Atlanta Real Estate Investors Alliance Blog

Making Creative Offers

Posted on February 28, 2013 byMaking creative offers is one of the most lucrative skills a real estate entrepreneur can master. Creative offers lead to creative financing and creative financing leads to faster financial freedom. I have built a portfolio of almost 400 units and I have never walked into a bank, qualified for a loan and put money down. I have a lot of bank loans now, but I took control of each property with some form of creative financing and then refinanced at a bank.

I did this by understanding one simple concept- “Solving people’s problems pays well!”

The first step to making offers that get accepted is to create an offer that solves one or all of these three problems; the seller’s problems, the properties problems, your problems.

You will need to gather a bit of information to effectively make your offer. Start by asking about the seller’s motivation to sell. Don’t always assume that money is the only motivation for a sale. Sellers often have other reasons for selling such as dealing with bad management or need to retire. Whatever the motivation is, finding a way to solve that person’s problem is key to writing an offer that gets accepted. A master lease works well for these situations. Read More→

Wholesaling 101 Workshop with Russ Hiner on March 30, 2013

Posted on February 26, 2013 byWholesaling 101 Workshop

With Russ Hiner on March 30, 2013 from 9AM – 5PM

At 315 W. Ponce de Leon Ave, Ste 100, Decatur, GA

This Event has SOLD OUT!

Do you want to play the real estate investing game but don’t know where to start? Do you have little or no cash or credit? Want to avoid risk, repairs, tenants and toilets? Want to buy houses with no money?

Do you want to play the real estate investing game but don’t know where to start? Do you have little or no cash or credit? Want to avoid risk, repairs, tenants and toilets? Want to buy houses with no money?

Wholesaling is a great strategy for making quick cash, low risk, without the use of your credit, income, or money. Wholesaling real estate is among the most popular investment strategies because anyone can do it — you don’t need a real estate license or a lot of money to start. And once you start, with a little effort, it’s nearly impossible to keep the money from pouring into your bank account.

If you want to learn how to wholesale houses and get paid within 30 days after you put a house under contract, you should consider attending our 3rd Annual Wholesaling 101 Workshop with Russ Hiner on March 30th, 2013 from 9AM to 5PM at the Keller Williams Office located at 315 W. Ponce de Leon Ave, Ste 100, Decatur, GA. This class has sold out very quickly in the past since we only hold it once a year, so be sure to reserve your seat before they are all gone.

At the workshop, Russ will teach you the wholesale strategies you need to succeed and take you step-by-step through the entire process of how to wholesale real estate. All applicable forms and agreements with filled out examples are included.

What’s Happening at Atlanta REIA – Week of February 25, 2013

Posted on February 25, 2013 by Monday is Atlanta REIA West with special guest, Rock Shukoor, who will be teaching attendees how to build a huge buyers list so you can sell or rent your properties faster than ever before in 2013. There will be Late Nite Networking after the Atlanta REIA West Meeting. Tuesday is the Note Buyers Group with Tom Boyer in Smyrna. Thursday is the Cash Cows Commercial Group with Steve Brown, Attorney Jon David Huffman and Dargan Burns, CPA on Tax Saving Strategies for Real Estate Investors at 5 Seasons Brewing in Sandy Springs. Immediately after Cash Cows is the Haves & Wants Meeting with Joe Thompson. Next Monday, March 4, 2013 will be the Atlanta REIA Main Meeting for March with Don DeRosa on the “New Subject-To” real estate investing strategies. Come join us! Read More→

Monday is Atlanta REIA West with special guest, Rock Shukoor, who will be teaching attendees how to build a huge buyers list so you can sell or rent your properties faster than ever before in 2013. There will be Late Nite Networking after the Atlanta REIA West Meeting. Tuesday is the Note Buyers Group with Tom Boyer in Smyrna. Thursday is the Cash Cows Commercial Group with Steve Brown, Attorney Jon David Huffman and Dargan Burns, CPA on Tax Saving Strategies for Real Estate Investors at 5 Seasons Brewing in Sandy Springs. Immediately after Cash Cows is the Haves & Wants Meeting with Joe Thompson. Next Monday, March 4, 2013 will be the Atlanta REIA Main Meeting for March with Don DeRosa on the “New Subject-To” real estate investing strategies. Come join us! Read More→

