Search Results for "bill cook"

The Profit Newsletter February 2014 Edition

Posted on January 24, 2014 by The February 2014 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on February 3rd. You can download The Profit Newsletter as a High Quality PD or Low Res PDF for slower devices. The Profit is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

The February 2014 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on February 3rd. You can download The Profit Newsletter as a High Quality PD or Low Res PDF for slower devices. The Profit is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

Learning About Real Estate Investing

Posted on January 24, 2014 byIf you’re a Baby Boomer or a Gen Xer, then you’re thinking more and more about retirement – mainly, how are you gonna afford it? After all, we all know that Social Security is not much of a retirement plan.

This need-to-know desire is driving lots of folks to learn about real estate investing. After all, more folks have achieved financial freedom from real estate than from all other types of investments – combined!

The question we’re continually asked is, “What’s the best way to learn how to successfully invest in real estate?” Here’s a hint: All those TV infomercials are nothing but hot air. Those “gurus” who come to town offering a “free” seminar are just snakes in the grass…but then, you already know this.

After 19 years of investing in real estate, we’ve learned that the two best ways to learn are 1) Meet with sellers and ask Pete Fortunato’s famous question: “Why are you selling such a nice house like this?” 2) Hang out with been-there-and-done-that investors.

Sure, neither of these ways is sexy, but they are incredibly effective. Gotta add one other thing: You’ve got to do both a lot…once or twice just won’t cut it. Read More→

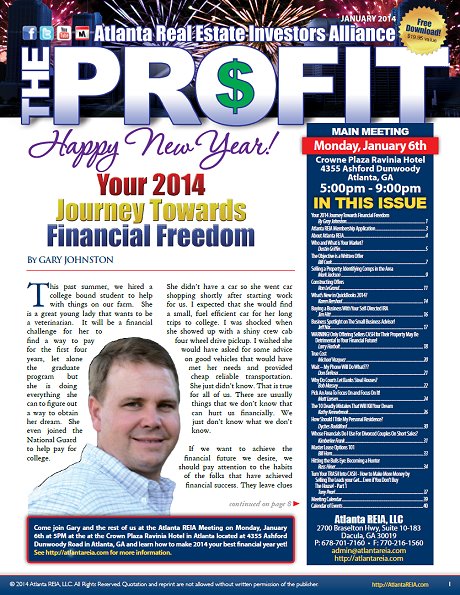

The Profit Newsletter January 2014 Edition

Posted on December 30, 2013 by The January 2014 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on January 6th. You can download The Profit Newsletter as a High Quality PDF or Low Res PDF for slower devices. The Profit is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

The January 2014 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on January 6th. You can download The Profit Newsletter as a High Quality PDF or Low Res PDF for slower devices. The Profit is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

The Profit Newsletter – January 2014

Posted on December 30, 2013 byYou Must Login to

Download The Profit January 2014

Sorry, this content is for members only.

If you are already an Atlanta REIA Member, please login below. Otherwise, click here to Join Atlanta REIA to access this content and more!

Check Out These Great Authors & Articles In

The Profit Newsletter for January 2014

Your 2014 Journey Towards Financial Freedom

By Gary Johnston This past summer, we hired a college bound student to help with things on our farm. She is a great young lady that wants to be a veterinarian. It will be a financial challenge for her to find a way to pay for the first four years, let alone the graduate program but she is doing everything she can to figure out a way to obtain her dream. She even joined the National Guard to help pay for college. Read More>>

This past summer, we hired a college bound student to help with things on our farm. She is a great young lady that wants to be a veterinarian. It will be a financial challenge for her to find a way to pay for the first four years, let alone the graduate program but she is doing everything she can to figure out a way to obtain her dream. She even joined the National Guard to help pay for college. Read More>>

Who and What is Your Market?

