Archive for January 2015

Do You Have Big But Disease?

Posted on January 4, 2016 byThe thing that kills most real estate investors – heck, the thing that prevents 95% of folks from reaching anywhere close to their full potential as human beings – is the dreaded Big But Disease!

It goes something like this: I want to start my own business, but… I want to do more for my church, but… I want to own 20 free-and-clear rental properties, but… I want to get in shape, but… I want to improve my marriage, but… I want to spend more quality time with my kids, but…

That stinky Big But Disease will squash your dreams, murder your goals, and destroy the person you were born to be!

Starting today, what if you replaced saying “but…” with saying “I’ll do whatever it takes to get this thing done!”

So instead of saying, “I want to run a marathon, but…” you’d say, “I want to run a marathon, and I’ll do whatever it takes to get this thing done!” With this attitude how much more would you accomplish in your lifetime? Read More→

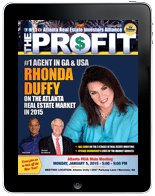

The Profit Newsletter January 2015 Edition

Posted on January 2, 2015 by The January 2015 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on January 5th. The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Be sure to Subscribe to The Profit Here so you don’t miss a single issue.

The January 2015 Edition of The Profit Newsletter is available for download just in time for our Atlanta REIA Main Meeting on January 5th. The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer. Be sure to Subscribe to The Profit Here so you don’t miss a single issue.

“Impossible” is a Human Invention

Posted on January 1, 2015 byRobert Schuller came up with a great quote in 1973: What would you attempt to do if you knew you could not fail?

As 2015 begins, after finding yourself a quiet place to write down your goals, place Mr. Schuller’s quote in front of you. Next, with each goal you put to paper ask yourself: If failure is impossible, is this still a worthy goal for me to pursue?

At the beginning of each January, many of us make goals – they’re called New Year’s resolutions. This flood of goal setting is evident by the huge increase in the number of folks in the gym, and also by the number of people reading self-help books.

Sadly, by February, we’re back to seeing just the regulars working out – with the exception of two or three new people who’ve gutted out the pain and continue coming to the gym. As for the self-help books, most lay half read on shelves gathering dust…never to be opened again. Read More→

Your Latte or Your Life

Posted on January 1, 2015 byPeople who want to invest often tell me the same thing: they are not reaching their goals because they think they do not have enough money.

Does this sound like you? Did you notice that I used the word “think” above? This is because if you are one of those people who think you have no money, I am going to open the door that you do.

I want to tell you this: You have much more money than you think you have. You must focus on possibility rather than on lack.

Don’t get me wrong. I understand that when I have $100,000 sitting in the bank, I feel much more powerful and less stressed about my bills. When I get down to $10,000 in my savings account, I feel a little bit of nervous pressure too.

But I know that I have two choices about my reaction to this stress: I can give up, or I can use it as motivation. Personally, I use it to fuel my drive to make deals, tackle the marketing, build relationships, and make money. Read More→

Keeping It Oh So Simple

Posted on January 1, 2015 by“Email, instant messaging, and cell phones give us fabulous communication ability, but . . . that communication is totally disorganized.” ~ Marilyn vos Savant

A couple months ago when I was getting coffee, I watched a guy – I’ll call him Otis – talking on the phone to his bank about a mortgage application. The bank wanted documents that he had already sent in twice. Boy, was that conversation painful to watch! Otis kept fiddling with his phone, signing in and out of different accounts and trying to find the emails and records he had sent to the bank. He was doing three things at once on his phone, and none of it was going well. It was clear he was getting frustrated, and with all that juggling he hung up on the bank manager three times. I’m pretty sure I saw smoke start to come out of his ears. The bank manager probably wasn’t having much fun, either.

Ah, technology!

In the olden days – you know, when your phone came in two heavy pieces and you had to plug it into the wall before it would work – using a telephone was a pretty simple matter. You dialed the number. It rang. Someone answered. You talked. Easy! And keeping track of appointments and contacts was easy, too. You just needed a pen, a calendar, and an address book. It wasn’t rocket science. The hardest part was keeping it from getting too messy to read.

