Atlanta Real Estate Investors Alliance Blog

How QuickBooks Helps You Accelerate Receivables

Posted on September 16, 2015 byGetting paid by your tenants in a timely fashion is one of the biggest challenges of being a landlord. QuickBooks can help in several ways.

You’re meeting your business goals. Making sure that every property that has a tenant has been invoiced in QuickBooks. (You invoice in QuickBooks so you can track the timely payments made by the tenants.) You take advantage of vendor discounts. Basically, doing everything in your power to keep cash flow humming.

But you can’t control how quickly your tenants pay you.

You can, though, use QuickBooks’ tools to:

- Make it easier for tenants to remit their payments,

- Remind tenants about unpaid balances, and

- Keep a close eye on unpaid invoices.

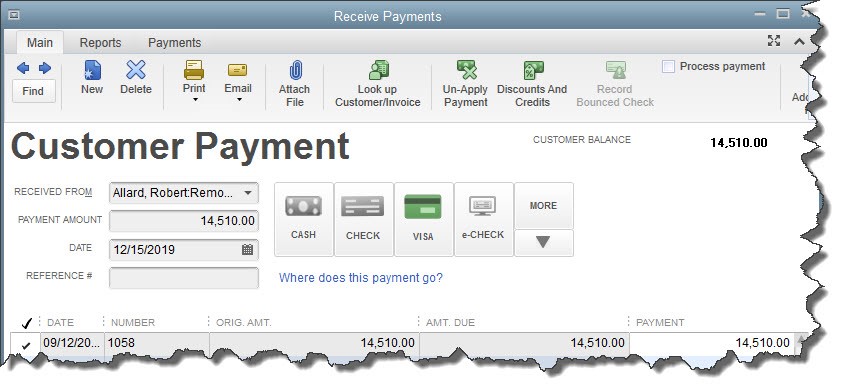

Figure 1: QuickBooks lets you accept payments from tenants in multiple forms. Accepting credit cards and e-checks is likely to speed up your receivables.

The Decision

Posted on September 16, 2015 byIt was March 12th, 1982, when I had a decision to make, and it didn’t seem like a very big one. You see, there was a seminar coming to town called “How to Buy Real Estate with No Money Down,” and it caught my attention because I certainly had none and didn’t want to continue doing what I had been doing for most of my life. I believe I saw the commercial on television, and after about the third time it aired I got to thinking about it and said, “Well, gosh, what have I got to lose. I know it’s a scam, I know they’re full of crap, but I might as well go down and check it out. Maybe there is something there, maybe I can find a way to get out of this mechanic job and make a little money for a change that lasts more than 15 minutes.”

Now, this was not an easy decision because I was going to miss my favorite television show “Dallas” with J.R. Ewing. For me to miss J.R. in order to go to the seminar was a big, big deal. We laugh about it now, but it wasn’t so funny back then because J.R. was the guy that gave me hope. He’s the first exposure I had to see what it was like to be very rich. I couldn’t really see myself as J.R. at that time, but I certainly wanted to be like him. I’m not sure I wanted to be as mean as he was. Of course, some people will say I am. I certainly wanted to have his money and his power. Read More→

Lender Denies Short Sale But Still Gets Paid

Posted on September 16, 2015 byNegotiating is a vital part of your business when it comes to cashing in big on short sales. It is always important to know who the investor is on the loan, and I’m not referring to who is servicing the loan and collecting the Sellers payments. There is an investor behind the scenes. Also, find out the type of loan, ie: private, conventional, FHA, Fannie Mae or Freddie Mac and whether there is private mortgage insurance (PMI) or mortgage insurance (MI) on the loan. Knowing all these facts allow you to negotiate based on the percent of value each one of the Investors and/or Private Mortgage Insurance Companies on the Loan will accept on a short sale.