By Dustin Griffin In last month’s article we discussed Step #1 of “Determining Your Marketing Plan in 7 Easy Steps” which was to “Determine How Many Leads You Need to Succeed”. This month we’re going to cover Step #2 which is to “Determine Your Market”. A Market (noun) is defined as “a place or area where products and services are bought and sold”. Your market consists of the area where you do business, the products and services you buy and sell as well as… Read More>>

In last month’s article we discussed Step #1 of “Determining Your Marketing Plan in 7 Easy Steps” which was to “Determine How Many Leads You Need to Succeed”. This month we’re going to cover Step #2 which is to “Determine Your Market”. A Market (noun) is defined as “a place or area where products and services are bought and sold”. Your market consists of the area where you do business, the products and services you buy and sell as well as… Read More>>

The Objective is a Written Offer

By Bill Cook A common mistake made by real estate investors is to forget why they knock on the seller’s door. By “forget,” I don’t mean the seller answers the door and the investor stands there with a stupid, lost look on his face. I mean the investor doesn’t understand the basic objective of why he’s there. Do you know the ultimate objective of meeting with sellers? I mean, why are you there? What’s the purpose? Is it to be given a tour of the seller’s house? Read More>>

A common mistake made by real estate investors is to forget why they knock on the seller’s door. By “forget,” I don’t mean the seller answers the door and the investor stands there with a stupid, lost look on his face. I mean the investor doesn’t understand the basic objective of why he’s there. Do you know the ultimate objective of meeting with sellers? I mean, why are you there? What’s the purpose? Is it to be given a tour of the seller’s house? Read More>>

Selling a Property: Identifying Comps in the Area

By Mark Jackson

Selling an investment property can be a very challenging process. One of the preliminary considerations in selling the property is what price you should ask. Evaluating the prices of comparable houses in the neighborhood may sometimes solve this problem. However, for those of you connected to REIAComps, the control and feeling of confidence you have over your deals is priceless. Read More>>

Selling an investment property can be a very challenging process. One of the preliminary considerations in selling the property is what price you should ask. Evaluating the prices of comparable houses in the neighborhood may sometimes solve this problem. However, for those of you connected to REIAComps, the control and feeling of confidence you have over your deals is priceless. Read More>>

Constructing Offers

By Ron LeGrand

Once the seller is called by either you or your virtual assistant using our property information sheet, the prospects will come at you in one of four categories: 1) they’ll be free and clear, 2) there’ll be a mortgage with lots of equity, 3) there’ll be a mortgage with a small amount of equity, or 4) they’ll be over-leveraged. All prospects will fall into one of these categories. So, now our job is to look at the property information sheet and figure out what to do next…. Read More>>

Once the seller is called by either you or your virtual assistant using our property information sheet, the prospects will come at you in one of four categories: 1) they’ll be free and clear, 2) there’ll be a mortgage with lots of equity, 3) there’ll be a mortgage with a small amount of equity, or 4) they’ll be over-leveraged. All prospects will fall into one of these categories. So, now our job is to look at the property information sheet and figure out what to do next…. Read More>>

What’s New in QuickBooks 2014?

By Karen Bershad

If you have QuickBooks® 2012 or older and are thinking about purchasing 2014 version – you are in for a surprise on how the program looks and some new areas that have been added. I will point out just a couple here but there are many more. QuickBooks Pro® 2014 has a “What’s New” yellow bar on the side of many of the windows that have new features… Read More>>

If you have QuickBooks® 2012 or older and are thinking about purchasing 2014 version – you are in for a surprise on how the program looks and some new areas that have been added. I will point out just a couple here but there are many more. QuickBooks Pro® 2014 has a “What’s New” yellow bar on the side of many of the windows that have new features… Read More>>

Buying a Business With Your Self-Directed IRA

By Jim Hitt

Stocks, bonds and mutual funds are all well and good – for those seeking ordinary returns. But if you have a particular expertise, or access to a lucrative market for just about any good or service, you have the potential to earn much more by going into business for yourself than you stand to gain by investing in the broad market. Fortunately, your Self-Directed IRA doesn’t limit you to the mundane investments you read about in the papers all the time. Read More>>

Stocks, bonds and mutual funds are all well and good – for those seeking ordinary returns. But if you have a particular expertise, or access to a lucrative market for just about any good or service, you have the potential to earn much more by going into business for yourself than you stand to gain by investing in the broad market. Fortunately, your Self-Directed IRA doesn’t limit you to the mundane investments you read about in the papers all the time. Read More>>

Atlanta REIA Business Spotlight on The Small Business Advisor!

