Archive for Articles

The Profit Newsletter March 2018 Edition

Posted on March 12, 2018 by The March 2018 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 54 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The March 2018 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 54 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer.

Be sure to Subscribe to The Profit by Email or Subscribe to The Profit by Text so you don’t miss a single issue.

Meet a Few Millennials Having Great Success in Real Estate Investing at West Meeting on February 26, 2018

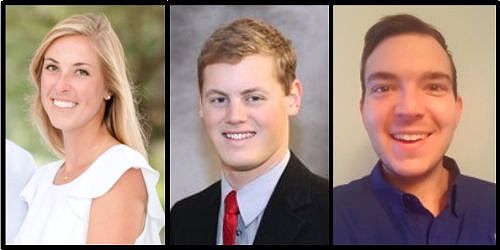

Posted on February 13, 2018 bywith Dorsie Boddiford, Matthew Fasnacht & Brandon Comer

Monday, February 26th @ 6:30PM,

Cherokee Cattle Company,

2710 Canton Rd, Marietta, GA

No Charge for Atlanta REIA Members, Guests $10 at the Door.

Millennials have been getting a bad rap lately. They don’t know what life was like before the advent of the internet. In addition, the educational system that they, as well as Gen X’ers and Baby Boomers have been subjected to is a training ground for a lifetime of employment and being average. Not a lot of room for “Shining Your Light” and independent thought.

There are some millennials that have “Seen The Light” and have turned toward investments in themselves, their business and entrepreneurship focused in real estate investing.

Come join us on Monday, Febraury 26th at 6:30PM at the Cherokee Cattle Company, 2710 Canton Rd, in near Marietta and hear the stories, answer audience questions, tell you some of their secrets and insights, let them motivate and inspire you into action.

Join us and you will learn…

- How they got started, what they do and where they are now

- What motivates them

- What is their best accomplishment

- What do they see as the future of real estate investing

- Answers to your questions and much more!

Dorsie Boddiford is a 28 year old, full-time real estate investor. She has built a business out of flipping houses while striving towards financial freedom with investments. Her deals include purchases at foreclosure auctions and tax deed sales, negotiations for owner-financing, deals through door knocking and mail outs, as well as deals with other investors through wrap mortgages, hard money loans, and equity participation.

Dorsie Boddiford is a 28 year old, full-time real estate investor. She has built a business out of flipping houses while striving towards financial freedom with investments. Her deals include purchases at foreclosure auctions and tax deed sales, negotiations for owner-financing, deals through door knocking and mail outs, as well as deals with other investors through wrap mortgages, hard money loans, and equity participation.

Matthew Fasnacht, is a full-time real estate investor in the metro-Atlanta market working with his family. Their businesses buy, sell retail, rehab, rent, wholesale, consult, and develop residential property primarily. They also have experience in manufactured homes and private lending. Matthew has worked previously in loan origination and processing commercial, residential, and business loans after earning a BBA in Finance from the University of Georgia in 2015 which has further enabled him to build a successful rental portfolio by leveraging assets to increase cash flow with little money out of pocket. Matthew often focuses on creative deal structuring for acquiring property instead of using his own funds.

Matthew Fasnacht, is a full-time real estate investor in the metro-Atlanta market working with his family. Their businesses buy, sell retail, rehab, rent, wholesale, consult, and develop residential property primarily. They also have experience in manufactured homes and private lending. Matthew has worked previously in loan origination and processing commercial, residential, and business loans after earning a BBA in Finance from the University of Georgia in 2015 which has further enabled him to build a successful rental portfolio by leveraging assets to increase cash flow with little money out of pocket. Matthew often focuses on creative deal structuring for acquiring property instead of using his own funds.

Brandon Comer, Brandon Comer is an investor from Dallas, Ga. He began his investing adventures in the summer of 2016 and has done dozens of deals since diving in full-time October of 2016. His main focus has been wholesaling properties to other investors and through his “By Any Means Possible” approach, has built the beginnings of an operation spanning the Southeast. Plans to truly 10X his goals in 2018 have already been set into action

Brandon Comer, Brandon Comer is an investor from Dallas, Ga. He began his investing adventures in the summer of 2016 and has done dozens of deals since diving in full-time October of 2016. His main focus has been wholesaling properties to other investors and through his “By Any Means Possible” approach, has built the beginnings of an operation spanning the Southeast. Plans to truly 10X his goals in 2018 have already been set into action

He’ll be the first to tell you he’s no expert, but will also be the first to research the answers for any questions presented. Brandon lives with his wife and four foster kids and loves the flexibility and freedom real estate has presented him to be able to make a true impact on these kids’ lives.

Mark your calendar because this is happening on Monday, February 26th at Atlanta REIA West Monthly Event. RSVP NOW & DON”T MISS IT!

Atlanta REIA Members Please RSVP on Meetup.com

Come in at 6PM so you may order a delicious dinner from Cherokee Cattle Steakhouse Restaurant

RSVP NOW! and join us for this Atlanta REIA West Real Estate Event at 6:30pm on Monday, February 26th at The Cherokee Cattle Company at 2710 Canton Rd. in Marietta. Come join us for this fun, informative event. See Y’all There!

Atlanta REIA Members can attend for no charge and Not-Yet Members for $10.00. Show up at 6:30 PM to eat and network before the meeting officially starts at 7:00 PM. Buying your own meal is optional but highly recommended and greatly appreciated since the Cherokee Cattle Company allows us to use their event room.