I found this new information to be very interesting and should not be taken lightly when negotiating on a short sale. Many Sellers are behind on their monthly payments which include principal, interest, taxes and hazard insurance. When the Sellers make their payments, the taxes and insurance monthly payment is placed into an escrow account to pay the taxes and hazard insurance when they become due. When there is not enough money in the Sellers escrow account to pay taxes, the Lender will pay them. However, when there is not enough money in the Sellers escrow account to pay the hazard insurance policy, the Lender still pays it, but it becomes Mortgage Forced Insurance. This is in place only for the protection of the Lender, not the Sellers, and normally costs 2 to 3 times more than normal Hazard Insurance. Read More→

Different Ways To Generate Substantial Income For Your Portfolio With Assets Other Than Real Estate – Part One

Posted on September 16, 2015 byRecently I was having a discussion with a friend of mine discussing some of the different ways to create wealth not only from real estate but other forms of investing that can give huge returns. We talked about the usual ways of making money buying real estate and we also talked about other ways of creating income without having to do any physical work for the money. Of course when you are a real estate investor your first thought is usually either about, buying foreclosure properties, wholesaling properties, fixing and selling houses at retail prices, and also buying long term income properties.

One subject I have never talked about before that I think is an important part of every real estate investors portfolio of investing opportunities is to also own paper assets for income. From this point forward we will refer to paper assets simply as “Paper”. So what are paper assets? Paper assets come in many different forms. Some different paper assets come in the form of property tax certificates, land contract paper, contract for deed paper and promissory notes secured by a mortgage or a deed of trust paper. It is my belief that every real estate investor should be diversified and have several different income streams to help them build the wealth they desire. Read More→

Are You Accountable?

Posted on September 16, 2015 byHave you been in real estate for 6 months, or have you really been in real estate for 1 month? Because if you’re really in real estate, you’ve made a deal by now, maybe several.

Here’s the truth: If you’re not making offers, if you’re not making deals, you’re not in real estate…yet.

Are you making the mistake of preparing and then doing nothing? Listen, if you’re prepared, then you have the education. You’ve paid a lot of money to take courses, you’ve read the books, and you’ve watched the videos. You understand that buying real estate is not rocket science. You understand that making an offer is not difficult. You have a power team: a contractor, an attorney, a survey company, and a real estate agent.

But you just don’t seem to be able to get one deal done.

What will it take for you to make a deal?

How can you overcome this fear and lethargy? Read More→

Is It A Rental Or Flip?

Posted on September 16, 2015 byOver the years investors have always wanted to know which way they should go. Buy a house cheap, fix it up and rent it out. Over time collect the cash flow, keep some and use a portion to pay the house off. It’s the oldest and truest way to build wealth and a secure retirement.

Then there are those who are seriously focused on making some money now. They either want to “Wholesale” a house doing nothing to it all or the alternative option may be to acquire, renovate and sell for a really good profit and do it again. This method doesn’t build wealth but you can make some potential steady income.

Truly good real estate investors know the valuation of their deals is key to insuring success and protecting projected profits. To effectively determine if a deal is a rental building wealth or flip to make some much needed cash, you have to analyze a deal fully. All the market areas covered by REIAComps.com, insure you easily know which way an investor should go. Read More→

Winning The Fight Against Time

Posted on September 16, 2015 byIf you are blessed and fortunate enough to have lived on this planet for a while, there eventually comes a time when you start to notice the same thing that countless ancestors of ours have noticed over the eons… The undeniable fact that, sorry! You’re getting old.

The first signs of this sad truth probably reveal themselves to you in a very subtle fashion… An extra ache when you wake up in the morning; Recuperating from injuries takes longer than it used to; Or it could be a grey hair or an extra wrinkle in your smile. As my (older) brother always likes to tell me, “getting old is not for the faint of heart.”

Such subtle signs are a painful reminder of our own mortality. They can either make you sad or remind you that you may only have a certain amount of time left on this spinning blue rock we call home.

If you like movies, you know you’re getting old when the actors you grew up watching & admiring start showing their age… or die. (Even though Tom Cruise & Keanu Reeves are immortal. They never age!) Read More→

Ready for Change?

Posted on September 16, 2015 byAs a real estate investor you must always adjust to new market trends, rules and regulations. Recently, as any good investor should know, the industry has been having to make some changes due to the TILA-RESPA Integrated Disclosure rule. These changes have and will continue to affect any person closing a property involving an owner occupant loan.

