Author Archive

How QuickBooks Helps You Accelerate Receivables

Posted on September 16, 2015 byGetting paid by your tenants in a timely fashion is one of the biggest challenges of being a landlord. QuickBooks can help in several ways.

You’re meeting your business goals. Making sure that every property that has a tenant has been invoiced in QuickBooks. (You invoice in QuickBooks so you can track the timely payments made by the tenants.) You take advantage of vendor discounts. Basically, doing everything in your power to keep cash flow humming.

But you can’t control how quickly your tenants pay you.

You can, though, use QuickBooks’ tools to:

- Make it easier for tenants to remit their payments,

- Remind tenants about unpaid balances, and

- Keep a close eye on unpaid invoices.

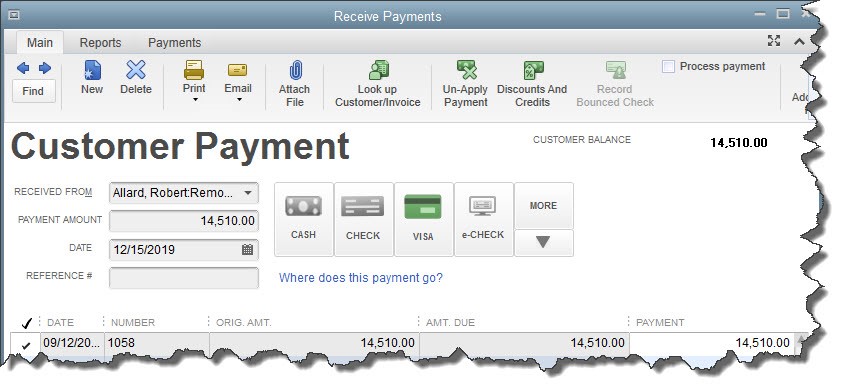

Figure 1: QuickBooks lets you accept payments from tenants in multiple forms. Accepting credit cards and e-checks is likely to speed up your receivables.

Receiving Payments in QuickBooks

Posted on August 1, 2015 byIt’s probably one of your favorite QuickBooks activities. Be sure you understand the mechanics of recording payments.

There are numerous ways to prioritize your workday. Do the most difficult things first. Get important phone calls out of the way. Respond to various emails.

But it’s likely that one activity takes precedence when you see that it needs to be done: recording payments. While you’re probably very careful with this process, it’s critical that your actions here are accurate. If they’re not, you could either lose money that you’ve earned or anger tenants by requesting payments they’ve already made.

QuickBooks comes with some helpful pre-defined payment types; however, you also have the flexibility to edit that list and add new types. To see your list, open the Lists menu and select Customer & Vendor Profile Lists, then Payment Method List. This window opens: Read More→

Why You Should Be Using Mobile Apps with QuickBooks

Posted on July 2, 2015 byIntuit discontinued its own QuickBooks mobile app a while back, but there’s still plenty of processing power available for your smartphone or tablet.

In days gone by, running a company was a 40 hour per week proposition. You might have taken work home some evenings or gone into the office on weekends.

Those days are over, thanks to the internet and mobile technology. This fundamental change in the way we do business means that it’s now hard to get away from work. Your smartphone and tablet are usually within easy reach, and they’re always tempting you to check in.

On the flip side, that kind of 24/7/365 accessibility has numerous benefits. There are, for example, apps that can be integrated with your desktop QuickBooks company file, which enable you to: Read More→

Preventing Data Theft in QuickBooks

Posted on May 29, 2015 byBe proactive about the security of your QuickBooks company file, and you’ll be less likely to encounter data theft.

Thanks to the internet, privacy has been on the wane over the last few years. We assume that our addresses and phone numbers are public information, thanks to sites like Switchboard and 411.com. We hope that our dates of birth are private (though the number of birthday wishes on Facebook makes that doubtful), and we assume that our Social Security numbers are hard to get.

Your customers/tenants trust you enough to provide you with additional private information, like credit card numbers, bank numbers and more. And you’ve seen what an uproar occurs when major corporate entities like Target and Home Depot get hacked.