Building a Cash Buyers List with Rock Shukoor on Monday, Feb 25 2013 at Atlanta REIA West

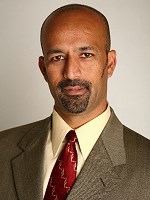

Posted on February 21, 2013 by Hi there, Partners! Yee-haw, I just have to share with you an absolutely fabulous opportunity we have coming up for you next Monday at Wild Wild West subgroup of Atlanta REIA. Our guest speaker has over ten years experience as a real estate investor, consultant, mentor, and coach. He has done phenomenally well in the business, has a servants heart, and a winning attitude. I call him “The King of Marketing”, because he has extraordinary talents in marketing, which he uses very effectively to build and run his real estate business (can you say “Empire”?!!).

Hi there, Partners! Yee-haw, I just have to share with you an absolutely fabulous opportunity we have coming up for you next Monday at Wild Wild West subgroup of Atlanta REIA. Our guest speaker has over ten years experience as a real estate investor, consultant, mentor, and coach. He has done phenomenally well in the business, has a servants heart, and a winning attitude. I call him “The King of Marketing”, because he has extraordinary talents in marketing, which he uses very effectively to build and run his real estate business (can you say “Empire”?!!).

Come join us on Monday, February 25th at 6:30 pm at the The Cherokee Cattle Company as Rock Shukoor shares with us how he finds CA$H buyers for his real estate deals. Rock wholesales a lot of properties consistently, and in order for him to do this, he has to have the cash buyers to wholesale them to, right? Come get a rare inside peek at Rock’s business, one of the most successful real estate investing businesses I know of. Rock will show us just how he goes about getting these cash buyers to come out of the woodwork and raise their hands to say, “Yes, I want those houses!” Duplicate his methods and get cash rolling in to your bank account ASAP!

If you want more CA$H coming to you in 2013, it just makes great good common cowboy sense to be there Monday night, doesn’t it? Mark your calendar now—Giddy-up on over and join the posse Monday night, February 25 at 6:30pm at the Cherokee Cattle Company in Marietta. See you there! Until then, Happy Trails!

Admission to Wild Wild West is FREE for all AtlantaREIA Members, and just $5 per Guest. In order to keep our meeting space free, we request that you order food and drink to support the restaurant. And don’t forget-Late Night Networking immediately follows the meeting-stay with us, order you up a drink, and chat with Rock and other investors. This is a great time to really connect with people that will help your business to grow – don’t miss out! Read More→

Wealth with the Financial Calculator

Posted on February 21, 2013 byFolks,

This Saturday – February 23, 2013, 9 a.m. to 5 p.m. – Kim and I will be teaching investors how to use their financial calculator.

This Saturday – February 23, 2013, 9 a.m. to 5 p.m. – Kim and I will be teaching investors how to use their financial calculator.

It ain’t sexy, and I know you’re probably thinking it’s boring stuff. The truth is, a financial calculator is an investor’s MOST valuable tool! It’s the tool that you can use at the seller’s kitchen table to help you determine whether the deal is a killer or a stinker. It also helps you turn good deals into great deals!

Below is a link to where you’ll find full information about this seminar. It includes four deal-structuring problems. See if you know the answers.

We look forward to seeing your smiling face. And remember: We LOVE questions!!! Questions make us all smarter!

LINK: atlantareia.com/news/events/workshops/grow-your-wealth-with-the-financial-calculator-workshop/

TO REGISTER: Click here to Register!

Cost: $149/Per. Spouse attends ½ price

Where: Cartersville Hilton Garden Inn. See map here: http://mapq.st/w3fCHT

GUARANTEE: Our seminar comes with a 100% no-questions-asked, money-back guarantee. If, for any reason, you do not think our meeting or seminar was worth your valuable time, we will gladly refund all of your money with a smile and no questions asked.

