Archive for The Profit

Time is on my Side: Hiring VA Professionals on Upwork

Posted on July 11, 2016 by“I like to talk to people. I’ve got one assistant, one Blackberry. That’s my overhead. I don’t text that much or email. I like to sit down face-to-face and have a conversation with you. I’m old-fashioned.” ~ Mark Wahlberg

As the owner and operator of my own business, I’ve become very self-reliant. I know that if I don’t take care of important tasks myself I will stress over them. It is hard to delegate work to others that you haven’t really had the time or know how to run background checks on. Even when you have carefully planned projects, sometimes it is difficult to find people with the qualifications you would prefer.

For the past few years now I have been discovering amazing talent online. I know it seems like a big risk, putting jobs online and hoping someone responsible answers your ad. Avoid the anxiety over in person interviews and researching qualifications, it’s time-consuming and I would rather focus my efforts elsewhere. It doesn’t mean I take hiring practices lightly, but I know where my strengths are.

There are many online freelance worker/client websites, but none other than Upwork. Upwork.com has been a great tool for my growing business. As I said, for many years I’ve been a one-man show. We all need a little help from time to time, and Upwork makes it simple and stress-free. Whether you need someone short term or long term, if there are short tasks you need to get done that you have no time for or if you want to build a working relationship with an independent contractor for the long haul, Upwork has this covered. For at least five years, the website has had some changes. It was once called oDesk, but the changes have been great improvements. Things have been simplified and there are safeguards in place for both contractors and clients. Plus you don’t need to be a large company to use this service. Businesses like Unilever, Pinterest, and NBC are just a few that use Upwork for hiring out virtual assistance specialists.

Read More→

The Master Lease Option Series – Part 5: Common Mistakes Using Master Lease Options

Posted on July 11, 2016 byI have made a ton of mistakes over the last 10 years of doing master lease options (MLO) deals. Would you like to avoid those mistakes? Well then read on!

-

A MLO Deal Is Not About You- One of the first and biggest mistakes I have made using MLOs is to think about what I want and not to give enough consideration to what the seller wants and what the property needs. Your first step in making a MLO offer is to decide if it is a fit for the seller and property. You need to find out if the seller even knows what a master lease options is. If not then you will need to spend a little time explaining it and how it will solve their immediate problems. If your offer does not solve a problem for the seller then it is likely just an offer that solves your problems. This is not likely to get accepted. Can you fix up the property using a MLO? Sometimes the answer is NO. Decide on the condition and area before you make a MLO offer. Some areas and some repairs cannot be dealt with no matter what type of offer the seller is willing to accept. You want to get good deals and solve problems not inherit someone else’s headache that can’t be fixed. Here is an acronym I use to remind myself of this process- S.P.Y. This stands for Seller, Property, You. This is the order in which you need to solve problems. Most people start a MLO offer with the reverse idea (Y.P.S.) and this doesn’t typically work. Read More→

Using Realtors To Find Leads For Your Real Estate Investing Business

Posted on July 11, 2016 byThere are several ways to use a Realtor to help you find good quality leads for your real estate investing business. If you have not already added a good Realtor or Realtors as a part of your real estate investing dream team, now would be a good time to do so. There are many types of leads your Realtor can generate for you so let’s discuss them one at a time.

The first service your Realtor should provide for you as a real estate investor is to e-mail you the expired listings on a regular basis. You will need to set up a way for your Realtor to be paid for providing these leads. One of the ways I provide payment to the Realtor I work with is to re-list some of these properties with the Realtor once I am ready to sell them. You see the Realtors I work with sees the “bigger picture” and you need to find someone willing to work with you on a long-term basis.

You need to take the time to find a Realtor who is very creative in the way they provide leads and sell properties for real estate investors, just as I have done in my own business. And you should be working with multiple Realtors in your business in order to find a variety of leads. Read More→

Securitization: A Refresher on The Biggest Fraud in American History

Posted on July 11, 2016 byI’ve been writing this column for several years now, and I’ve covered a lot of in-depth information about the securitization swindle pulled by the major banks that led to the mortgage crisis and the Great Recession. What I’m going to do this month is to take a step back and give a quick recap of what the securitized loans scam is and how the banks got away with it for so long.

First a little background. The way a bond is supposed to work is that an investor purchases a bond from a trust. The trust then uses this money to purchase mortgages or originate their own. The trust then uses the money made off of these mortgages to pay off the bonds to their investors.