By Jeff Nix You’ve heard her at the monthly meetings, “I’m Karen Bershad and I am the Small Business Advisor!” Karen’s firm has been a business member with Atlanta REIA since it started and has been helping small businesses and their owners for almost 20 years. The past eight years however have been tailored to the specialized services for the Real Estate Investment industry. Read More>>

You’ve heard her at the monthly meetings, “I’m Karen Bershad and I am the Small Business Advisor!” Karen’s firm has been a business member with Atlanta REIA since it started and has been helping small businesses and their owners for almost 20 years. The past eight years however have been tailored to the specialized services for the Real Estate Investment industry. Read More>>

WARNING! Only Offering Sellers CASH for Their Property May Be Detrimental to Your Financial Future!

By Larry Harbolt

A few weeks ago I attended a weekend training put on by, who I believe is the most creative and knowledgeable real estate investor and teacher in this country. The training was put on by Peter Fortunato. Peter spent two days with his class explaining how dozens and dozens of deals he had helped structure without the need for institutional financing or credit. It truly amazed me how he never completed any of the deals he spoke about in the same way twice. Read More>>

A few weeks ago I attended a weekend training put on by, who I believe is the most creative and knowledgeable real estate investor and teacher in this country. The training was put on by Peter Fortunato. Peter spent two days with his class explaining how dozens and dozens of deals he had helped structure without the need for institutional financing or credit. It truly amazed me how he never completed any of the deals he spoke about in the same way twice. Read More>>

True Cost

By Michael Vazquez

When you begin to learn about real estate investing you normally hear about the big picture of how to find and sell real estate. Obviously, this is important because without a piece of real estate to buy or sell there are no profits. However, let’s assume you have the acquisition and disposition of real estate down to a science. Now it’s time to pay more attention to the details because as the saying goes, “the devil is in the details.” I like to say, “Profit is in the details.” Read More>>

When you begin to learn about real estate investing you normally hear about the big picture of how to find and sell real estate. Obviously, this is important because without a piece of real estate to buy or sell there are no profits. However, let’s assume you have the acquisition and disposition of real estate down to a science. Now it’s time to pay more attention to the details because as the saying goes, “the devil is in the details.” I like to say, “Profit is in the details.” Read More>>

Wait – My Phone Will Do What???

By Don DeRosa So, here it is: January. You’ve gotten most of the pine needles and tinsel out of the carpet so the dog won’t eat it. Aunt Flora and Uncle Ruben have gone back to Miami. Your kids are back in school. And you? You’ve had a minute or two to breathe and enjoy the satisfaction of a holiday season well spent. Time is precious, isn’t it? But now, it’s time to get moving again. Read More>>

So, here it is: January. You’ve gotten most of the pine needles and tinsel out of the carpet so the dog won’t eat it. Aunt Flora and Uncle Ruben have gone back to Miami. Your kids are back in school. And you? You’ve had a minute or two to breathe and enjoy the satisfaction of a holiday season well spent. Time is precious, isn’t it? But now, it’s time to get moving again. Read More>>

Why Do Courts Let Banks Steal Houses?

By Bob Massey If the courts rule against the banks in the homeowners’ favor, but no news outlets report it, does it really happen? That’s the situation we’re in now. If you’ve been digging deep, you might have seen that the estimate of bank losses from mortgage related lawsuits has increased to $100 BILLION in future payouts. This number includes settlements and judgments as well as legal fees for defending all of the lawsuits. How many stories about this have you heard on the major news outlets? Read More>>

If the courts rule against the banks in the homeowners’ favor, but no news outlets report it, does it really happen? That’s the situation we’re in now. If you’ve been digging deep, you might have seen that the estimate of bank losses from mortgage related lawsuits has increased to $100 BILLION in future payouts. This number includes settlements and judgments as well as legal fees for defending all of the lawsuits. How many stories about this have you heard on the major news outlets? Read More>>

Pick An Area To Focus On And Focus On It!

