners along with improving communities everywhere we work. We buy and sell houses anywhere in Atlanta and its surrounding areas. Read More>>

Jack Kudron of Georgia Home Deals

Rock Shukoor of Cash Now Deals

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More>>

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More>>

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more! Read More>>

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more! Read More>>

Secured Investment Lending – A licensed direct mortgage lender specializing in non-traditional hard money loans for non-owner occupied buy/fix sell properties or rental properties throughout the GA and FL. Read More>>

Secured Investment Lending – A licensed direct mortgage lender specializing in non-traditional hard money loans for non-owner occupied buy/fix sell properties or rental properties throughout the GA and FL. Read More>>

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele. Read More>>

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele. Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Visio Lending – Simply put, we thrive on real estate. Dedicated to serving the landlord investor space, we crafted our loan products with three words in mind: fast, simple and dependable. Our suite of 30-year fully amortizing loans starts as low as 5.99%. Read More>>

Visio Lending – Simply put, we thrive on real estate. Dedicated to serving the landlord investor space, we crafted our loan products with three words in mind: fast, simple and dependable. Our suite of 30-year fully amortizing loans starts as low as 5.99%. Read More>>

Angel Oak Prime Bridge – A direct hard money lender headquartered in Atlanta. We provide renovation/construction loans for investors and builders to purchase and renovate residential properties. Read More>>

Angel Oak Prime Bridge – A direct hard money lender headquartered in Atlanta. We provide renovation/construction loans for investors and builders to purchase and renovate residential properties. Read More>>

Auction.com – The nation’s leading online real estate marketplace, having sold over $34 billion in real estate assets. Auction.com’s mission is to provide the most trusted online real estate marketplace, making transactions easier and more transparent. Read More>>

Auction.com – The nation’s leading online real estate marketplace, having sold over $34 billion in real estate assets. Auction.com’s mission is to provide the most trusted online real estate marketplace, making transactions easier and more transparent. Read More>>

Equitable Consulting – Investors, wether you have a short term or long term plan, “fix & flip” or “buy & hold”, individual units or entire portfolios, Equitable Consulting is your resource at every step. Read More >>

Equitable Consulting – Investors, wether you have a short term or long term plan, “fix & flip” or “buy & hold”, individual units or entire portfolios, Equitable Consulting is your resource at every step. Read More >>

CRS Data – We offer comps from the MLS & FSBO’s, custom searches, property tax records, interactive maps, sales & mortgage info, real estate valuations, mailing lists & more. Read More>>

CRS Data – We offer comps from the MLS & FSBO’s, custom searches, property tax records, interactive maps, sales & mortgage info, real estate valuations, mailing lists & more. Read More>>

Legal Shield

Mane Haus Capital Group

New Western Acquisitions

Jack Kudron

Posted on January 30, 2017 by I’m originally from Massachusetts and moved to South Florida when I was 19. I worked full time while putting myself through college, graduating from Florida Atlantic University with a degree in Marketing.

I’m originally from Massachusetts and moved to South Florida when I was 19. I worked full time while putting myself through college, graduating from Florida Atlantic University with a degree in Marketing.

I’ve been investing in real estate for the past 30 years. I started at the age of 21 with a 1/3 investment in a house in South Florida. We sold the house and split the $21,000 profit 3 ways, each receiving $7,000.

I then started buying properties on my own. I couldn’t afford a lot back then, so I moved into them, sleeping on the floors and using a cooler as my refrigerator. I sold one house at a time, increasing my net worth over time.

Beginning in 1986, I moved 8 times within a 6-month period, selling the homes while I lived in them, until I could finally afford to buy a condo on the beach. Read More→

Mike Cherwenka

Posted on January 30, 2017 by Mike Cherwenka is Atlanta’s leading expert in residential quick turn real estate. Mike has wholesaled and fixed and flipped over 2,050 single family homes since 1996 and is known as the “Godfather in flipping homes”. Mike has also acquired 93 rental properties on the Atlanta Housing Authority Section 8 program.

Mike Cherwenka is Atlanta’s leading expert in residential quick turn real estate. Mike has wholesaled and fixed and flipped over 2,050 single family homes since 1996 and is known as the “Godfather in flipping homes”. Mike has also acquired 93 rental properties on the Atlanta Housing Authority Section 8 program.