Your small business may not have hundreds of thousands of customer/tenant information files, but you can still be targeted by external hackers and even your own employees. Are you taking measures to ensure the security of that data stored on your hard drive and/or in the cloud? Read More→

Customize QuickBooks’ Reports, Make Better Business Decisions

Posted on April 30, 2015 byQuickBooks simplifies and speeds up your daily accounting work, but you’re missing out on valuable insight if you don’t tailor your report data.

Do you remember why you started using QuickBooks? You may have simply wanted to produce sales forms and record payments electronically. Gradually, you expanded your use of the software, perhaps paying and tracking bills through it and keeping an eagle eye on your inventory levels. Certainly, you’ve run at least some of the pre-built report templates offered by all versions of QuickBooks since their inception.

QuickBooks’ automation of your daily bookkeeping tasks has undoubtedly served you well. But that’s merely limited use; now it’s time to take advantage of QuickBooks’ greatest strength: customizable reports.

One of the rewards for diligently entering all of your accounting information is a better grasp of your company’s financial performance to date. That insight ultimately leads to better business decisions that can contribute to your future growth and success. Read More→

Is Your QuickBooks Full of “Suspense”?

Posted on April 3, 2015 byIt is the goal of this column to answer questions about QuickBooks and how it is used in the REI arena. Know how to record transactions in the proper way and have your set of books in good shape when it comes time for taxes. It is our intention to do this by you the members submitting questions to Karen@smallbusinessadvisor.biz, and getting answers here in this column.

Q: From time to time I have an entry that I really don’t know how to enter properly. It may be a deposit or a check and I don’t know where to either show the income or the expense. Where can I put this until I can find out from my CPA how to handle it?

A: Create an account named ‘SUSPENSE” and make the type of account a “Bank”. It will live on the balance sheet and will immediately get the attention of your CPA. If you use only this account for these types of entries you can eliminate the Miscellaneous, Uncategorized and Ask my Accountant accounts. Too often these types of accounts get used and the information is scattered across them instead of being in one single account. I usually delete these accounts after I have moved all the transactions to their proper place and then only have Suspense to work with. Read More→

Are You An App Junkie?

Posted on February 27, 2015 byThere are a number of apps that will work with QuickBooks to make your life easier to work with QuickBooks software.

There are a number of categories that you may want to look at for apps that will work with QuickBooks:

- Sales and Marketing

- Productivity

- Operations

- Finance & Accounting

In the app center you can click on the area above that you are interested in and your topic will be sorted and brought to the top and you can look over each app, see how many reviews it has received. Be aware that not all the apps work with every version of QuickBooks. Some are for the “On-Line” only, some are for “Desk Top” only and some work with both – some may only work with Premier or Enterprise. Read More→

Are You Ready For Your Taxes To Be Prepared?

Posted on January 30, 2015 byApril 15th — tax day — will be here before you know it. Actually, most businesses need to file by March 15th and there are a number of special things small-business owners need to be aware of when preparing their taxes this year. Let’s take a look at four areas that may affect your business’ 2014 tax return.

The Affordable Health Care Act

Most people know that businesses with more than 50 employees will be heavily impacted by the Affordable Health Care Act. But what about companies with only a few employees? It turns out that if small companies want to provide health insurance for their employees, they may be eligible for increased tax credits this year. Check it out with your CPA.

Section 179 Tax Deduction

The Section 179 Tax Deduction allows business owners to write off equipment in the same year they bought it. But the $500,000 limit of 2013 was reduced to just $25,000 for tax year 2014. However, Congress passed the Tax Extenders Bill in mid-December, restoring the $500,000 expense limit. President Obama is expected to sign it into law, but has not done so yet (see “Tax Incentives Extended,” below). Read More→

What’s New in QuickBooks 2015?

Posted on January 1, 2015 byIt is the goal of this column to answer questions about QuickBooks® and how it is used in the REI arena. Know how to record transactions in the proper way and have your set of books in good shape when it comes time for taxes. It is our intention to do this by you the members submitting questions to Karen@smallbusinessadvisor.biz, and getting answers here in this column.