In the case of Mortgage Backed Securities (bonds issued by trusts that consist solely of mortgages), the money the investor paid to purchase the bond was never given to the trust. Since the money wasn’t paid into the trust, it never had any money to purchase or originate ANY loans. Instead the bank essentially put the investor’s money into its checking account. A note was made that said the investor purchased a bond, but the trust never received the money and a bond was never issued. Read More→

Four Reasons Real Estate IRAs Might Be Right For You

Posted on July 11, 2016 byWhen you think about the acronym “IRA,” what do you think about? For most people, it’s a very common recipe: an IRA is something in which you put your mutual funds, your bonds, your stocks…and very little else. It’s the beaten path to retirement, and it works for a lot of people. But others wonder if there aren’t ways to supplement this type of investment and ensure a consistent level of income for your retirement years. These are the kinds of people who start to research Real Estate IRAs.

If that sounds too complicated for you, just remember: the IRS allows for lots of different types of investments through retirement accounts. A Real Estate IRA is simply a Self-Directed IRA in which you place a real estate investment. And considering just how common of an investment real estate is—especially for America’s seniors who want to ensure that they have consistent income for the future—then maybe it’s time that you consider real estate IRAs too.

Not convinced yet? Let’s take a look at some of the most common reasons people consider these IRAs: Read More→

Properly Analyzing Potential Property Purchases

Posted on July 11, 2016 byWhen I was going through a divorce I had no idea what to do. I was negotiating blind. I did not know what would be an equitable split. I had nowhere to look to find the answers either. The divorce attorney was not much help because they were more interested in keeping the chaos going rather than moving toward clarity. There were many variables including alimony, child support, the marital house, insurance coverage for the children, Custody rights, retirement benefits, the value on her business and mine, saving account, Christmas ornaments and the photos/ videos tapes of the family.

The way I was able to get a handle on the divorce was to set my priorities. What was most important to me? This has been covered before at the beginning of the year in the blog of setting goals. So I won’t go into it here. The next biggest thing was the evaluation of the assets. One thing that I could not put a value on was the relationship I have with my daughters.

Sounds like the same thing in real estate where there are many variables and there are a few things you cannot put a price on. So let’s make it simple to understand. Follow the money! That’s the difference between divorce and real estate. Divorce is more than the money. Real estate is about money and returns and providing service with value. If you disagree, then call me. I need to talk to you! Read More→

Rehab Execution Is Key

Posted on July 11, 2016 byReal estate investing is easy once you have an idea of what you are doing but there are many moving parts. The one gear that can make or break a real estate investment project is the execution of the renovation. You could have bought the property for the right price, this is where you make your money, but not properly executing a renovation can kill all the hard work done upfront.

Before I learned how to contract properties, wholesale and/or invest, I knew the cost of construction and materials. I was into DIY before it was mainstream. At first it was by force because my father had me helping him with projects around the house. Later in life it grew on me. It pains me still today to pay for items I know I can do myself but it no longer makes business sense for me to do those items. I remember a contractor trying to charge me above retail prices because I was young, well dressed and an investor. After I explained the process of the work he was being hired to do, the cost of the material and the time it will take, I asked for a realistic price. Not to my surprise I received an amazing price. I still do this today when contractors try to overcharge and it usually works. In fact, they respect me more for it. While you are not doing the work you want to know what goes into doing the renovation. How can you hire a contractor if you do not know what he is being hired to do? Also, do not judge a contractor only by a finished product but from start to finish. I have walked projects that looked great but once I “looked under the hood” I notice the craftsmanship was lacking. Read More→

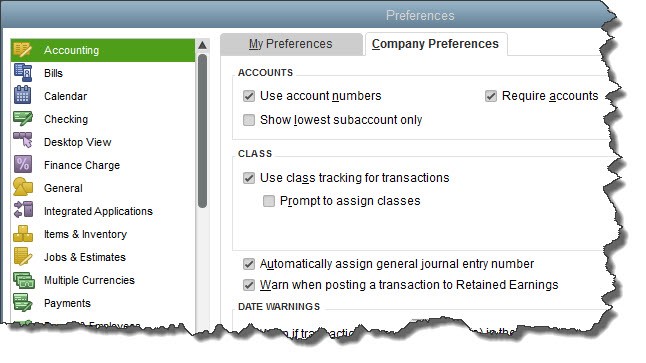

Make QuickBooks Your Own: Specify Your Preferences

Posted on July 11, 2016 byYour business is unique. Make sure that QuickBooks knows how you operate.

QuickBooks was designed to be used by millions of businesses. In fact, it’s possible to install it, answer a few questions about your company, and start working right away.