Mike is known for literally transforming blighted communities into beautiful neighborhoods. His niche is “MAKING MONEY IN THE HOOD”. A true “TRANSACTION ENGINEER”. Nobody find bargains like Mike.

Mike believes learning the skills to fix and flip residential real estate correctly is the surest way to achieve financial freedom. Unlike most of the educational speakers on the circuit who have not even flipped a handful of properties, Mike is the “real deal” flipping 2-3 properties weekly. It is safe to say Mike has more experience than anyone in the market place.

A true “Rags to Riches” story on how Mike overcame $100,000 in debt to becoming a multi-millionaire through real estate investing in 1996. And lost several millions during the real estate crash of 2008-2013 and had to start all over again. Learn the TRUTH in achieving financial freedom. What really works and how to achieve it.

BIGO Webinar Replay: Jump Start Your Real Estate Investing Business with Don DeRosa

Posted on January 26, 2017 byWatch the “BIG O” Webinar Replay

with Don DeRosa

Don DeRosa will helped us kick off our first meeting of the New Year yesterday on how to jump-start your real estate investing business in 2017. If you missed the webinar or couldn’t get on because the webinar was full, now is your chance to watch the webinar 24/7 whenever you get a chance to watch the webinar below.

Don DeRosa will helped us kick off our first meeting of the New Year yesterday on how to jump-start your real estate investing business in 2017. If you missed the webinar or couldn’t get on because the webinar was full, now is your chance to watch the webinar 24/7 whenever you get a chance to watch the webinar below.

Don is a full-time, active real estate investor, coach and trainer who had done all types of real estate deals such as wholesaling, creative financing on pretty house deals, rehabbing and retailing, rentals, short sales, foreclosures, new construction, private lending and much, much more. This year, Don is focusing on fixing and flipping and doing creative deals with his coaching students.

Watch the BIG Online Replay we recorded Live with Don DeRosa on January 25, 2017 and he will teach you the quickest and easiest way to get started in the real estate investing business with limited time and funds. He will also talk about his upcoming training workshops and boot camps for 2017 that he is doing in conjunction with our REIA as well as the Property Protege Group and Coaching Program. Watch the Webinar Replay Now! Read More→

Watch the BIG Online Replay we recorded Live with Don DeRosa on January 25, 2017 and he will teach you the quickest and easiest way to get started in the real estate investing business with limited time and funds. He will also talk about his upcoming training workshops and boot camps for 2017 that he is doing in conjunction with our REIA as well as the Property Protege Group and Coaching Program. Watch the Webinar Replay Now! Read More→

Jump-Start Your Wholesaling Business – Day 1

Posted on January 25, 2017 by3125 Presidential Pkwy, Atlanta, GA

Wholesaling houses is one of the quickest ways to start cashing checks in real estate without using any of your own money or credit. There is no one better to teach you how to get started in wholesaling than Don DeRosa. Whether you want to be a full-time investor or are just getting started part-time, let Don show you how to start wholesaling profitably today in this live training event.

Wholesaling houses is one of the quickest ways to start cashing checks in real estate without using any of your own money or credit. There is no one better to teach you how to get started in wholesaling than Don DeRosa. Whether you want to be a full-time investor or are just getting started part-time, let Don show you how to start wholesaling profitably today in this live training event.

During the Day 1 of the 3-Day Jump-Start Boot Camp, you will learn about:

- Wholesaling – What it is and how it works

- How to find the deals with the most profit potential

- How to determine the wholesale value of a property

- How to negotiate the deal

- The Closing process – Step by Step directions

- All the paperwork involved from start to finish

- Pitfalls to avoid

- All this and so much more!

If you want to learn how to find distressed, ugly properties and to wholesale them to other “fix and flip” and “buy and hold” investors for nice chunks of fast cash, often in 30 days or less, this is a training event you don’t want to miss… Register Now!

You can also purchase any of these 3 events separately or get more detailed information about each event using the links below.

- Day 1: Jump-Start Your Wholesaling Business (Distressed Houses)

- Day 2: Jump-Start Your Creative Real Estate Investing Business (Pretty Houses)

- Day 3: Jump-Start Your High Tech Homebuying Business (Using Technology to Operate and Automate Your Business)

Sign up for all 3 Days of the Jump-Start Your Real Estate Investing Business Boot Camp!