Investors that renovate properties to sell will need to add at least an extra month or two of carrying costs. Why? Well, while not going into too much detail, all HUDs will need to be approved by the buyer and underwriter at least 3 days before closing. In reality, this will mean that the delay may be as many as 6 days because we all know how long underwriting can take. Some investors may not know this, because it is normally not enforced, but currently buyers are supposed to receive a HUD 2 days prior to closing. However, the norm for most closings is having a HUD prepared the day or evening before or the morning of the closing. I have even witnessed some buyers and sellers not receive a HUD until minutes before closing. This way of doing business will soon be gone and I for one like this part of the change. Originally the changes were to be enforced in August but the enforcement date was changed to October 3rd. Therefore, make sure your lenders and title companies are ready for these changes and do not delay your closing any more than needed. Read More→

Working with Superstar Realtors at Atlanta Wholesalers Group

Posted on September 15, 2015 bywith Frank Iglesias

September 15th, 7PM, Hudson Grille

6317 Roswell Rd, Sandy Springs, GA

Atlanta REIA Members & Guests, Please RSVP on Meetup.com

You know you need them…Realtors. Despite what any you’ve read anywhere, whether online or offline, you must know how to work with Realtors. They are a key part to your success so getting this one right can mean the difference in big paychecks or none at all.

You know you need them…Realtors. Despite what any you’ve read anywhere, whether online or offline, you must know how to work with Realtors. They are a key part to your success so getting this one right can mean the difference in big paychecks or none at all.

Realtors come across wholesalers quite often in many of our markets. While this works well in some scenarios, far too often the experience is one that the Realtors do not speak highly of. And I am not referring to the Realtors who are ignorant wholesaling!

I am referring to the ones that do ‘get it’. And I assure you they are out there.

This month, we will be joined by two Superstar Realtors that have extensive experience working with investors. Because Atlanta is like two large markets in one, we will have one who specializes in in-town properties near downtown Atlanta and another that specializes in the suburbs.

You want to be here as you will find out that some Realtors know more than you may have given them credit for…A LOT more in this case.

Learn what is going on through their minds when you approach them with when you ask for their general help, or your offers or if you are looking for one for a specific deal.

This one you cannot afford to get wrong. An effective wholesaler knows how to leverage Realtors to their advantage and create win-win relationships that benefit all parties not just once but repeatedly!

Proximity is power so come join us as you get to meet two of the best agents out there for working with investors in the city!

Bring your best energy, your deals and let’s do some business on the spot. See you then.

My name is Frank Iglesias. Come join us on Tuesday, September 15th at 7PM at the Hudson Grille located at 6317 Roswell Rd in Sandy Springs as we network, do what is now our standard deal analysis at every meeting and then we will dive into our topic for the evening!

Atlanta REIA Members & Guests, Please RSVP on Meetup.com

This Atlanta Wholesalers group is primarily for wholesalers who are serious about the business and not just “trying” Real Estate out. Frank started this group to work with other wholesalers who are serious about building their business using the utmost of honesty and integrity. We are looking forward to exploring how we can grow together in our local market. We hope you will join us!

This Atlanta Wholesalers group is primarily for wholesalers who are serious about the business and not just “trying” Real Estate out. Frank started this group to work with other wholesalers who are serious about building their business using the utmost of honesty and integrity. We are looking forward to exploring how we can grow together in our local market. We hope you will join us!

Learn All About Rock’s Real Estate Investor Tools at AIM

Posted on September 8, 2015 byWhat to Use & How to Use Them

with Rateb “Rock” Shukoor

Sept 9th, 7:00PM, Hudson Grille, Sandy Springs, GA

Atlanta REIA Members Please RSVP on Meetup.com

Our next All Inclusive Marketing (AIM) Group Meeting is Wednesday, September 9th at 7:00PM at the Hudson Grille located at 6317 Roswell Rd in Sandy Springs.

Our next All Inclusive Marketing (AIM) Group Meeting is Wednesday, September 9th at 7:00PM at the Hudson Grille located at 6317 Roswell Rd in Sandy Springs.

Let me ask you a couple of questions:

- Do you know what tools to use to get all the leads you want?

- Do you know what tools to use to sell all the deals you have?

- Do you have enough time to do everything in this business and still have a lot of time to enjoy life?

- Are you able to find enough deals to have a sustainable flow of leads, and buyers to have a successful real estate business?

If the answer is NO to any of the questions above, then this meeting is for you.

If the answer is yes, and you want to increase the number of deals you do or just improve the quality of your life, then this meeting is for you, too.