By Matt Larsen

Happy New Year!! You may be reading this in early January even though I am writing this in December so I figured I’d throw that out. Hope you had a great Christmas season as well. It’s always my favorite time of the year. Our December one year ago I think was still our best month Wholesaling. We did 12 deals – which was insane. Don’t let up in the holiday season – it can be a good time to get deals. Read More>>

Happy New Year!! You may be reading this in early January even though I am writing this in December so I figured I’d throw that out. Hope you had a great Christmas season as well. It’s always my favorite time of the year. Our December one year ago I think was still our best month Wholesaling. We did 12 deals – which was insane. Don’t let up in the holiday season – it can be a good time to get deals. Read More>>

The 10 Deadly Mistakes That Will Kill Your Dream

By Kathy Kennebrook

I am frequently asked, “If you had it to do over again what would you do differently?” Well, I’d like to answer that question for you. There are several things you can do to help your business grow and several things you can do to kill the dream before it ever has a chance to become a reality. Let’s talk about the “ten deadly mistakes” that can kill your dream. Read More>>

I am frequently asked, “If you had it to do over again what would you do differently?” Well, I’d like to answer that question for you. There are several things you can do to help your business grow and several things you can do to kill the dream before it ever has a chance to become a reality. Let’s talk about the “ten deadly mistakes” that can kill your dream. Read More>>

How Should I Title My Personal Residence?

By Dyches Boddiford Often I have investors ask me what entity should hold their personal residences. Many want to use at least the land trust or Family Limited Partnership. But by using any of these, you could be losing tax and financial benefits. So, how do you protect it? Your personal residence is protected by being mortgaged 100%. Don’t worry, I am not suggesting that you have loans out totaling the full value of your residence, but have a home equity line up to 90-100% of the value. Read More>>

Often I have investors ask me what entity should hold their personal residences. Many want to use at least the land trust or Family Limited Partnership. But by using any of these, you could be losing tax and financial benefits. So, how do you protect it? Your personal residence is protected by being mortgaged 100%. Don’t worry, I am not suggesting that you have loans out totaling the full value of your residence, but have a home equity line up to 90-100% of the value. Read More>>

Whose Financials Do I Use For Divorced Couples On Short Sales?

By Kimberlee Frank Many of my students repeatedly ask me, “Do I need both the Wife and the ex-Husband’s financial documents when negotiating a short sale?” I let them know that there are several variables that I need in order to give them an answer. In order to have a clear understanding of whose financials I need to collect, I need the following information: Property Appraiser sheet, a copy of the last recorded Deed, a copy of the Property Settlement and Judgment of Divorce. Read More>>

Many of my students repeatedly ask me, “Do I need both the Wife and the ex-Husband’s financial documents when negotiating a short sale?” I let them know that there are several variables that I need in order to give them an answer. In order to have a clear understanding of whose financials I need to collect, I need the following information: Property Appraiser sheet, a copy of the last recorded Deed, a copy of the Property Settlement and Judgment of Divorce. Read More>>

Master Lease Options 101

By Bill Ham

Lease options have made a big comeback in today’s market. They are great ways to take control of real estate without using banks or lenders. They are also a great way to fix up a distressed asset that a bank won’t lend on. Once you have the property up and running, you can then sell for quick cash or refinance for a long term hold. A master lease option is a set of two contracts that give us the right to control the operations and the sale of a property. Read More>>

Lease options have made a big comeback in today’s market. They are great ways to take control of real estate without using banks or lenders. They are also a great way to fix up a distressed asset that a bank won’t lend on. Once you have the property up and running, you can then sell for quick cash or refinance for a long term hold. A master lease option is a set of two contracts that give us the right to control the operations and the sale of a property. Read More>>

Hitting the Bulls Eye: Becoming a Hunter

By Russ Hiner Owners of vacant houses can be hard to find, so I am about to give you some insider tips so you can hunt these elusive owners… Once upon a time, I found a boarded up house and wanted to find the owner. Given my experience, I knew that trying to find the owner through tax records might get me an address, but mailing anything to that address would be a waste of my hard earned 42 cents. I needed to find another way to hunt this owner. Read More>>

Owners of vacant houses can be hard to find, so I am about to give you some insider tips so you can hunt these elusive owners… Once upon a time, I found a boarded up house and wanted to find the owner. Given my experience, I knew that trying to find the owner through tax records might get me an address, but mailing anything to that address would be a waste of my hard earned 42 cents. I needed to find another way to hunt this owner. Read More>>