Jump-Start Your Creative Real Estate Investing Business – Day 2

Posted on January 25, 2017 byCreative Real Estate Investing Business

Day 2 Only of the 3-Day Jump-Start Boot Camp

3125 Presidential Pkwy, Atlanta, GA

Without Using Your Own Cash or Credit with Don DeRosa

One of the easiest ways to get into real estate is by taking over existing mortgage payments, especially on pretty houses. Don DeRosa is an expert at doing just that. There are six simple steps to get you on your way to becoming an expert as well and Don DeRosa will teach you what you need to know during Day 2 of the 3-Day Jump-Start Boot Camp. The six steps are:

One of the easiest ways to get into real estate is by taking over existing mortgage payments, especially on pretty houses. Don DeRosa is an expert at doing just that. There are six simple steps to get you on your way to becoming an expert as well and Don DeRosa will teach you what you need to know during Day 2 of the 3-Day Jump-Start Boot Camp. The six steps are:

- Locating Sellers

- Prescreening Sellers

- Constructing Offers

- Presenting Offers

- Finding the Money

- Selling Houses

Once you learn about each of these steps and how to execute them, you can continue to do it over and over again for massive profits. In addition to taking you through each of the steps above, Don will also teach you about:

- Finding the easiest ways to attract motivated sellers

- 20 questions you should always ask a potential seller

- Differentiating between a need to sell and someone who wants to sell

- Avoiding the “due on sale” clause

- How to track your progress

- The top five negotiating tactics to get sellers to say “yes!”

- Exit strategies that will not only make you lots of money today, but make you wealthy long term

- And so much more!

If you want to learn the “Pretty House” side of the business and how to buy nice houses, in nice neighborhoods with none of your own cash or credit for fast cash up front, monthly cash flow and often huge backend profits, don’t miss this training event… Register Now!

You can also purchase any of these 3 events separately or get more detailed information about each event using the links below.

- Day 1: Jump-Start Your Wholesaling Business (Distressed Houses)

- Day 2: Jump-Start Your Creative Real Estate Investing Business (Pretty Houses)

- Day 3: Jump-Start Your High Tech Homebuying Business (Using Technology to Operate and Automate Your Business)

Sign up for all 3 Days of the Jump-Start Your Real Estate Investing Business Boot Camp!

Jump-Start Your High-Tech Homebuying Business – Day 3

Posted on January 25, 2017 by3125 Presidential Pkwy, Atlanta, GA

with Don DeRosa

Most people only use their smartphones and tablets to talk, text, play games, and watch videos. But did you know that you can also use your mobile devices to successfully operate and automate most of your real estate investing business so you can work less and earn much more?

Most people only use their smartphones and tablets to talk, text, play games, and watch videos. But did you know that you can also use your mobile devices to successfully operate and automate most of your real estate investing business so you can work less and earn much more?

Imagine this… You’ve found a deal. You’re at the seller’s house and everything seems to look good… but you suspect the sellers might have an appointment with your competition later. You need to lock this deal down NOW so you don’t lose it. NO problem! You smile as you pull out your tablet, tap a few apps, run a few numbers and… BAM!

In just a few moments, you’ve pulled comps, estimated the repairs, made your offer to the seller, gotten them to sign the contract, then submitted that contract to your title company, your attorney, and the seller… ALL BEFORE ever leaving their house! Best of all, it was not only EASY, but FUN to do it all that way!

At this full day training, Don DeRosa will teach you about all the tip, tools and technology you need to take your business to the next level and beyond! He will teach you about…

During the Day 3 of the 3-Day Jump-Start Boot Camp, you will learn about:

- How to find leads on your tablet or smart phone

- How to easily run your business from the palm of your hand

- How to carry your business with you so you never miss an important opportunity

- How to find comps without ever stepping out of your car

- How to automate all the parts of your business that suck up your time

- How to complete your paperwork on the fly

- Don’s favorite hardware, software, gadgets and apps to make your much more productive and efficient

- And much more!