Bill and Kim Cook

Grow Your Wealth With The Financial Calculator Workshop

Posted on February 20, 2013 byA Full Day Workshop with Bill & Kim Cook

Saturday, February 23, 2013 from 9am – 5pm

At the Hilton Garden Inn, Cartersville, GA

Want to know how to use the financial calculator to help determine whether the deal you are working on is worth pursuing?

Want to know how to use the financial calculator to help determine whether the deal you are working on is worth pursuing?

Want to know how to calculate the mortgage payments when a homeowner says “Yes!” to your offer of “Will you owner finance?”

Want to know how long it will take you to pay off your credit card balance, or how much interest you will have paid on your mortgage ten years from now?

Want to learn how wealthy people just keep getting wealthier? It isn’t a secret. They simply understand Money. Learning the financial calculator will help you construct safer, better, more profitable Real Estate Investing Deals!

Join us for an eye-opening, full day workshop on Creating Wealth by Understanding the Power of the Financial Calculator!

Atlanta REIA North Meeting Postponed Until March

Posted on February 20, 2013 byPOSTPONED UNTIL MARCH 20TH

(POSTPONED UNTIL MARCH 20TH) Atlanta REIA North is a of the Atlanta Real Estate Investors Alliance that meets on the 3rd Wednesday of each month at from 6:30 PM to 8:30 PM at 1960 Skylar Hill Dr, Suite D, Buford, Georgia in North Gwinnett County just a few miles from the Mall of Georgia. Like the Main Atlanta REIA Monthly Meeting, this subchapter will be led by Dustin Griffin and will focus on a wide variety of cutting edge real estate investing strategies with a special emphasis on Internet Marketing and Technology for the modern day “High Tech Investor”. The cost is $5.00 at the door for non-members.

(POSTPONED UNTIL MARCH 20TH) Atlanta REIA North is a of the Atlanta Real Estate Investors Alliance that meets on the 3rd Wednesday of each month at from 6:30 PM to 8:30 PM at 1960 Skylar Hill Dr, Suite D, Buford, Georgia in North Gwinnett County just a few miles from the Mall of Georgia. Like the Main Atlanta REIA Monthly Meeting, this subchapter will be led by Dustin Griffin and will focus on a wide variety of cutting edge real estate investing strategies with a special emphasis on Internet Marketing and Technology for the modern day “High Tech Investor”. The cost is $5.00 at the door for non-members.

(POSTPONED UNTIL MARCH 20TH) Immediately after the Atlanta REIA North Monthly Meeting at approximately 9 PM, we will reconvene at the Mall of Georgia Tilted Kilt located at 3480 Financial Center Pkwy in Buford, GA for the meeting-after-the-meeting, AKA Late Nite Networking. We hope you will come out and eat, drink, network, learn and have fun with us and keep the investing conversations going late into the evening! If the North Meeting is running a little late, be sure to save us a seat.

(POSTPONED UNTIL MARCH 20TH) Immediately after the Atlanta REIA North Monthly Meeting at approximately 9 PM, we will reconvene at the Mall of Georgia Tilted Kilt located at 3480 Financial Center Pkwy in Buford, GA for the meeting-after-the-meeting, AKA Late Nite Networking. We hope you will come out and eat, drink, network, learn and have fun with us and keep the investing conversations going late into the evening! If the North Meeting is running a little late, be sure to save us a seat.

The Adairsville Tornado Brought Out the Best in Folks!

Posted on February 12, 2013 by Kim and I were at our horse ranch when the Adairsville tornado came spinning through last week. When the rain began blowing sideways and we saw a couple of our trees crash to the ground, we beelined it for the hall closet.

Kim and I were at our horse ranch when the Adairsville tornado came spinning through last week. When the rain began blowing sideways and we saw a couple of our trees crash to the ground, we beelined it for the hall closet.

Almost immediately, TV news began showing all the destruction the tornado had done to our wonderful little town – it was one video clip after another of total devastation!

We have a lot of friends and a number of investment properties in Adairsville and Calhoun. We called to make sure folks were all right, but the phones were out. We prayed – a lot!