However, we strongly suggest you take the time to specify your Preferences. QuickBooks devotes a whole screen to this customization process. You can find it by opening the Edit menu and selecting Preferences.

Figure 1: The My Preferences window in QuickBooks’ Preferences

This is the screen you’ll see when you go to Edit | Preferences in QuickBooks. You can turn features off and on, and customize the software in numerous other ways. For Real Estate investing you should turn on the “Use Class tracking” AND “prompt to assign classes”. This will allow you to see each property with its own Income Statement. Read More→

Land and Lot Transactions Are More Complex

Posted on July 11, 2016 byLand and lots just sat on the market for years during the last economic down turn and now are a hot commodity on this hot market. What most people do not realize is that land is a much more complex transaction.

PROPERTY

How large is the property? Typically a lot is sold with an individual price for the entire parcel. Larger tracts are often sold at a price per acre times the number of acres. Properties in downtown areas with high density zoning are sold by the square foot, so a couple of inches will change the price.

ZONING

First, what is the highest and best use? Determine first whether the property in the city or in the county. If it is in city limits, go to the city’s zoning ordinances. If not, go to county zoning. Is it residential, commercial, or agricultural? What is the zoning on the property? Zoning is usually stated on tax records. Unfortunately, all the counties and cities in Georgia have their own zoning codes and what holds true about a zoning code in one area, is totally different in another. Generally speaking, in order of density: Read More→

The Profit Newsletter June 2016 Edition

Posted on June 6, 2016 by The June 2016 Edition of The Profit Newsletter is now available for download. There are 54 pages this month full of upcoming meetings, workshops, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The June 2016 Edition of The Profit Newsletter is now available for download. There are 54 pages this month full of upcoming meetings, workshops, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer.

Be sure to Subscribe to The Profit by Email or Subscribe to The Profit by Text so you don’t miss a single issue.

Saving Taxes Accelerates Wealth Growth

Posted on June 6, 2016 by If you take $1.00 and double it tax-free for 20 days it’s worth $1,048,576 (over a million dollars). Take that that same $1.00, taxed at 30%, it will be worth only about $40,640 — A LOSS of a MILLION DOLLARS! Why is this so? Because with tax-free compounding, earnings accumulate not only on the principal amount of money but also accumulate on the tax-free earnings as well. (“Earnings on Earnings”). Thus compounding combines earning power on principal and earning power on interest. Compounding has been called the ”8th wonder of the world”, a “miracle”. Compounding money at high rates of tax-free return is a definite advantage of real estate, especially with a great tax plan.

If you take $1.00 and double it tax-free for 20 days it’s worth $1,048,576 (over a million dollars). Take that that same $1.00, taxed at 30%, it will be worth only about $40,640 — A LOSS of a MILLION DOLLARS! Why is this so? Because with tax-free compounding, earnings accumulate not only on the principal amount of money but also accumulate on the tax-free earnings as well. (“Earnings on Earnings”). Thus compounding combines earning power on principal and earning power on interest. Compounding has been called the ”8th wonder of the world”, a “miracle”. Compounding money at high rates of tax-free return is a definite advantage of real estate, especially with a great tax plan.

The wealthy know that taxes are a primary factor in determining whether you get rich or stay poor. Let’s say, for example, you’re able to save just $2,000 annually on your tax bill. (With a good tax plan it will be much higher). You invest the $2,000 annually in an IRA which earns a tax-free annual return of 10%. After 20 years, you’ll have over $114,000! If you can save $10,000 annually on your tax bill and invest it in a Simple IRA for 20 years, you’ll end up with almost $573,000! Read More→

Conquering the Fear of Investing

Posted on June 6, 2016 byPerhaps you’re a new real estate investor who has thought about using real estate comps to dive into real estate investing but have been hesitant due to a feeling that the market will collapse once you get in and you will lose all your money. Well rest assured; you are not alone.

Fear touches every new investor; and no one successfully investing in real estate today would tell you otherwise. So let’s address some of the most common fears and see whether we can help calm you and urge you to take the plunge into real estate investing.

Having to feed a property won’t cut it; no investor wants to feed a rental property. Believe it or not, this fear might be the easiest to manage because it’s straightforward: simply run the numbers before you buy, using real estate comps makes this a breeze. Obtain the property’s last twelve months income and operating expenses, calculate a mortgage payment, and plug the results into a spreadsheet or real estate investment software program to determine cash flow. If the cash flow is negative, weigh the deal and decide. If the numbers work then, move forward. Read More→