Turn Your TRASH Into CASH – How to Make More Money by Selling The Leads You Get… Even if You Don’t Buy The House! – Part 1

By Tony Pearl Not too long ago, I wrote a sweet 3-part article on how to fill your pipeline full of leads & deals. I hope by now that you’re using that advice to get lots of leads coming in that you can work with. If not, then go back & read it again! And now that you (hopefully) have leads coming in, it’s time to introduce you to a new technique to make money. Read More>>

Not too long ago, I wrote a sweet 3-part article on how to fill your pipeline full of leads & deals. I hope by now that you’re using that advice to get lots of leads coming in that you can work with. If not, then go back & read it again! And now that you (hopefully) have leads coming in, it’s time to introduce you to a new technique to make money. Read More>>

Stay Focused On Your Area

Posted on December 23, 2013 bySome real estate investors invest in a concentrated area. Others work huge, multi-county areas. In our case, we work a five-mile circle around the Cartersville, Georgia Wal-Mart. This allows us to better manage our rental properties, plus, when a seller calls, we can quickly get to their house.

Staying in our five-mile circle takes a lot of discipline. We often get calls from motivated sellers a county or two away. Having a great deal placed on your plate, then having to pass it on to another investor, flat out hurts.

For example, last week a seller called, desperate to sell quickly. She owned a three-bedroom, two-bath mobile home in a trailer park. The home was in great condition and needed little work. We agreed to a purchase price of $4,500.

These kinds of deals are called Lonnie Deals. A Lonnie Deal is when you buy a mobile home in a park for cash (you own the trailer, not the dirt), then sell it on time to an owner/occupant. You may think this is a silly deal, but believe me, Lonnie Deals are the highest yielding deals we do.

Let’s look at the numbers: We’d sell this nice mobile home for $9,000. The buyer would give us $500 down. Here are the terms of the note: $250 per month, for 48 months, at 18.07% interest. So what’s the yearly yield on a simple deal like this? Would you believe 70.08%? Try finding a bank that will pay you 70% interest on your savings account! Read More→

Are Women Better Real Estate Investors?

Posted on December 23, 2013 byI must start by saying: If you’re looking for politically correct, then I’m DEFINITELY not your guy!

Kim and I were discussing who is better at real estate investing – men or women. Lord knows men and women are very different creatures. Men are clear, concise and rational thinkers. Women are not.

Seriously, I think women can be better – a LOT better – at real estate investing than men. To prove this, our real estate investor’s meeting this month is about successful women real estate investors. Our panel will be four women who, between them, do over – way over – 100 deals a year!

Three reasons why I think women can be better at real estate investing: 1) Great time management. 2) Not ego driven. 3) Aren’t scared of hard, dirty work. Read More→

Cut Through The Obvious

Posted on December 23, 2013 byThis past weekend, I was one of the instructors who taught at a boot camp for new real estate investors. At the end of the four-day event, the frequently asked question was, “What do I do first?”

The advice from the instructors varied. One said to spend the week reviewing the course notes. Another told the investors to put their real estate investing team together. Several thought it best to work on a marketing plan.

When it comes to advising would-be investors how to start – or seasoned investors how to get back on track – I often feel like a salmon swimming upstream. I think the FIRST, most important thing an investor needs to do is to get face-to-face with sellers as SOON, and as OFTEN, as possible!

A number of the attendees didn’t care too much for this advice. One woman best summed up the fears in the room when she said, “I’m not sure what to say to a seller. I’m not comfortable creatively structuring a win-win deal. I don’t know what to do if the seller accepts my offer.” Read More→

Vacancies Are a Fact of Life

Posted on December 23, 2013 byWhy would a reasonably sane person own rental property? After all, we’ve all heard lots of landlording horror stories, right? You know the ones: the tenants refuse to pay rent, the tenants trash the property, the tenants move out in the middle of the night, etc.