Here’s the thing: we quickly realized that the tornado was not about the devastation and destruction: It was about all the wonderful people who came together to help make things better! Read More→

Are You An Eagle Or An Oyster?

Posted on February 2, 2013 byLast week’s column brought in lots of calls and emails asking for more information about how we buy mobile homes for cash and then sell them with terms. The two most common questions we received were: 1) How do we determine our purchase price? 2) How do we determine our sale price?

Today, let’s answer these questions. Oh, and if you think this is boring stuff, then you must think 70% yields on your investment dollars is boring stuff, too.

Let’s look at how we determine our purchase and sale price. For this example, let’s assume we’re thinking about buying a fifteen-year-old, two-bedroom, two-bath singlewide mobile home in a park.

First, we investigate to see how much other 2/2 properties are RENTING for in the area. Let’s say, between apartments and single-family houses, the average rent in the immediate area is $700 per month. Read More→

Atlanta REIA Meeting on Feb 4, 2013

Posted on February 1, 2013 bywith Bill Cook on

“How to Earn Mail Box Money”

at the Crowne Plaza Ravinia on February 4th

Guests Can RSVP Online Now for $15 or Pay $20 at the Door.

Atlanta REIA is very excited to announce that local real estate investing expert and leader of North Georgia REIA, Bill Cook, will be speaking at our Atlanta REIA Main Meeting on February 4th at the Crowne Plaza Ravinia in Atlanta which starts at 5:30 PM.

Atlanta REIA is very excited to announce that local real estate investing expert and leader of North Georgia REIA, Bill Cook, will be speaking at our Atlanta REIA Main Meeting on February 4th at the Crowne Plaza Ravinia in Atlanta which starts at 5:30 PM.

Bill Cook and his wife Kim have been investing in real estate in Georgia for over 18 years. They own a fair number of single-family rental homes, they flip houses, plus they do a lot of note and option deals. But the one unique thing they do that gives them the highest yields on their investment dollars and jam packs their mailbox with money is their mobile home investments… that’s right, they buy ugly, used trailers!

For example, they buy a used mobile home in a mobile home park for around $3,000, do a quick clean up and fix up, then sell it for $9,000 with $500 down at 18% interest with payments of around $275 per month for around 4 years. The results of this simple deal are eye-popping! They quickly turn $3,000 into $12,000 while getting a yield of around 100%! Try matching these results with ANY other type of real estate investing vehicle. And here’s the best part, you don’t need a lot of money and there is very little competition!

Join us at our February meeting if you want to see real-world examples – including pictures and paperwork – of what Bill and Kim do to earn their mailbox money and how they do it! There is no fluff… it will be all meat and potatoes!

- Why do Lonnie Deals?

- What is a Lonnie Deal and how does it work?

- How do you find the right mobile homes to buy?

- Which mobile home deals should you avoid?

- How to work with park owners?

- How to find sellers?

- How to buy a “trailer”?

- How to sell a “mobile home”?

- What to do if the buyer doesn’t pay you?

- When is the best time to do Lonnie Deals?

- Examples of real deals that Bill and Kim have done…

- And much more!

Come spend the evening with Bill on February 4th and let him teach you how to earn all the mailbox money you can handle in 2013! Also, be sure to check out Bill’s two latest articles on mobile home investing:

with Don DeRosa

Please join us for the “Mobile Real Estate Rockstars Group” (Rockstars) hosted by Don DeRosa at our “Meeting-Before-The-Meeting” on Monday, February 4th at 3:00 PM at Total Wine & More located at 124 Perimeter Center W (see map). The Mobile Real Estate Rockstar Group is an educational and networking group for investors who want to leverage mobile technology to become more competitive, profitable investors. You’ll learn how to use the latest apps, tips and techniques to use the information they need, right now, at their fingertips, from anywhere. At 5:00 PM, Total Wine & More will be offering a complimentary wine tasting to all those who attend our meeting and wish to participate. There is NO CHARGE to attend this meeting or the wine tasting for Atlanta REIA Members and guests. Thanks Total Wine & More!