If you want to learn how to use the latest technology such as PCs, Smart Phones, Tablets and other hardware, software, apps and gadgets to operate, systematize and automate your real estate investing business to be leaps and bounds ahead of your competition, don’t miss this event… Register Now!

You can also purchase any of these 3 events separately or get more detailed information about each event using the links below.

- Day 1: Jump-Start Your Wholesaling Business (Distressed Houses)

- Day 2: Jump-Start Your Creative Real Estate Investing Business (Pretty Houses)

- Day 3: Jump-Start Your High Tech Homebuying Business (Using Technology to Operate and Automate Your Business)

Sign up for all 3 Days of the Jump-Start Your Real Estate Investing Business Boot Camp!

Jump-Start Your Real Estate Investing Business in 2017

Posted on January 24, 2017 bywith Don DeRosa, Jan 25th @ 7PM

No Charge to Attend for Members or Guests

Who Attend Online via GoToWebinar.com!

The Beginning Investors Group Online (The “Big O” or BIGO) is an new online educational group that currently meets on the 4th Wednesday for new investors who are just getting started in real estate investing as well as “new again” real estate investors who’ve taken a few years off and are looking to get back in the game.

The Beginning Investors Group Online (The “Big O” or BIGO) is an new online educational group that currently meets on the 4th Wednesday for new investors who are just getting started in real estate investing as well as “new again” real estate investors who’ve taken a few years off and are looking to get back in the game.

Each month, we will be bringing in local and national real estate experts to teach new investors how to survive and thrive in our ever changing economy and real estate market. The entire purpose of this group is to help new investors get their first deal and help new again investors get their next deal.

Don DeRosa will help us kick off our first meeting of the New Year 2017 on Wednesday, January 25th at 7:00PM ET. Don is a full-time, active real estate investor, coach and trainer who had done all types of real estate deals such as wholesaling, creative financing on pretty house deals, rehabbing and retailing, rentals, short sales, foreclosures, new construction, private lending and much, much more. This year, Don is focusing on fixing and flipping and doing creative deals with his coaching students.

Don DeRosa will help us kick off our first meeting of the New Year 2017 on Wednesday, January 25th at 7:00PM ET. Don is a full-time, active real estate investor, coach and trainer who had done all types of real estate deals such as wholesaling, creative financing on pretty house deals, rehabbing and retailing, rentals, short sales, foreclosures, new construction, private lending and much, much more. This year, Don is focusing on fixing and flipping and doing creative deals with his coaching students.

Join Don at BIG Online as he teaches you the quickest and easiest way to get started in the real estate investing business with limited time and funds. He will also talk about his upcoming training workshops and boot camps for 2017 that he is doing in conjunction with Atlanta REIA as well as the Property Protege Group and Coaching Program.

TO ATTEND ONLINE: 7:00PM Start Time. To attend the Beginning Investors Group Online via your PC, smart phone or tablet, Register Here for the Meeting on GoToWebinar.com and you will be emailed login instructions for the event.

No Charge to Attend for Members or Guests

Who Attend Online via GoToWebinar.com!

Once you get your Webinar Confirmation Email, you can login on about 5-10 minutes prior to the 7PM start time to reserve a spot using your PC, Mac, Tablet or Smart Phone. You can download the GoToWebinar App here on iTunes App Store or the Google Play Store.

Wild Women of Real Estate at Atlanta REIA West on January 30, 2016

Posted on January 23, 2017 byPLEASE NOTE SPECIAL DATE & TIME

Wild Women of Real Estate

with Darlene Coquerel, Carole VanSickle Ellis & Leslie Mathis

January 30th @ 6:30PM, Cherokee Cattle Company,

2710 Canton Rd, Marietta, GA

Free for ATL REIA Members, Guests $10 At The Door. This month only we have a 2-for-1 Guest Special!

Come join us at the Wild West Real Estate Event at 6:30pm on Monday, January 30th at The Cherokee Cattle Company at 2710 Canton Rd. in Marietta as we host a panel of 3 WOMEN EXPERTS in the field of residential real estate! The experts on the panel are Darlene Coquerel, Carole VanSickle Ellis, and Leslie Mathis. These talented, successful women are excited to meet the crowd and share with you the knowledge they’ve gained over the years.