I will be sharing with you

- All the tools of the trade

- What tools to use to find tons of leads

- What to use to sell all your deals

- How to reach thousands of people within minutes

- All the small, but vital details of each tool

- How to set up each of the tools I will teach you about

- Where to get the tools from

- How to automate your marketing and your business using these tools

- And much more

Marketing has been one of my strengths and I am very proud of the results I have produced over the years from most of my marketing campaigns. I will share all the tools I have used and am currently using to run all of my marketing and most of my business on autopilot.

We will meet on Wednesday September 9th at the Hudson Grille, at 7PM. Get there early at 6:30 to order your food and drink.

On September 9th, I will show you what tools are necessary to have which can help you with:

- Email marketing

- Call blasting

- Direct mail marketing

- Text blasting

- Social media marketing

- Posting ads on websites

- Placing classified ads

- And much, much more!

EARLY BIRD BONUS: I believe in rewarding action takers and entrepreneurs that are willing to do what it takes in order to change their lives or have the desire to get better at what they are already doing. Therefore, I will offer some bonuses. As a special bonus this month for all “early birds,” I am offering the following:

- A digital copy of my book, “Extraordinary Results by Ordinary Investors”

- A trip for 2

- Marketing audit of your business or consulting, $250 value

- The first 2 attendees will get a copy of Bill Glazer’s “Outrageous Advertising That is Outrageously Successful”

This is a must attend event! We will meet at our usual location at the Hudson Grille at 7:00PM and be there until 9:00PM and then hang out and have our Late Nite Networking. I look forward to seeing you at the meeting!

Atlanta REIA Members Please RSVP on Meetup.com

*Please Note: AIM Meeting agenda is subject to change.

After the conclusion of our All Inclusive Marketing Meeting, we will be hanging out at the Hudson Grille for “Late Nite Networking” to socialize and build stronger bonds. So come and join us for the AIM Meeting and be prepared to stay late and network and have fun with like minded real estate investors, marketers and other professionals late into the evening!

After the conclusion of our All Inclusive Marketing Meeting, we will be hanging out at the Hudson Grille for “Late Nite Networking” to socialize and build stronger bonds. So come and join us for the AIM Meeting and be prepared to stay late and network and have fun with like minded real estate investors, marketers and other professionals late into the evening!

The Atlanta REIA All Inclusive Marketing (AIM) Group (formerly known as the “I Love Marketing” group) is a networking and educational meeting led by Rock Shukoor for like-minded real estate investors and small business owners who enjoy marketing and are interested in taking their business to the next level through creative marketing techniques.

The Atlanta REIA All Inclusive Marketing (AIM) Group (formerly known as the “I Love Marketing” group) is a networking and educational meeting led by Rock Shukoor for like-minded real estate investors and small business owners who enjoy marketing and are interested in taking their business to the next level through creative marketing techniques.

AIM is for people who want to get together, learn and discuss marketing challenges, strategies and opportunities. Although many of the examples we cover at the meetings will be geared towards real estate investors, the techniques and strategies learned can easily be applied to any business. AIM now meets on a new date on the 2nd Wednesday of each month at 7:00PM at the Hudson Grille located at 6317 Roswell Rd in Sandy Springs.

Learn All About Home Inspections and How They Can Save You Money

Posted on August 31, 2015 bywith Special Guest, Rick Harris

September 1st, 6:30PM, Golden Corral, Cumming, GA

We are excited to announce that ASHI certified home inspector, Rick Harris, will be our special guest speaker this month at the Mountain REIA monthly meeting. The meeting will be held on Tuesday, September 1st at 6:30PM at the Golden Corral located at 2025 Market Place Blvd, Cumming, GA. Rick will be teaching us all about home inspections and why they are such a critical part of your real estate investing business.

We are excited to announce that ASHI certified home inspector, Rick Harris, will be our special guest speaker this month at the Mountain REIA monthly meeting. The meeting will be held on Tuesday, September 1st at 6:30PM at the Golden Corral located at 2025 Market Place Blvd, Cumming, GA. Rick will be teaching us all about home inspections and why they are such a critical part of your real estate investing business.

Whenever you are buying a new home either as a rental or to rehab, you will definitely want to have that house examined by a certified home inspector. A home inspector can save you from so many headaches by bringing to light potential problems that you may not have been able to see just by walking through the property. They can also save you a lot of money by helping you more accurately figure your rehab costs prior to purchase so that you can buy smart, and earn a large profit. You could potentially only estimate a $10,000 rehab, but a thorough home inspection may find an additional $15,000 in other repairs you didn’t see during your walk though. That additional $15,000 in repairs will come straight out of your pocket if you don’t factor it in before you make your offer.