Please join us for the “Mobile Real Estate Rockstars Group” (Rockstars) hosted by Don DeRosa at our “Meeting-Before-The-Meeting” on Monday, February 4th at 3:00 PM at Total Wine & More located at 124 Perimeter Center W (see map). The Mobile Real Estate Rockstar Group is an educational and networking group for investors who want to leverage mobile technology to become more competitive, profitable investors. You’ll learn how to use the latest apps, tips and techniques to use the information they need, right now, at their fingertips, from anywhere. At 5:00 PM, Total Wine & More will be offering a complimentary wine tasting to all those who attend our meeting and wish to participate. There is NO CHARGE to attend this meeting or the wine tasting for Atlanta REIA Members and guests. Thanks Total Wine & More!

After the conclusion of the Main Meeting, we will be reconvening at the Tilted Kilt Perimeter located at 1155-B Mount Vernon Highway in Atlanta for the “Meeting after the Meeting”. The Tilted Kilt will be offering half price appetizers as well as food and drink specials for our members and guests. Come eat, drink, network and have fun with us as hang out late into the night!

After the conclusion of the Main Meeting, we will be reconvening at the Tilted Kilt Perimeter located at 1155-B Mount Vernon Highway in Atlanta for the “Meeting after the Meeting”. The Tilted Kilt will be offering half price appetizers as well as food and drink specials for our members and guests. Come eat, drink, network and have fun with us as hang out late into the night!

*Please Note: Meeting agenda is subject to change.

Each and every month, for the duration of our meeting, we have a Vendor Trade Show in which you can come out and meet many of our participating business members who help sponsor our meeting. Thanks again sponsors!

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

Networth Realty of Atlanta, LLC – A licensed, full-service residential wholesale brokerage that specializes in finding quality wholesale properties and making them available to you. Read More>>

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

American IRA – The American IRA mission is to provide the highest level of customer service in the self-directed retirement industry.

Read More>>

Goldmine Properties, Inc. – As Atlanta’s first full service real estate wholesaler, we offer wholesale property at 65% loan to value, with financing available. Purchase price and repairs are 65% of certified after repaired appraisal. Read More>>

Goldmine Properties, Inc. – As Atlanta’s first full service real estate wholesaler, we offer wholesale property at 65% loan to value, with financing available. Purchase price and repairs are 65% of certified after repaired appraisal. Read More>>

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more! Read More>>

Advanta IRA Administration – With the help of your local Advanta IRA staff, use your IRA to invest in assets you know, understand and control, such as real estate, notes & mortgages, private placements, and much more! Read More>>

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele.

Halperin Lyman, LLC – A transactional real property law firm devoted to providing the full spectrum of non-litigation related real estate legal and consulting services to its clientele.

Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Lima One Capital, LLC – A fully capitalized, direct lender for residential real estate investors and homebuilders. We are fully capitalized and our team prides itself on closing loans quickly for our clients. Read More>>

Pete’s Friendly Home Inspections, LLC. – Pete’s provides home inspections, radon monitoring, gas/water/septic tests, checks pools/sprinklers and any other type of inspection needed to get you that next home! Read More>>

Pete’s Friendly Home Inspections, LLC. – Pete’s provides home inspections, radon monitoring, gas/water/septic tests, checks pools/sprinklers and any other type of inspection needed to get you that next home! Read More>>

Craftbuilt, Inc. – We are a Metro Atlanta design-build construction firm specializing in whole-structure renovations, restorations, and new construction. No matter what the situation, we are up to the challenge! Read More>>

Craftbuilt, Inc. – We are a Metro Atlanta design-build construction firm specializing in whole-structure renovations, restorations, and new construction. No matter what the situation, we are up to the challenge! Read More>>

Platinum Real Estate– A full service real estate brokerage that provides a wide range of real estate services including full service property management. We assist our clients in buying residential, commercial and investment properties throughout metro Atlanta. Read More>>