Things sure have changed. Read More→

What’s Wrong With Work?

Posted on January 1, 2015 byWhen I want to play, I play. When I go to Alaska, I don’t work; I go there to kill stuff, and I make darn-sure before the day is over that something dies out there– every single day. I’ve never been on a trip to the resort in all these years where I didn’t fish every single day I was there. I enjoy that. I go fishing every chance I get. When I’m out there, I might be thinking a little bit about work, but I’m thinking more about fishing. When I dive, I dive, and that’s the way entrepreneurs are. Nobody is going to take that away from you, nor should they try, nor should you let them. We’re constantly on the job, and there’s absolutely nothing wrong with it.

I go on cruises, too. Yes, when I go on cruises, I’m working. Every once in a while, Beverly, my wife, talks me into going on a cruise where we don’t work, and I must confess it’s the most boring cruise I take.

Even then, I take something to write. I could not possibly stand to put in the time it takes to go on a cruise without getting something productive done. I’d rather have a root canal on both sides, simultaneously, with no anesthetic, than to go on a cruise and spend all that time just killing time. Entrepreneurs can’t stand to just kill time. At least smart entrepreneurs. I was raised on the beach, but I can’t fathom somebody coming down and throwing a blanket on the beach and laying there all day, with no clothes on, in the sun, getting fried, without absolutely nothing going on but sweat. I don’t get this. I never could get this. It just seems like a waste of time! They call that relaxation, but not to me. I gotta work! Read More→

Techniques To Find Motivated Buyers For Your Real Estate Investing Business

Posted on January 1, 2015 byThere are so many easy ways to find motivated buyers for your real estate investing business, no matter what your current market is doing. I have several favorite methods for locating buyers for my properties which I would like to share with you.

The first technique I would suggest is using wholesale buyers for those properties you want to sell quickly. Finding wholesale buyers for your real estate investing business is fairly easy. You can either run a simple ad in the newspaper or on Craigslist advertising properties for sale on a wholesale basis to draw wholesale buyers or you can find wholesale buyers at your local real estate club.

I also suggest finding wholesale buyers through local realtors, especially those who deal with bank REOs or foreclosure properties. Wholesale buyers are always interested in finding properties to grow their real estate investing business and wholesaling properties is a good way for a real estate investor to get cash coming in immediately. Another simple way to find wholesale buyers is to simply call on the signs by the side of the road that say “We Buy Houses”. Read More→

The Real Estate “Dance” – Part 1

Posted on January 1, 2015 byDancing… and Real Estate? What gives?

Good question! Let me explain…

I don’t know if you knew this, but before I started investing in real estate, I was a professional Ballroom & Latin Dance Instructor/Competitor of 14 years!

Although it might not seem like these two careers have much in common, I actually began to realize just how similar these apparently different disciplines really are during my early days as an investor.

For example, I remember this one time when I was talking with a seller of an ugly house and trying to get her bottom price.

I asked her the notorious question, “Janice, if I paid you all cash & closed quickly, what’s the least you could accept for your house?”

“Well, what could you offer me?” She replied.

“That all depends. What’s the least you could take?” I shot back.

“I really don’t know. Why don’t you just make me an offer?”

Do you recognize that dance? It’s the “Scared Swing!” The “Cheap Chicken Cha-Cha!” Read More→

It’s Time to Start Thinking About Your Financial Goals and Needs for the New Year

Posted on January 1, 2015 byI’m very excited about the New Year and all of the possibilities I believe real estate investors will have the opportunity to take advantage of in 2015. Every New Year I sit down and write out my goals and needs for the coming year on my yellow pad. Once I have my goals written down for the year I then write a contract with myself setting forth what I promise myself and my family I will do this year to achieve my goals. For years I used to do a New Year’s resolution and I found that by the third week of the New Year my resolutions were already forgotten and I was just going through my days as I had always done in the past, sometime productive, sometimes not productive.