You definitely do not want to miss this meeting and learn directly from a certified home inspector what he looks for in houses and how he can save you a lot of money on the front end, before you buy your next investment property. There will be a lot of learning and great networking. Make sure to bring your business cards and deals to discuss.

We look forward to seeing you at the meeting!

Atlanta REIA Members & Guests, Please RSVP on Meetup.com

Non-Members can also attend at No Charge

Mountain REIA is a new real estate investors association being formed by Gordon Catts that meets on the 1st Tuesday of the month at 6:30PM at the Golden Corral located at 2025 Market Place Blvd in Cumming, Georgia. This group is an educational and networking group that brings in local, active investors and to provide information and education in a low or no-sales environment. This group is open to everyone, so please come join local real estate investors to network, share information, and interact with local and regional experts. Please be prepared to patron the restaurant, enjoy the networking, and the outstanding information!

Mountain REIA is a new real estate investors association being formed by Gordon Catts that meets on the 1st Tuesday of the month at 6:30PM at the Golden Corral located at 2025 Market Place Blvd in Cumming, Georgia. This group is an educational and networking group that brings in local, active investors and to provide information and education in a low or no-sales environment. This group is open to everyone, so please come join local real estate investors to network, share information, and interact with local and regional experts. Please be prepared to patron the restaurant, enjoy the networking, and the outstanding information!

Learn How To Build a Multifamily Real Estate Business on September 2, 2015

Posted on August 28, 2015 bywith Special Guest Speaker, Bill Ham

September 2nd, 6PM, Club E Atlanta

3707 Main Street, College Park, GA

Atlanta REIA Members and Guests Please RSVP on Meetup.com

We are excited to announce that this month at the Atlanta REIA South / Multi-Family Commercial Investing Group monthly meeting, our special guest speaker will be expert real estate investor, Bill Ham. The meeting will be held on Wednesday, September 2nd at 6PM at Club E Atlanta located at 3707 Main Street in College Park, GA. At the meeting, Bill will be teaching us about the business side of multifamily real estate investing and how to set up a business model to make you a lot of money.

We are excited to announce that this month at the Atlanta REIA South / Multi-Family Commercial Investing Group monthly meeting, our special guest speaker will be expert real estate investor, Bill Ham. The meeting will be held on Wednesday, September 2nd at 6PM at Club E Atlanta located at 3707 Main Street in College Park, GA. At the meeting, Bill will be teaching us about the business side of multifamily real estate investing and how to set up a business model to make you a lot of money.

Setting up a new business model can be a bit scary and intimidating, especially when it comes to venturing into multifamily properties. Truth be told, it all boils down to working with bigger numbers. Bill is going to teach you all about the systems he uses and processes he has set up in his own multifamily real estate investing business. He will cover how to get things set up so you can get started the right way with the proper systems in place. He will also show you how to run the day to day operations of the business model he will be showing you. At the end of this meeting, you will be much less intimidated about the idea of starting your multifamily real estate investing business because you will have the knowledge and the tools available to you to set yourself up for success.

Bill Ham has been investing in multifamily real estate for over 10 years. He has created a portfolio of nearly 400 units in Macon, GA. His entire real estate investing portfolio was created using creative and seller financing methods. Bill definitely knows what it takes to run a successful multifamily real estate investing business. Do not miss this opportunity to learn from the best and get your own portfolio started the right way to help ensure your success!

Atlanta REIA Members and Guests Please RSVP on Meetup.com

The Atlanta REIA South monthly meeting, led by Reggie Jackson and Gordon Catts, is held on the 1st Wednesday of each month at 6PM at Club E Atlanta located at 3707 Main Street, College Park, GA.

The Multi Family Investing Focus Group Meeting, led by Carla Gamper and Gordon Catts has NEW Date, Time and Meeting location. The group will be meeting on the 1st Wednesday of each month at 6PM at Club E Atlanta located at 3707 Main Street, College Park, GA.

There is currently a $15 cover charge for everyone who attends the meeting which is payable at the door and includes a light meal. Get there at 6:00PM to eat and network before the meeting begins. There will be lots of learning and lots of networking. Make sure to bring your deals and your haves, wants, and needs to the meeting. See you there!