Come join us at the Wild West Real Estate Event at 6:30pm on Monday, January 30th at The Cherokee Cattle Company at 2710 Canton Rd. in Marietta as we host a panel of 3 WOMEN EXPERTS in the field of residential real estate! The experts on the panel are Darlene Coquerel, Carole VanSickle Ellis, and Leslie Mathis. These talented, successful women are excited to meet the crowd and share with you the knowledge they’ve gained over the years.

This night won’t be about theory, folks. Each lady will share with you their unique experience, as well as what it has really taken to for them to become an expert in real estate. You won’t want to miss this POWERHOUSE PANEL, so be sure to come early and get a great seat. You’ll be surprised at what you hear!

What you will learn:

- What unique challenges women face in the real estate business

- How women relate with sellers differently than most men, and what you can learn from that to increase the number of deals you close, starting right now!

- Specific strengths women bring to the table, and how you can incorporate those strengths into your business to become a profit making machine!

- And much more!

Whether you are a woman or a man, there’s a lot to learn during this evening! This one promises to be both informative and entertaining. We look forward to seeing your smiling face. Please bring your family and friends and be ready to interact with this very special women’s panel. And remember: We LOVE questions– questions enlighten us all! You can ask questions of the panel, and to be sure your question is answered, email it right now to LeslieMathisMEntor@gmail.com. See you there!

Atlanta REIA Members get in at no charge with Membership Card and Guests are just $10 CA$H at the door. Happy New Year! Guests are 2 for 1 admission this month only! See you there!

Atlanta REIA Members Please RSVP on Meetup.com

Atlanta REIA Members get in FREE, and guests are just $10 at the door.

*Please Note: West Meeting agenda is subject to change.

The Atlanta REIA West Monthly Meeting is an Atlanta REIA Subchapter led by Leslie Mathis that is held on the 4th Monday of each month at 6:30 PM at the Cherokee Cattle Company located at 2710 Canton Rd in Marietta. The next meeting will be held on Monday, January 30th at 6:30PM. Atlanta REIA Members can attend for FREE and guests for $10. Show up at 6:30 PM to eat and network before the meeting officially starts at 7:00 PM. Buying your own meal is optional but highly recommended and greatly appreciated since the Cherokee Cattle Company allows us to use their meeting room. There will be lots of learning and lots of networking. Bring your deals and your haves, wants and needs to the event.

The Atlanta REIA West Monthly Meeting is an Atlanta REIA Subchapter led by Leslie Mathis that is held on the 4th Monday of each month at 6:30 PM at the Cherokee Cattle Company located at 2710 Canton Rd in Marietta. The next meeting will be held on Monday, January 30th at 6:30PM. Atlanta REIA Members can attend for FREE and guests for $10. Show up at 6:30 PM to eat and network before the meeting officially starts at 7:00 PM. Buying your own meal is optional but highly recommended and greatly appreciated since the Cherokee Cattle Company allows us to use their meeting room. There will be lots of learning and lots of networking. Bring your deals and your haves, wants and needs to the event.

See you at the meeting on Monday, January 30th at 6:30PM at the Cherokee Cattle Company located at 2710 Canton Rd in Marietta!

After the conclusion of the Atlanta REIA West meeting (after 9PM), you are encouraged to hang around and join us for Late Nite Networking also held at Cherokee Cattle Company. So please come eat, drink, network and have fun with like-minded investors and real estate professionals as we hang out late into the night!

After the conclusion of the Atlanta REIA West meeting (after 9PM), you are encouraged to hang around and join us for Late Nite Networking also held at Cherokee Cattle Company. So please come eat, drink, network and have fun with like-minded investors and real estate professionals as we hang out late into the night!

Time Management & Goal Planning Workshop for Busy Real Estate Investors

Posted on January 10, 2017 byFor Busy Real Estate Investors

Having worked in the real estate industry for almost 20 years, I know and understand better than anyone how poor goal planning and time management can significantly wreck your business both from a productivity and profitability stand point.

Having worked in the real estate industry for almost 20 years, I know and understand better than anyone how poor goal planning and time management can significantly wreck your business both from a productivity and profitability stand point.

This brand-new Time Management & Goal Planning Workshop has been in the making for many years and it is now finally here. This class will focus on practical, easy-to-implement time management and goal planning concepts that anyone can do.