There will be lots of learning and lots of networking. Bring your Flyers, your deals, haves, wants and needs to the event.

The Profit Newsletter February 2018 Edition

Posted on February 12, 2018 by The February 2018 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 46 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The February 2018 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 46 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer.

Be sure to Subscribe to The Profit by Email or Subscribe to The Profit by Text so you don’t miss a single issue.

The Profit Newsletter January 2018 Edition – Happy New Year!

Posted on January 8, 2018 by The January 2018 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 48 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The January 2018 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 48 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer.

Be sure to Subscribe to The Profit by Email or Subscribe to The Profit by Text so you don’t miss a single issue.

The Profit Newsletter December 2017 Edition

Posted on December 4, 2017 by The December 2017 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 48 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The December 2017 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 48 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer.

Be sure to Subscribe to The Profit by Email or Subscribe to The Profit by Text so you don’t miss a single issue.

The Profit Newsletter November 2017 Edition

Posted on November 6, 2017 by The November 2017 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 50 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The November 2017 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 50 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer.

Be sure to Subscribe to The Profit by Email or Subscribe to The Profit by Text so you don’t miss a single issue.

The Profit Newsletter October 2017 Edition

Posted on October 3, 2017 by The October 2017 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 46 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The October 2017 Edition of The Profit Newsletter, the official newsletter of the Atlanta Real Estate Investors Alliance, is now available for download. There are 46 pages this month full of upcoming meetings, workshops, webcasts, educational articles and other valuable information for your real estate investing pleasure and success. Download it and check it out!

The Profit is Atlanta REIA’s digital, interactive newsletter for serious real estate investors delivered as an Adobe PDF file to read on your PC, Mac, Smart Phone, iPad or other mobile ready devices. Many of the articles and ads in The Profit contain many hyperlinks you can click to get more information online! The high res version of The Profit is “print ready” for those who want to print the newsletter on their home or business printer.

Be sure to Subscribe to The Profit by Email or Subscribe to The Profit by Text so you don’t miss a single issue.

7 Strategies to Increase ROI on Keeper Properties by Reducing Vacancy

Posted on October 3, 2017 by Here are my seven strategies to help increase your return on investment on keeper properties by reducing vacancy.

Here are my seven strategies to help increase your return on investment on keeper properties by reducing vacancy.

- Do Your Homework Before You Buy

Location, Location, Location… Search out the areas that have low vacancy rates. Talk to local realtors, property managers, and seasoned investors who have been renting units for over a decade before you take the plunge and buy a property.

For example, I want to own property where supply of rental properties is low and the demand is high. I own properties in a town where the schools are in the Top 50 Schools in America. Demand for rental property is high and my average days on market to rent are usually less than 2 weeks. Read More→

Why Improve Your Raising Capital Presentation Skills?

Posted on October 3, 2017 byI believe we all need to improve our businesses. The only way to do this is intentional reflection and forensic analysis. We all can learn a better way to look at our business to stay on top of our game. The best example of this was back in 2000 when the market opened up and anyone who had credit could get into a house. I was using an old business model to screen tenants and respond to inquiries about my properties. I had to make a change quickly because the vacancies lasted longer than needed. I learned the lesson to stay on top of the market. If you become complacent your business will drop off.

In the last article, I wrote about sitting at the table with two sellers and working to get them to finance their house so I could renovate it. Then I would pay off the mortgage. It was a buy, fix, and sell. I will be using poetic license in referring to the “lender” as owner financing / private lending/ hard money. Read More→

Rehabbing Your Way To Millions

Posted on October 3, 2017 byIn just about any real estate market I believe that there are a lot of great ways to make a fortune in real estate and one of those ways is to rehab and sell properties quickly. This is a strategy I implement on a daily basis in my own Real Estate Investing business.

There are some excellent resources for you to use to find vacant, ugly properties to rehab and sell in virtually any price range. One of those ways is to simply use targeted direct mail campaigns like I do to find motivated sellers of ugly vacant properties or estates.

This is a great way to find highly motivated sellers who need to sell quickly and there are great deals to be made for pennies on the dollar. Remember, your profit is made when you buy a property. Read More→

Real Estate IRAs – Special Considerations for Vacant Properties

Posted on October 3, 2017 byWe are seeing more interest among real estate IRA enthusiasts in purchasing distressed and vacant properties. Many times, the real estate IRA investor can purchase a promising vacant property at a substantial discount to its intrinsic value, which make these properties attractive value investments – especially for those real estate IRA investors who have the capital to upgrade these properties and make them once again attractive to tenants at a reasonable rent.

But as long as a property is vacant, there are some special considerations that investors need to consider: Read More→

Why Can’t You Get Sellers to Give You Seller Financing Terms? – Part 2

Posted on October 3, 2017 byLast month I explained why sellers who live in the property they are selling usually do not have to pay high capital gain taxes. It is the exact opposite for property owners who do not live in the property they are selling. This is why I always prefer buying properties from sellers whose property is not their primary residence. These sellers will definitely have high capital gains taxes to pay if they get all cash when they sell.

Paying high taxes can be a huge deterrent for many sellers once they understand how much they will be losing. On the other hand, if the sellers do not, or have not lived in the property as their primary residence and you can’t convince them that if they get all of their money from the sale of their property at closing they will have to pay high taxes in the year of the sale you need to explain to them… Read More→