Platinum Real Estate– A full service real estate brokerage that provides a wide range of real estate services including full service property management. We assist our clients in buying residential, commercial and investment properties throughout metro Atlanta. Read More>>

Angel Oak Funding – A direct hard money lender headquartered in Atlanta. We provide renovation/construction loans for investors and or builders to purchase and renovate residential properties. Read More>>

Angel Oak Funding – A direct hard money lender headquartered in Atlanta. We provide renovation/construction loans for investors and or builders to purchase and renovate residential properties. Read More>>

Solutions Realty Network – Providing expert property management and investment services since 2003. You invest and we take care of the rest! We’re the solution to all your real estate needs. Read More>>

Solutions Realty Network – Providing expert property management and investment services since 2003. You invest and we take care of the rest! We’re the solution to all your real estate needs. Read More>>

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More>>

The Small Business Advisor – A full service small business consulting firm specializing in QuickBooks with a wide variety of specialized services, trainings and products for small businesses. Read More>>

Atlanta Carpet Services, Inc. – Providing carpet, wood, vinyl, and tile, ACS is dedicated to every aspect of your floor covering needs from initial consultation to the sale and follow-up services. Read More>>

Atlanta Carpet Services, Inc. – Providing carpet, wood, vinyl, and tile, ACS is dedicated to every aspect of your floor covering needs from initial consultation to the sale and follow-up services. Read More>>

Fuller Center for Housing of Greater Atlanta – A faith-driven, Christ-centered, non-profit organization dedicated to providing adequate shelter for people in need in the Greater Atlanta area. Read More>>

Fuller Center for Housing of Greater Atlanta – A faith-driven, Christ-centered, non-profit organization dedicated to providing adequate shelter for people in need in the Greater Atlanta area. Read More>>

Simply Amazing Staging Atlanta – We have a proven record of converting those “For Sale” signs into “Sold” signs. We use 5 proven and time tested steps to sell your home in record time.

Simply Amazing Staging Atlanta – We have a proven record of converting those “For Sale” signs into “Sold” signs. We use 5 proven and time tested steps to sell your home in record time.

WGC Lending

AtlantaHomesYall.com

Alexandra Spollen

Vacant Investment Protection, Inc

Robin Mitchell Agency

Gary Carrol Renovations

The Profit February 2013 Edition

Posted on January 30, 2013 by The February 2013 edition of The Profit Newsletter is now ready for download as a High Quality PDF or Low Res PDF format. The Profit Newsletter is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digitally delivered, interactive newsletter for real estate investors to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! And yes, The Profit is “print ready” for those who still like a paper newsletter. Be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

The February 2013 edition of The Profit Newsletter is now ready for download as a High Quality PDF or Low Res PDF format. The Profit Newsletter is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digitally delivered, interactive newsletter for real estate investors to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! And yes, The Profit is “print ready” for those who still like a paper newsletter. Be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

Which Type of Real Estate Investing Deal Has The Highest Yield?

Posted on January 30, 2013 byOur bank savings account is earning less than 1% interest. It’s not even keeping up with inflation. Meanwhile, Kim and I did a Lonnie Deal a few weeks back and we’re getting an eye-popping 50.38% yield on our investment. If you’re like us, you believe it makes better financial sense to get a higher yield versus a much lower one.

So what’s a Lonnie Deal? Basically, it’s when you buy a mobile home (that’s right, a trailer) in a mobile home park for cash and then sell it on time. Hey, in 2008, I had the same soured look on my face as you do right now as you ask, “Trailers? Seriously? Are you kidding me?”

Back then we were getting tons of calls from folks looking for $500-per-month housing. We couldn’t help them because our single-family houses rented for between $800 and $1,400 per month. I remember telling Kim that because of the huge demand for $500-per-month property, we needed to start doing Lonnie Deals.

We bought our first trailer on September 19, 2008 in Bartow County, Georgia. Our all-in purchase cost was around $5,500. We sold it on November 9, 2008 for $16,900 with the following sale terms: $500 down, $16,400 loan balance for 75 months at 18% interest with monthly payments of $375. Our yield on this deal is a jaw dropping 81.22%! Read More→