Here’s something to consider: We had 61 investors attend our monthly real estate investors meeting in October. These 61 mom-and-pop investors control 573 properties. A couple of weeks back, I (along with seven other instructors) was asked to teach at a boot camp for new real estate investors. The instructors controlled 122 properties. All told, that’s 69 investors controlling almost 700 properties – incredible, isn’t it?

So why do all these folks own rental property? Easy answer: They want MAILBOX MONEY! What’s mailbox money? It’s when you get checks in the mail because your capital is working for you, instead of you working for your capital.

Are there other ways to get mailbox money? Sure – some folks own stock and live off the dividends. We have friends who make purchase-money loans to real estate investors and live off the interest they make. Of course, there’s also a one-in-a-billion chance that you’ll win the lottery – talk about a shaky retirement plan! Read More→

He Appealed to My Greed

Posted on December 23, 2013 byA few months back, one of our rental properties went vacant. It’s a nice three-bedroom, two-bath home with a fenced yard. After a bit of paint and clean up, we stuck a For Rent sign on the lawn.

Over the course of two weeks, we received several great applications. One application stood out above all the others. The applicants had been on their jobs for years, they had solid references, they had the move-in funds ready to go, and they kept their current residence immaculate. They would make PERFECT tenants!

Shortly before I called these ideal tenants to give them the good news that they got the house, I got a call from someone who wanted to buy the property. They explained that their credit stunk, but they had $10,000 to put down.

Their $10,000 down payment got my attention and put the brakes on everything. A thorough background check revealed that the prospective buyers didn’t pay their bills or maintain their current residence well.

Over coffee, the potential buyers explained that they had just inherited $20,000, had always wanted their own home, loved the house we had on the market, and buying it – if we gave them owner financing – would be a dream come true. Read More→

But I Don’t Have the Money

Posted on December 23, 2013 byIs real estate a good, safe, profitable investment? Consider this: More millionaires have made their fortunes using real estate as their primary investment over any other investment vehicles – including stocks and bonds.

With real estate, an average American with no college education can buy a house – often at less than 50 cents on the dollar – with little or none of his own money, get great tax breaks, and here’s the best part: have his tenant (or buyer) pay for it all!

Can you name any other investment that can match these benefits? No? So then why aren’t a lot more folks investing in real estate? Why do so many people choose to be realtors instead of investors – lord knows, investing pays a lot more!

The answer to these questions is best summed up by the excuse most would-be investors give: “I’d love to invest in real estate, but I don’t have the money, and the bank won’t loan me a dime.” Folks, this is one lame, stinkin’ excuse!

Rarely do Kim and I go to banks for our purchase funds. In fact, since 2005, we can count on three fingers the total number of loans we’ve gotten from banks to do our deals. So how are we paying for them? Read More→

I’m A Failure…Or Am I?

Posted on December 23, 2013 byLast month, I did a knocking-on-sellers’-doors challenge. To help folks better understand what real estate investing is really like, I posted my daily results on North Georgia REIA’s Facebook page – including pictures and many of the creative offers I structured!

For the month, I spent 9 days out getting face-to-face with sellers. In total, I talked to 30 sellers at the door, 27 invited me in, and I made 23 written offers – including a $1 million offer on a $125,000 house!

Yesterday, I spoke with an investor who followed me on Facebook. He said, “If I had been you, I would never have done a public challenge.” “Why not?” I asked. He answered, “Because you talked to all those sellers but didn’t find a single deal. Now everyone is gonna think you’re nothing more than a big, fat, ball-headed failure!” Read More→

The Profit Newsletter December 2013 Edition

Posted on November 26, 2013 by The December 2013 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on December 4th. You can download The Profit Newsletter as a High Quality PDF or Low Res PDF for slower devices. The Profit is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.

The December 2013 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on December 4th. You can download The Profit Newsletter as a High Quality PDF or Low Res PDF for slower devices. The Profit is the official newsletter of the Atlanta Real Estate Investors Alliance and is a digital, interactive newsletter for new and seasoned real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices with a PDF reader. Many of the articles and ads in The Profit contain many hyperlinks you can click or tap to visit websites, watch videos, listen to audios, download content, send emails, comment on articles, share socially and much more! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Also, be sure to Subscribe to The Profit Here so you don’t miss a single monthly issue.