I don’t know about you, but when I give my word to someone in my mind I have just made a contract with that person. When I give my word, I will do whatever I can possibly do to keep my word to the other person. I want the other person to feel confident whatever I tell them they can believe in. I feel the same way about signing a contract. As with giving my word to someone, signing a contract to me is a very significant obligation I don’t take lightly whether to someone else or to myself. I started writing a contract with myself 20 plus years ago as what I promise myself I will do in the coming year. Some year’s life got in the way and I wasn’t able to fulfill my promises to myself even though I tried my best. Other year’s just because of the fact that I had the contract I could review every couple of months kept me on track to achieve what I had planned to do that year. Read More→

Year-End Blow Out For Short Sales!

Posted on January 1, 2015 byExperienced Negotiators, you and I, know that December is time to help the banks clear their books. Since many of the Bank Negotiators get bonuses, they want to see as many short sales close as possible in December.

Recently, we fought on several deals wherein the Banks kept asking for higher counter offers. Holding off until the beginning of December can put more money into your pocket. In Florida, the Banks pay all property taxes at the end of November, just before the due date, so they don’t get penalized. After that date, when you make offers, the taxes are paid and the Bank’s net has increased versus what they would have received in the month of November when taxes were not yet paid. Recently, we were fighting with a lender over $2,000 on the purchase price because the bank wanted a specific net. You might say ‘that is not much,’ but once the taxes were paid, the bank’s net was higher. Remember, that once the taxes are paid, they are no longer on the HUD as a deduction to the banks net, so by default the bank’s net increases. Did the bank still pay them either way? Absolutely, but that doesn’t affect us. The investor’s offer no longer needed to be increased to reach the bank’s net and that’s all we needed. The investor’s offer was now right in line with their value to receive short sale approval. Read More→

What Comes First – “Finding the Deal” or “Finding the Buyer”?

Posted on January 1, 2015 byWhen it comes to Wholesaling properties, I see the question asked frequently: “Where should I start? Marketing for Motivated Sellers? Or Marketing for Cash Buyers?”

We are somewhat biased when it comes to this subject, because in most of the materials we went through when we were first getting started out all said to start with Marketing for Motivated Sellers. The theory is that if you find a Hot Deal, meaning a property under contract that is WAY below market value, if you have that then the Cash Buyers will find you. So just get out there and go find a Hot Deal and the Cash Buyers will come to you. On a side note, same principle applies when it comes to finding Private Money. If you find the Hot Deal, the Money will find you. Not, go find a Private Lender then go look for a Hot Deal. I always like to have the Ace up my sleeve – when you have the Hot Deal, you have control.

I am somewhat intrigued by the theory of building your Cash Buyers List first though. The theory with that one is that if you go out and build a big buyers list, then you can just wholesale other Wholesalers deals. So you have lined up “Buyer Bob” and he wants to spend $100K this week on some cheapo rental houses, but you have nothing under contract. You don’t tell him you have nothing, you say “let me check with my people”, then you call your Wholesaler buddies and see if you can Joint Venture on some deals that they have under contract and split the profits. I can see this as a viable strategy. Read More→

Flippers Earning Record Profits

Posted on January 1, 2015 byThe market’s never been better for house-flippers. That’s the word from a recent report from real estate data and information clearinghouse Realty Trac.

Flippers accounted for 26,947 home sales in the 3rd quarter of 2014. That represents roughly 4 percent of all single-family home sales in the U.S., according to Realty Trace – a five-year low and close to the long-term average historic levels. Those figures are down somewhat from 4.6 percent in the preceding quarter, and even more from the 5.6 percent of single family residential home sales accounted for by fix-and-flippers in the year-ago period, according to the Realty Trace U.S. Home Flipping Report.

So flippers represent a somewhat smaller percentage of the market than they used to. But they’re getting their prices: The average fix-and-flip deal averaged a gross profit of nearly $76,000 per home. That’s the highest average profit per flip in history.

Breaking the numbers down a bit further: Read More→