QuickBooks Pro 2015

If you have QuickBooks 2013 or 2014 and are thinking about purchasing 2015 version – there are a few changes to this update. I will point out just a couple here but there are many more.

The same as 2014, QuickBooks Pro 2015 has a “What’s New”yellow bar on the side of many of the windows that have new features. When you click on the bar an overlay feature will pop up to indicate where the new features are. Most of these are in your shortcut windows. Once you have viewed them and are comfortable that you know the features you can turn off the yellow bar under the “Help” drop down list. You can always turn it back on if you need to refresh your memory about a feature. Read More→

Year End Tasks

Posted on November 28, 2014 byIt is the goal of this column to answer questions about QuickBooks and how it is used in the REI arena. Know how to record transactions in the proper way and have your set of books in good shape when it comes time for taxes. It is our intention to do this by you the members submitting questions to Karen@smallbusinessadvisor.biz, and getting answers here in this column.

Q: What are the important tasks I should be doing to prepare for Year End?

- There are a number of things to do for Year End and tax filing:

- Reconcile all bank statements and credit card accounts – you may have to reconcile the credit cards into January to capture all your December expenses

- Order w-2’s and 1099’s forms and envelopes

- Print W-2’s and 1099’s – W-2’s if you are using the Pay Roll module and 1099’s for all subcontractors (they should be set up as vendors and you must have their Social in order to print a 1099). You have until January30th to produce these.

- If you have inventory that you track in QuickBooks you must take a physical inventory and reconcile with book inventory for accuracy.

- Check with your CPA if he/she requires a full back up of your QuickBooks or an Accountant’s copy. If they take a full back up that they are going to make adjustments to you cannot work in your copy – if they are going to send you a printed copy of the adjustments for you to enter then you can continue working.

- An Accountant’s copy will ask for a cutoff date for the accountant to work in a certain period and this allows you to continue work – when the accountant has finished you should be able to import the accountant’s changes.

- Back up your data as an additional safety at year end for you to keep after you send the file to the CPA

- Print out your Income Statement and Balance Sheet with a comparison to the prior year. This will provide you with some information on increases/decreases in expenses, income, liabilities, assets, etc. Don’t forget the Income statement is only half the picture – the Balance sheet is the other half.

Top 10 Ways to Get Help from IRS.gov

Posted on October 31, 2014 byWith only a few days left on extensions for business filing (Sept 15th) and a few weeks for personal (Oct 15th), I recently have had a number of clients who need some basic information that really has to come from the IRS. It might be a form or other basic information. Always check with your CPA first then if you still need assistance look at the IRS website.

When you’re looking for tax information help, you want to find it as quickly and easily as possible. That’s why the IRS redesigned its website. It’s now even more user friendly.

Here are the top 10 reasons to visit IRS.gov: Read More→

How a Payment Policy Can Help Your Business

Posted on October 1, 2014 byIt is the goal of this column to answer questions about QuickBooks and how it is used in the REI arena. Knowing how to record transactions in the proper way and have your set of books in good shape when it comes time for taxes. It is our intention to do this with you, the members, submitting questions to info@smallbusinessadvisor.biz and getting answers here in this column.

From time to time I have clients ask me questions that are related to the finances of their business and how they should implement certain business practices. These questions do not always relate directly to QuickBooks® but how these things are handled may directly affect how they are entered in QuickBooks®. I felt that one of these may be of interest to the AtlREIA membership and have compiled a few answers here:

Q: Why would I need a Receipt of Payment Policy- in writing – for my business?

A: A uniform payment policy keeps customers and employees on the same page and improves cash flow management. You may use your payment policy to spell out accepted methods of payment and accounting practices. If your business extends credit to customers or sells a subscription or membership service, you should clearly define the expectations for payment as well as the consequences for failing to make payment. As a landlord you should have already done a credit check on your tenant – which does not mean they can’t have problems from time to time. Read More→