I will show how new technologies help you get better results and provide you new ways to get more done in today’s busy, fast paced environment. I will show you how to eliminate time wasters and put an end to procrastination for good. I will show you how to manage priorities and communicate better than you ever dreamed possible.

If you want 2017 to be a breakout year for you then don’t wait to get started. Take the first step in eliminating procrastination and Sign Up Today! Don’t look back at the end of the year and say “I should have….” look back and say “Wow, look what I accomplished this year!”

In this class you will learn:

- How to write well-constructed performance goals

- How to avoid procrastination by asking yourself a few simple questions

- Prioritizing task using the ABC method

- How to use fingertip management to reduce time looking for “stuff” you need

- Implement on demand information retrieval systems

- How to delegate like a pro

- Learn how to master the Pareto Principal, (80/20 rule)

- Initiate systems to reduce time spent by 75% on daily tasks

- How to automate repetitive tasks and focus on follow up and closing deals.

- And tons more…

Sign Up Today and make 2017 your most productive and profitable year in real estate investing!

*Meeting facilities provided by Deborah Harris of Keller Williams Realty First Atlanta. Contact Deborah for all your commercial or residential real estate needs at 404-272-9827 or AtlantaRealty@KW.com. Thanks Deborah!

Get Back to Real Estate Investing Basics at Beginning Investors Group on January 16, 2017

Posted on January 10, 2017 bywith Ron Dimmock on Mon, Jan 16th

Like all things in life, if you are persistent, you will get it. If you are consistent, you will keep it. Success is the sum of small efforts repeated day in and day out. Will you do what it takes to grow your real estate investing business this year? Now is your chance!

Like all things in life, if you are persistent, you will get it. If you are consistent, you will keep it. Success is the sum of small efforts repeated day in and day out. Will you do what it takes to grow your real estate investing business this year? Now is your chance!

Join us at the Beginning Investors Group on Monday, January 16th at 6:30PM at the Hudson Grille located at 6317 Roswell Rd in Sandy Springs, GA, with Ron Dimmock, as we get back to the basics of real estate investing so you can start the New Year off on the right track.

Ron Dimmock is an Atlanta native who understands hard work. He believes that one should never let where they are in life define who they are, or who they can become. Ron is currently helping new and seasoned investors create long term wealth through Real Estate Investing. His Real Estate experience includes over 40 million dollars in real estate investing projects. In addition, he’s partnered with some of the largest builders in the city, and has had the opportunity to work with large investors in joint ventures that have contributed to his experience and success.

At the meeting, Ron will talk about…

- Mindset

- Goals

- Take Action

- Build Your Network Outside of Real Estate

- Teaming Up with other industry professionals (Agents, contractors and Inspectors)

- Meeting New Investors

- Retirement Plan

- Exit Strategy

- Role Play

- How to use the Atlanta REIA network to build your networth

- And answers to your questions!

Atlanta REIA Members Please RSVP on Meetup.com

*Please Note: Meeting agenda is subject to change.

The Beginning Investors Group (BIG) is an educational and networking group for new investors who are just getting started in real estate investing as well as “new again” real estate investors who’ve taken a few years off and are looking to get back in the game.

The Beginning Investors Group (BIG) is an educational and networking group for new investors who are just getting started in real estate investing as well as “new again” real estate investors who’ve taken a few years off and are looking to get back in the game.

Each month we bring in local and national real estate experts to teach new investors how to survive and thrive in our ever changing economy and real estate market. The entire purpose of this group is to help new investors get their first deal and help new again investors get their next deal.

After the conclusion of the Atlanta REIA BIG Meeting (after 9:00PM), we will be hanging out at the Hudson Grille for Late Nite Networking also known as the “Meeting After the Meeting”. Stick around, have some dessert, a drink, network and have fun with like-minded investors and real estate professionals as we hang out late into the night!

After the conclusion of the Atlanta REIA BIG Meeting (after 9:00PM), we will be hanging out at the Hudson Grille for Late Nite Networking also known as the “Meeting After the Meeting”. Stick around, have some dessert, a drink, network and have fun with like-minded investors and real estate professionals as we hang out late into the night!